Already a disappointing morning.

Already a disappointing morning.

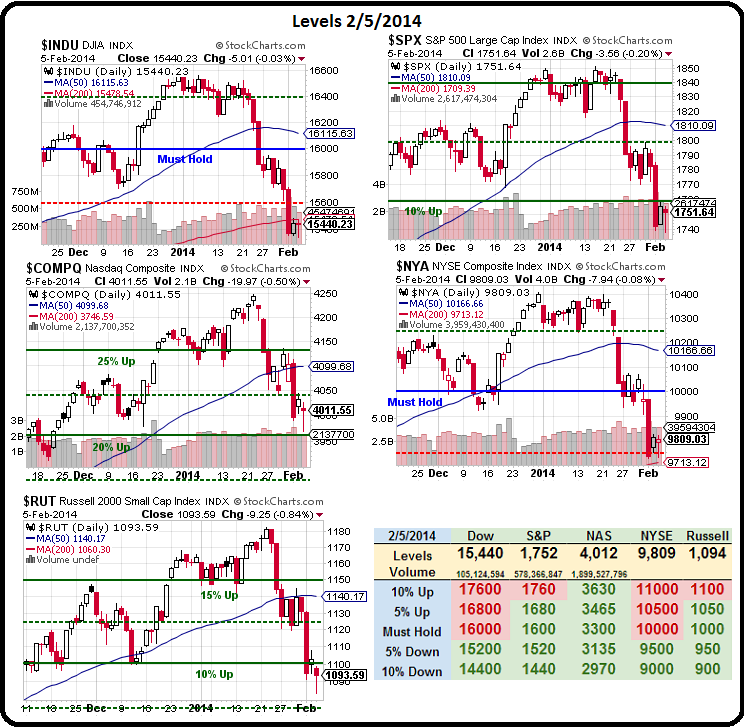

We had a little move up in the Futures but it's fading as the Dow is unable to get back over 15,500 (15,450 in the /YM Futures). As you can see from Dave Fry's chart, that 200 dma is turning into some nasty upside resistance and that is NOT a trend you want to see continuing into the close of the week (weak).

Nonetheless, I just sent an Alert out to our Members to press a few of our postions in the Long-Term Portfolio and we're going to balance that by shorting GMCR (see why here) off that silly pop on the KO news.

The BOE held rates steady this morning and we expect the ECB to do the same but we are concerned by weakening German Manufacturing Orders, but, in the US, productivity gains will offset poor unemployment news so it's going to be another day of waiting and seeing how our bounce levels do.

As you can see from our Big Chart, we are down about 7.5% on our indexes and, according to the 5% Rule™, that means we need to see 1.5% gains just to make a weak bounce out of it. 1.5% is 231 Dow points (15,670), 26 S&P points (1,780), 60 Nasdaq points (4,075), 147 points on the NYSE (9,950) and 16 Russell points (1,110). Those are just our WEAK bounce lines – the same lines that kept us from making a mistake by getting too bullish on the previous bounce – so take heed!

8:30 Update: ECB held rates, as expected but Draghi actually mentioned GRADUALLY raising rates in the future and that was enough to send the Dollar down from 81.40 to 81 (0.5%) in seconds. That shows us that the Dollar's "strength" is a very fragile thing and it won't take much for our currency to reprice down to Argentina-like levels if the rest of the World begins to tighten without us.

8:30 Update: ECB held rates, as expected but Draghi actually mentioned GRADUALLY raising rates in the future and that was enough to send the Dollar down from 81.40 to 81 (0.5%) in seconds. That shows us that the Dollar's "strength" is a very fragile thing and it won't take much for our currency to reprice down to Argentina-like levels if the rest of the World begins to tighten without us.

Meanwile, that's certainly NOT happening at the moment as the BOE and ECB don't see enough inflation to bother them (because we're all exporting it to the 3rd World) and none of us have much of a recovery going, so all the Central Banksters are still saying they will remain "accomodative" for as long as it takes (for the top 1% to get the rest of the money).

While the weaker Dollar is somewhat supportive of stocks and commodities – let's not lose sight of WHY the Dollar is diving – total lack of demand. One out of 6 (17%) of the prime working-age (25-54) men in America DO NOT HAVE JOBS! Our Government may cut their benefits and stop calling them unemployed but those are the facts – what buying power do all these disenfranchised people have?

This is not a problem that will go away if we ignore it harder. The President is right, we need to take action to reverse this trend. While Conservatives like to say we're living in a welfare state – perhaps the problem is that the "jobs" that are available don't pay a living wage – so what is the point of taking them?

It's not like it's the same 10M guys laying around the house all day playing XBox, it's a lot of guys who were making $50-100,000 a year and lost their jobs and can't find another REAL job and they would rather eat into $10,000 of their retirement savings than get up every day, go to McDonalds, clean out the grease traps and microwave burgers all day from 8 to 4 or from 4 to midnight in exchange for 35 hours (you don't get paid for lunch) x $7.25 = $253 BEFORE TAXES (and yes, there are taxes, see above for $10 per hour worker).

So, given the choice of working 40 hours at a terrible for net $220 or staying home and playing XBox, what would you, a rational person, choose?

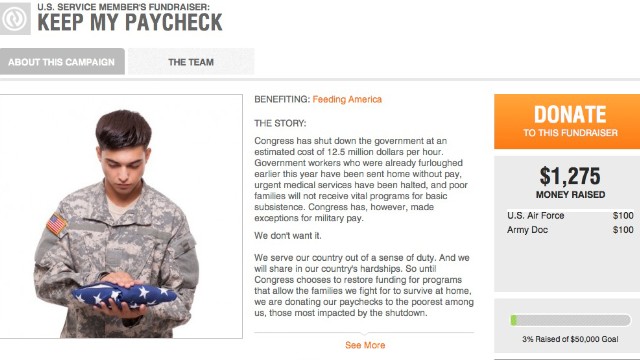

Don't forget you have to pay for your uniform and clean it and eat lunch at work and transport yourself to work and oh, did I mention you are flipping burgers at McDonalds or stocking shelves at Wal-Mart or protecting our country from terrorists overseas in the armed forces (what, you think they make $10 an hour?).

At least in the Army, the food and the uniform come with the job!