Wheeeee, what a ride!

Wheeeee, what a ride!

As noted by Dave Fry, Friday's jobs report was bad – and that's good, isn't it? We need bad news to put an end to all this taper talk so the Dollar can continue to devalue almost as quickly as the Yen and Emerging Market currencies can stop collapsing and control their skyrocketing inflation caused by high commodities prices due to the Fed's easy-money policies. Get it?

It's one of those serpents eating its own tail kind of things that you know so well, we don't even need a picture, do we?

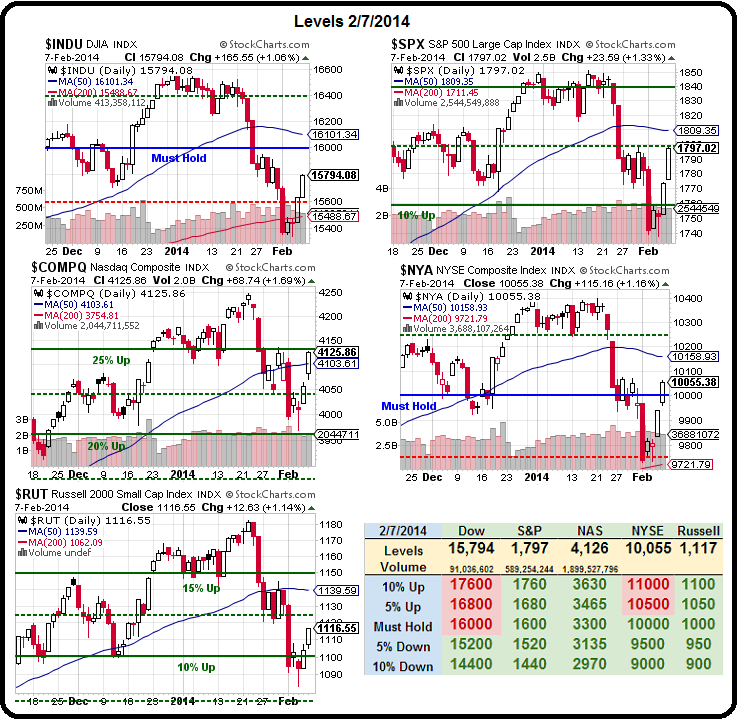

What we do need pictures of is the S&P and we had a huge volume spike into the close but, strangely, it did not move the market higher – that's not really a good sign – it just means all the people who pretended to be interested in buying the S&P up from 1,178 to 1,180 took the money and ran from the ETFs that were forced to buy at at market on close prices.

What we do need pictures of is the S&P and we had a huge volume spike into the close but, strangely, it did not move the market higher – that's not really a good sign – it just means all the people who pretended to be interested in buying the S&P up from 1,178 to 1,180 took the money and ran from the ETFs that were forced to buy at at market on close prices.

That is how they screw all the suckers who put their money into IRAs and ETFs, who are forced to buy on close at the end of each day, usually at whatever prices the Banksters want to dump the shares at (hence all those big rallies in the last 15 minutes) – that's why Banksters spend so much time and effort convincing you to buy IRAs, 401Ks, ETFs – anything that does the buying for you (on their schedule)!

As you can see from Dave's 3 S&P studies – it's all a matter of perspective. Our Members have been singing "Head and Shoulders" for over a week now, though, as this pattern was pre-ordained by our 5% Rule™ long before it showed up on the charts.

As I said back on January 28th:

As I said back on January 28th:

This does not change our 5% Rule's™ ranges at all – these are just the very short-term moves we need to see in order to start pulling back our bearish bets (long in place) and begin to consider some bullish plays:

- Dow 15,940 (weak) and 16,080 (strong)

- S&P 1,794 (weak) and 1,808 (strong)

- Nasdaq 4,100 (weak) and 4,135 (strong) (includes moring drop not on chart)

- NYSE 10,080 (weak) and 10,160 (strong)

- Russell 1,138 (weak) and 1,146 (strong)

During the two weeks following our initial dip, we made more generous lines for us to flip a bit more bullish and those were Dow 15,900, S&P 1,806, Nasdaq 4,135, NYSE 10,100 and Russell 1,126, all missed on Friday, which kept us generally bearish into the weekend.

During the two weeks following our initial dip, we made more generous lines for us to flip a bit more bullish and those were Dow 15,900, S&P 1,806, Nasdaq 4,135, NYSE 10,100 and Russell 1,126, all missed on Friday, which kept us generally bearish into the weekend.

Our finish on Friday had just enough volume where we didn't want to be any more bearish, but we are cautious as we did a lot of bottom-fishing in our Income Portfolio and our Long-Term Portfolio, when the S&P bottomed out on Wednesday, the 29th (see our January Trade Review)

We certainly didn't buy anything we wouldn't be happy to buy more of if that 1,750 line hadn't held on the S&P but, for now, we're drifting along with a healthy 5% pullback off that 25% run from last Feburary. Also note on the daily S&P chart that the MACD and RSI lines both seem to have bottomed out, so we certainly do have the technicals in place to rally back – now we'll see if enough buyers are there to pop our bounce lines.

As long as we're over our adjusted set (lower bar), we're happy to do a few bullish trades, like those from Part 1 of our January Trade Review, which were:

As long as we're over our adjusted set (lower bar), we're happy to do a few bullish trades, like those from Part 1 of our January Trade Review, which were:

- ABX 2015 $15/25 bull call spreads at $2.30, selling 2016 $13 puts for $2.25 for net 0.05, now $2.53 – up 4,960%

- 10 SSO March $92/97 bull call spreads for $3.20 ($3.200), selling 5 ISRG April $300 puts for $5.50 ($2,500) for net $700, now net $3,150 – up 350%

See, not very hard to make money in a bull market, is it. We pick a spread on something we feel is undervalued and sell offsetting puts on something we would REALLY like to own if it got cheaper and then we have a low-cost trade and we certainly don't need to wait a year to make very nice returns. Just $500 cash and $14,000 in margin invested in 100 of the ABX spreads would have already returned $24,800 and the worst case to the downside is owning ABX at net $13.05 (now $18.89).

This is what we mean when we tell you to BE THE HOUSE – Not the Gambler!

And where was the S&P when we initiated that trade? 1,800! It didn't have to move up for us to make money because we SOLD premium – we didn't buy it. While our S&P spread gained just $100 (was more when we were higher, of course but assume poor timing), the short ISRG position lost a lot of money after earnings supported our bullish premise. Had they not – then we'd be the proud owners of 500 shares of ISRG!

- Since SSO is at $96.68 and that $5 spread is still just $3.30, all we have to do is find another stock we believe in to sell puts against and we can set up a similar play. AMZN has support at the 200 dma at $325 and you can sell the April $325 puts for $5.60 (just 5) for $2,800 and that makes the spread net $500. As a longer-term play, I also like IBM 2016 $150 puts, which can be sold for $10.40 and just 3 of those net's just $180 on the spread.

Keep in mind our premise on this spread is that the S&P gets over 1,800 this week and holds it (this is not our market premise, this is our premise for entering a new bullish spread). So, if the S&P does not get over 1,800 and holds it this week – we get out of the spread and wait for the next time we think the market may be bouncy.

CI has dropped earnings forecast for next year down to $7 (from $7.30) and the stock dropped 15% so we're liking that one for a long now and we're happy to own them for net $55 as $7 per $55 share is a p/e of 7.8 so we're very happy to sell 5 of the 2016 $60 puts for $5 and collect $2,500, which we can use to buy 10 of the still beaten-down SLW Jan (2015) 20/25 bull call spreads at $2.35 which keeps a net credit of 0.15 on the CI short puts and SLW is already half in the money at $22.62, on the way to a potential $4,850 gain against our net $150 cash outlay. As long as we REALLY want to own 500 shares of CI for 22% off the current price ($77.50) – what's the downside?

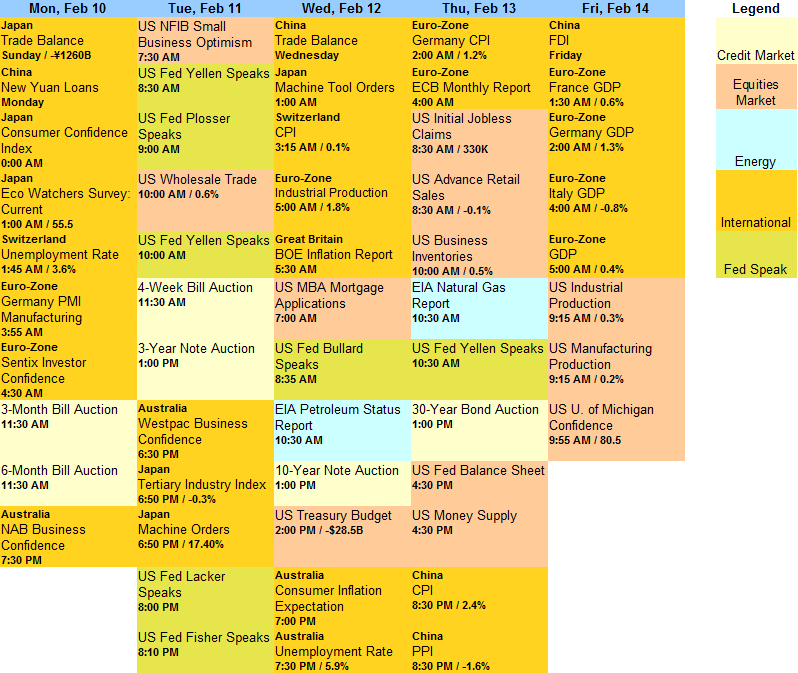

So, there's two bullish triggers we can pull if just two of our strong bounce lines are crossed today and, of course, we'll have plenty more in our Member Chat Room (these are just the free samples!). It's going to be a crazy week with Yellen speaking 3 times, including her introduction to Congress but we'll also here from noted Fed hawks; Plosser, Lacker and and Fisher ahead of our 10 and 30-year note auctions.

So mixed messages are guaranteed this week – be careful out there: