On Tuesday, the 11th, we found our thrill on Capitol Hill when Janet Yellen testified before Congress (summarized in my Wednesday post) and the markets took off like a bat out of Hell and today, after a snow delay, is the second part of her double feature testimony over at the Frankenstien place we like to call the United States Senate.

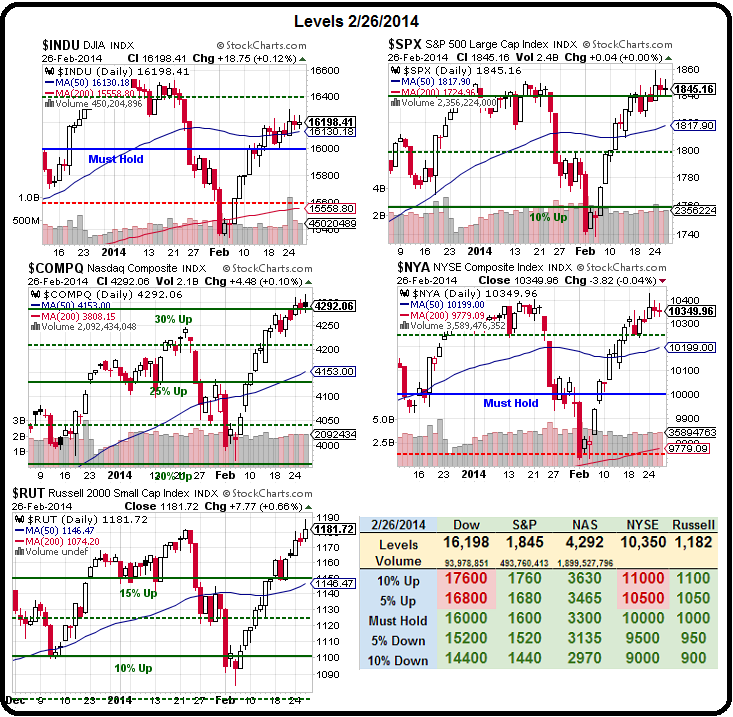

Will the markets do a time warp and repeat the rocketing performance she set off that week or have we already taken all she has to give (see yesterday's post for my market angst – today I'm staying positive!)? As you can see from Dave Fry's chart – so far, my prediction of pump and dump action at the top of the channel is paying off and we're having tons of fun trading the Futures but today it's put up or shut up for the Bulls – as finishing this week without taking new highs will not be good enough.

Already this morning, we picked up our Egg McMuffin money with an early short from Dow (/YM) 16,200 to 16,050 ($750 per contract) and Russell (/TF) 1,080 to 1,070 but now we flipped bullish again at 16,100 (7:08 am) with tight stops – hoping Janet can once again make a new man out of the markets and rose tint our World (had to get in a last Rocky Horror reference).

We were nice and bullish after Yellen's testimony on 2/12, with 9 bullish picks right in the morning post but we got killed on a WYNN short (so far) and AAPL is back to $515 but we added to our long positions yesterday – as it's only the pullback we expected. AAPL is often held back to be used as rocket fuel when a push to new highs is needed. Since it's about 15% of the Nasdaq and 4% of the S&P, just manipulating that one stock can give you total control of the markets.

We were nice and bullish after Yellen's testimony on 2/12, with 9 bullish picks right in the morning post but we got killed on a WYNN short (so far) and AAPL is back to $515 but we added to our long positions yesterday – as it's only the pullback we expected. AAPL is often held back to be used as rocket fuel when a push to new highs is needed. Since it's about 15% of the Nasdaq and 4% of the S&P, just manipulating that one stock can give you total control of the markets.

Speaking of manipulating the markets – let's here it for Morgan Stanley, who put out a note on Tuesday raising their price target for TSLA from $153 to $320 (not a typo), which would make TSLA, who sold 25,000 cars last year, worth as much as Ford (F) or GM, who sold over 2M cars EACH in 2013. That's 100 TIMES more cars – for those of you who, like the Morgan Stanley analyst, struggle with basic math skills….

That prompted Jabob, in our Member chat, to comment on the pending note offering from TSLA: "I wonder if Morgan Stanley is the underwriter?? " Now, we KNOW the stock market is blatantly manipulated but, surely, it can't be THAT BLATANTLY MANIPULATED, can it? Well, funny story, turns out it is! MS is indeed underwriting TSLA's $1.6Bn convertible note deal and both MS and TSLA stand to substantially benefit from the 20% bump in TSLA's price – thanks to the MS upgrade.

Will anyone be arrested? ROFL! Don't be silly, this is America, not some Socialist Nation where the Government regulates things like that. These guys will get fat bonuses and be featured on the cover of business magazines for their "financial innovation." As I said to our Members in chat yesterday:

Will anyone be arrested? ROFL! Don't be silly, this is America, not some Socialist Nation where the Government regulates things like that. These guys will get fat bonuses and be featured on the cover of business magazines for their "financial innovation." As I said to our Members in chat yesterday:

It's BRILLIANT to announce you have to build a factory to provide batteries for 500,000 cars a year when you're currently producing 25,000 because – if you are building a great big battery factory, you must REALLY be serious about selling 500,000 cars and, if you say the batteries will be 30% cheaper – you must be right because, after all, you are a car company and you know what you want to pay for batteries. Wash, rinse and repeat until you actually believe it…

Imagine if AAPL builds a chip factory to make 300M chips for IPads in 2020, even though they only sold 15M last year. Now imagine it's for an IPad that costs twice as much as competitors' tablets. Of course, it did win the tablet of the year award and rich people did buy some, so why wouldn't they be able to sell 20x more in 6 years? AAPL would get laughed off the planet – Musk gets a halo – amazing!

I'm not going to sit here and tell you why TSLA isn't worth $260 (we're short), or $200 — maybe $150 if you want to be an optimist, today we are bullish, at least back to the lines we just shorted this morning (and don't forget /NG long at $4.50!) and, if we get over those, then we go long on the laggard (standard Futures trick) and we hunt for more long opportunities but, if we fail to get to new highs… No, I'm not going to go there. It's Janet's day today and dammit, we love her!