Up and up we go.

Up and up we go.

Sure it's low-volume, sure it's coming on a day when the Fed put $4Bn worth of POMO into the system and sure it came on Yellen's second day of Free Money-Chanting before Congress but 1,854!!! 1,854!!! 1,854!!! If we keep saying it, it will begin to sound "normal."

I don't want to be a party-pooper but I was bullish yesterday and I can't bite my tongue all the way into the weekend. We are "Cashy and Cautious" once again (see our February Trade Review) at the top of the rally. Today is the last day of the month and ANYTHING can happen as Fund Managers square off their bets and Banksters manipulate the markets to match the brochures they already sent to the printer.

Turns out the President of the Ukraine did not step down and is not a wanted criminal, he's just on vacation in Moscow! That is, according to the Russians, who have now occupied two of the Ukraine's major airports with armed soldiers.

Turns out the President of the Ukraine did not step down and is not a wanted criminal, he's just on vacation in Moscow! That is, according to the Russians, who have now occupied two of the Ukraine's major airports with armed soldiers.

Vlad the Inhaler (of Billions of Rubles) put out a statement this morning instructing his government to “continue contacts with partners in Kiev” and it was just announced that Viktor Yanukovych (ousted President) will hold a press conference in Moscow this morning, but on a 10-minute delay (to make sure he sticks to Putin's script).

Ukraine’s interior minister, Arsen Avakov, said on Friday that Russian forces had seized two airports in Crimea. In a statement on his Facebook page, Mr. Avakov said he considered the actions “armed invasion and occupation in violation of all international agreements and norms.” He would have made the statement from his office, but Russian troops have also taken over those buildings!

Now, before we start booing Russia for their heavy-handed action, let's keep in mind that Sevastopol is a major Russian Naval Port and it cannot be denied that they have VITAL interests in that region. What does the US do when their is unrest in places we have "vital" (ie. oil) interests in? We send in "peacekeepers," don't we? Of course, that's how we spin it – in the countries we send the troops to, it's called an invasion. Funny how it feels to be on the other side for a change…

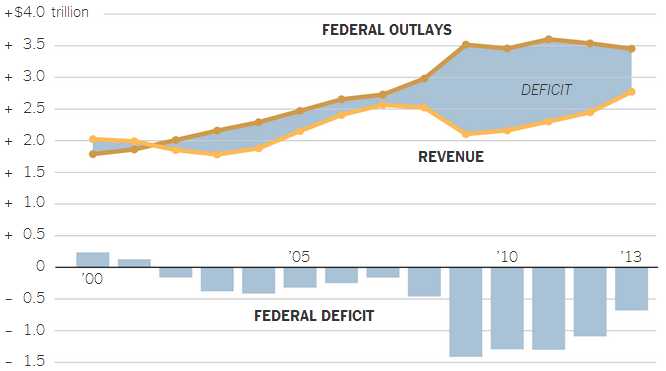

8:30 Update: Q4 GDP came in at 2.4%, revised down from the original estimate of 3.2% but Government Purchases were revised down 5.6% and Government Spending is about 20% of the GDP so that shaves 1.1% off the total. If we have to lose GDP points – that's the best way to do it. In fact, as I pointed out to Members this morning, under the evil, Democratic Overlord, Barack Obama, our Budget Deficit has fallen at the sharpest rate since WWII due to a combination of spending cuts and tax increases. You know – balancing the budget like a responsible adult.

The Deficit is still $680Bn this year but that's just 4.1% of GDP, vs 10% of GDP in 2009 and 2010. Declining deficits, improving job markets, rising home prices, no war and record high stock markets – I'll bet the GOP can't wait for a chance to screw this all up again!

The Deficit is still $680Bn this year but that's just 4.1% of GDP, vs 10% of GDP in 2009 and 2010. Declining deficits, improving job markets, rising home prices, no war and record high stock markets – I'll bet the GOP can't wait for a chance to screw this all up again!

Obama wants to keep the momentum going by turning his attention to stimulus measures to boost the economy, including begining to re-invest in America by rebuilding our aging infrastructure. Republicans want bigger tax cuts – because that always works out so well, doesn't it?

The Treasury said revenue climbed $324 billion, to $2.8 trillion, from 2012 to 2013. That is growth of around 12.9 percent, reflecting both higher income tax rates and the strengthening economy. A year ago, the top marginal tax rate increased to 39.6 percent, from 35 percent. At the same time, a payroll tax holiday expired, bolstering government receipts.

The Treasury said revenue climbed $324 billion, to $2.8 trillion, from 2012 to 2013. That is growth of around 12.9 percent, reflecting both higher income tax rates and the strengthening economy. A year ago, the top marginal tax rate increased to 39.6 percent, from 35 percent. At the same time, a payroll tax holiday expired, bolstering government receipts.

Over the same period, total government spending barely grew, rising to $3.9 trillion, from $3.8 trillion a year earlier, the Treasury said. (Federal budget outlays — the number most often cited as annual spending — were about $3.5 trillion in both years. The Treasury included a fuller accounting in this analysis, including costs incurred but not paid out.)

“Thanks to the tenacity of the American people and the determination of the private sector we are moving in the right direction,” Treasury Secretary Jacob J. Lew said in the report. “The United States has recovered faster than any other advanced economy, and our deficit today is less than half of what it was when President Obama first took office.”

We'll see if these market highs hold into next week. If so, we have some buying to do – especially in our Short-Term Portfolio, which is clearly too bearish. Unless, of course, this turns out to be window-dressing into the end of the month. Until next week, then.

Have a great weekend,

– Phil