That was quick, wasn't it?

That was quick, wasn't it?

What's a little invasion between friends? Apparently, it was enough to cancel the US delegation to the Paralympics (but our athletes are still going), but not much else of note happened which is why, in a "sudden" crisis, we follow the tried and true strategy of "Don't Just Do Something, Stand There!" You can follow the link to get my logic on inaction but, suffice to say, we practice what we preach!

We opprtunistically went short on oil at $105 (now $103.50 for a $1,500 per contract gain), we also picked up the USO April $38 puts for $1.25 and we went long EWG, buying 10 of the July $30 calls for $1.60 and selling 10 of the April $31 calls for 0.65 in our $25,000 Portfolio – taking advantage of what we considered to be Germany's over-reaction to the "crisis".

We also added more AAPL, of course – but we do that any time they dip, so it had little to do with the Ukraine. Going long on /NG (Natural Gas Futures) is something we've been doing since last week and that trade has been very reliable for quick $500 per contract gains ($4.55) – over and over again. That's all we did yesterday – those few trades – because it was wiser to watch and wait than adjust our larger positions, when we didn't have all the facts yet.

We also added more AAPL, of course – but we do that any time they dip, so it had little to do with the Ukraine. Going long on /NG (Natural Gas Futures) is something we've been doing since last week and that trade has been very reliable for quick $500 per contract gains ($4.55) – over and over again. That's all we did yesterday – those few trades – because it was wiser to watch and wait than adjust our larger positions, when we didn't have all the facts yet.

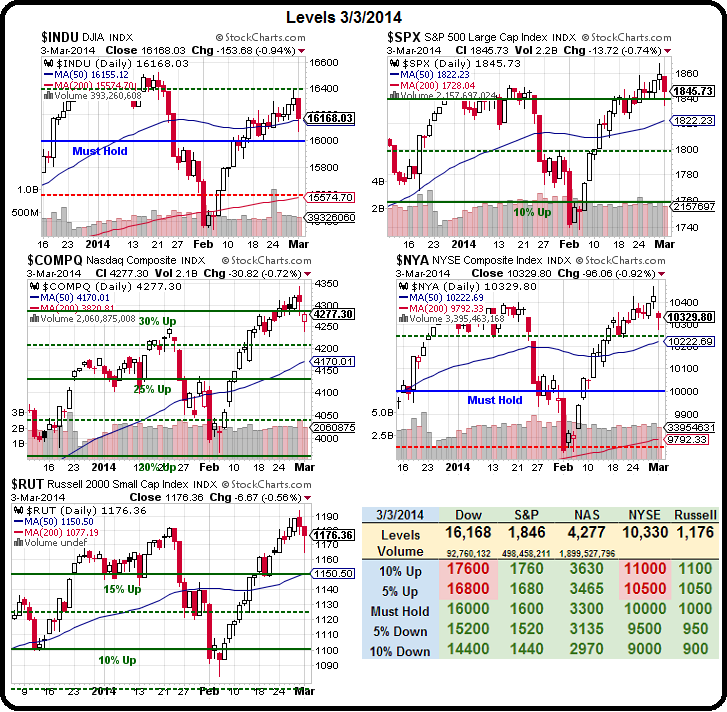

As you can see from Dave Fry's Dow Chart, after a dip to 16,100, we held the 50 dma at 16,155, prompting me to say to our Members after lunch:

Germany finished down 3.44% today, France down 2.66%, Italy down 3.34%, Spain down 2.33% and London down 1.49% so either they are way too worried or we are not worried enough…

We've been improving since they closed – hard to see how we can ignore things if they have another down day tomorrow but, technically, this is a strong move by our indexes (if it sticks).

That's why, other than shorting oil (which we had a whole conversation about), all of our trade ideas were bullish yesterday – despite the crisis atmosphere. Now we can get back to being our old, skeptical selves and see if we can finally break out and hold some new highs for more than a day. If not – back to bearish!

That's why, other than shorting oil (which we had a whole conversation about), all of our trade ideas were bullish yesterday – despite the crisis atmosphere. Now we can get back to being our old, skeptical selves and see if we can finally break out and hold some new highs for more than a day. If not – back to bearish!

The situation in the Ukraine isn't over yet, Putin is still calling the ousting of Puppet President Yanukovych an "unconstitutional coup." And Putin should know, as he wrote that constitution!

Still, he acknowledged that Mr. Yanukovych had no political future and said Russia would not rule out dealing with the winner of May presidential elections in Ukraine if what he called the "terror on the streets of Kiev" stopped. He brushed off Western threats of sanctions in response to Russian actions in Crimea as "mutually harmful."

Already, this morning (7:30), Germany and France are up 2.25%, Italy 2.5%, Spain 1.7% and the UK is up 1.6% into their own lunch. Russian markets, which dropped 11% yesterday have recovered half of their losses already and, more imporantly, the Russian Oligarchs, who were estimated to have lost $11Bn in asset value, have recovered about $6B today and, like any modern country – when the Billionaires are happy, the President is happy.

Already, this morning (7:30), Germany and France are up 2.25%, Italy 2.5%, Spain 1.7% and the UK is up 1.6% into their own lunch. Russian markets, which dropped 11% yesterday have recovered half of their losses already and, more imporantly, the Russian Oligarchs, who were estimated to have lost $11Bn in asset value, have recovered about $6B today and, like any modern country – when the Billionaires are happy, the President is happy.

Workers of the World, of course, are unhappy, with RSH (Radio Shack) laying off about 10,000 people in 1,100 stores – that can't be helpful to the Feb jobs report (not out for another month), nor will it be helpful for the REIT industry, as new inventory floods the market. Chief Executive Joseph C. Magnacca said the poor results were driven by lower store traffic, intense discounting particularly in consumer electronics and a "very soft" mobility marketplace, as well as a few operational issues.

What's really shocking about this story is that Radio Shack does, indeed, have their own batteries and, according to TSLA investors, that should be making them Trillions of Dollars – go figure…

Speaking of overvalued Momentum Stocks – CMG has managed to sneak down $40 in two days despite the national roll-out of tofu tacos. Maybe it's their "jumping the shark" moment as people begin to realize 50 time earnings is kind of a lot to pay for mexican food, no matter how you dress it up. But, with TSLA still valued at $1.2M per $80,000 car sold – maybe not…

Just as we watched and waited yesterday, we'll be watching and waiting today. As we are still "Cashy and Cautious," we'll be ready, willing and ABLE to take full advantage of any market strangeness – hopefully live in our 1pm (EST) Live Trading Webcast this afternoon.

See you there,

– Phil