MORE FREE MONEY!

MORE FREE MONEY!

Both the ECB and the BOE have maintained their record-low rate policies today, despite the "strong" economy that is pushing Global Markets to daily new highs. For the Bank of England, this is year 6 of monetrary stimulus, which means there are 30 year-old brokers out there who have never traded in an Economy that wasn't supported by a Central Bank.

Not only is GS alumni Mark Carney keeping rates at 0.5% in the midst of a real estate bubble that has tripled the price of London housing, but today they announce they will immediately reinvest funds from the asset-purchase facility that matures tomorrow – so not even a winding down (taper) is in sight. Carney says there’s “no rush” to remove the emergency stimulus put in place by his predecessor Mervyn King, even after the strongest expansion since 2007 pushed unemployment toward the 7 percent level at which officials had said they’d consider a rate increase.

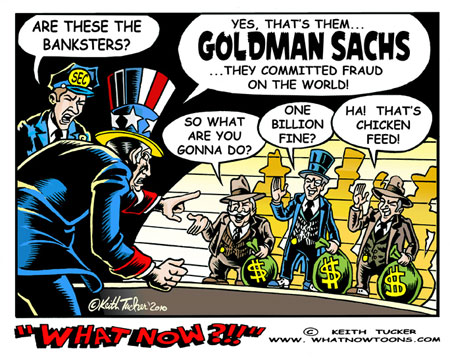

Going Carney one better, former Managing Director of Goldman Sachs, Mario Draghi is leaving the ECB rates at 0.25% – keeping money free for his Bankster buddies (subsidized by the population of the EU, of course).

Going Carney one better, former Managing Director of Goldman Sachs, Mario Draghi is leaving the ECB rates at 0.25% – keeping money free for his Bankster buddies (subsidized by the population of the EU, of course).

A rational person may wonder how strong does the economy have to be before it's no longer necessary to subsidize the top 1% by giving them free access to money for unlimited amounts of time. Fortunately, most rational people have gotten out of the market by now, and aren't around to bother the Central Banksters with their silly questions…

With Trillions and Trillions of Dollars flowing into "the system," the money has to go somewhere and, so far, it isn't going to pay more workers higher wages, is it? It's also not going into gold or oil or silver or copper – money isn't backed by anything anymore and Donald Trump is done gold-plating the 15th bathroom in his 10-bedroom home, so demand can't keep up and housing itself still hasn't come back in most places but STOCKS – stocks are a fun place to put money, aren't they?

With Trillions and Trillions of Dollars flowing into "the system," the money has to go somewhere and, so far, it isn't going to pay more workers higher wages, is it? It's also not going into gold or oil or silver or copper – money isn't backed by anything anymore and Donald Trump is done gold-plating the 15th bathroom in his 10-bedroom home, so demand can't keep up and housing itself still hasn't come back in most places but STOCKS – stocks are a fun place to put money, aren't they?

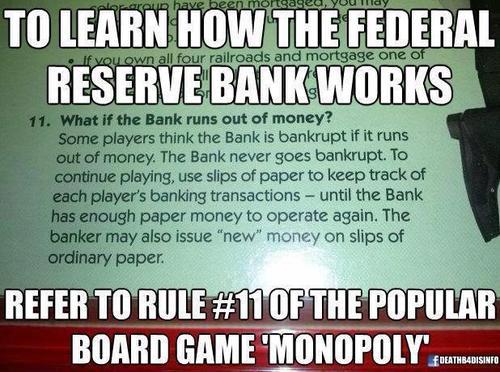

That's because, like money, stocks have only an abstract value. Sure, you can be nit-picky and say the value is somehow determined by taking into account earnings, growth prospects and safety of the investment, but that's the kind of old-fashioned thinking based on a time when money had value. These days, we are literally playing with Monopoly Money and, like the board game, the goal for the winner is to be in the top 1% and end up owning all the property while wiping every other player out.

Here's a nice little cartoon that can get you up to speed on our present situation:

If you don't have time to watch the above – here's the George Carlin summary:

Sorry to be such a downer today but I did a couple of TV appearances yesterday and I met in the city with some financial people and we ended up discussing what a complete joke the economy is becomming as America is being sold down the river in pursuit of greater Corporate profits.

As I'm writing this, the Dollar is plunging below 80. Why? Because Draghi only kept the current level of easing and didn't ad more and that pushes the Euro higher against the Dollar, where the Fed is still creating $65Bn per month or about $3Bn every single day the market is open, which the Banksters then turn around and leverage 10:1, lending out to top 1% people and corporations who use it to drive up the price of the things they like to buy, like art, homes, stocks, other companies…

As I'm writing this, the Dollar is plunging below 80. Why? Because Draghi only kept the current level of easing and didn't ad more and that pushes the Euro higher against the Dollar, where the Fed is still creating $65Bn per month or about $3Bn every single day the market is open, which the Banksters then turn around and leverage 10:1, lending out to top 1% people and corporations who use it to drive up the price of the things they like to buy, like art, homes, stocks, other companies…

Not wages, of course.

In fact, productivity hit a pretty hard wall today, rising just 1.8% vs 2.5% expected and 3.2% on last report. Unit Labor costs, however, still dropped 0.1% so Big Business is still squeezing the workers as best they can – but it may not be enough to sustain these sky-high valuations – no matter how much money we create.