What a ride!

What a ride!

In a single day we make up 40% of the week-long drop on the Dow and the S&P and this morning we're up again in the Futures, despite Putin making a speech in which he says Russia WILL annex Crimea – despite all threats of sanctions, etc.

In fact, Russia is now sanctioning US, banning our officials from visiting their country and freezing any assets our Congresspeople may have in Russia.

Whether or not this spreads to Corporate assets – who knows? But what difference would it make – the market would still go up anyway because no news seems to matter.

Japan has a looming sales tax increase in two weeks that most analysts say will be a complete disaster in the World's 3rd largest economy, China's Yuan is dropping and it's killing local companies and investors in China and it's already showing up in slowing home prices as well as property defaults. Like Japan, China's debt is now 238% of their GDP and economist Diana Choyleva notes:

Japan has a looming sales tax increase in two weeks that most analysts say will be a complete disaster in the World's 3rd largest economy, China's Yuan is dropping and it's killing local companies and investors in China and it's already showing up in slowing home prices as well as property defaults. Like Japan, China's debt is now 238% of their GDP and economist Diana Choyleva notes:

"Debt in China over the past five years has grown much faster than in Japan at the same stage of development. Studies show the rate of increase in debt is as important, if not more important, in precipitating a crisis than the absolute level of debt. On that front, China scores extremely poorly. Japan’s debt didn’t start to rise at a similar speed until the mid-1980s. China’s debt has surged sooner because its economy is much bigger than Japan’s was. The world is just not big enough to let China continue to increase its income per capita and waste its savings on a vast scale for years to come. The financial crisis was the beginning of the end of China’s export and investment-led growth model."

She says China is rapidly approaching a "Bear Stearns Moment." Meanwhile, the US is experiencing 3.5% food inflation, which is more than twice the rate at which salaries are increaseing and 5 times faster than Social Security adjustments are keeping up. Should we worry? Of course not! After all, the Fed will surely save us, right?

She says China is rapidly approaching a "Bear Stearns Moment." Meanwhile, the US is experiencing 3.5% food inflation, which is more than twice the rate at which salaries are increaseing and 5 times faster than Social Security adjustments are keeping up. Should we worry? Of course not! After all, the Fed will surely save us, right?

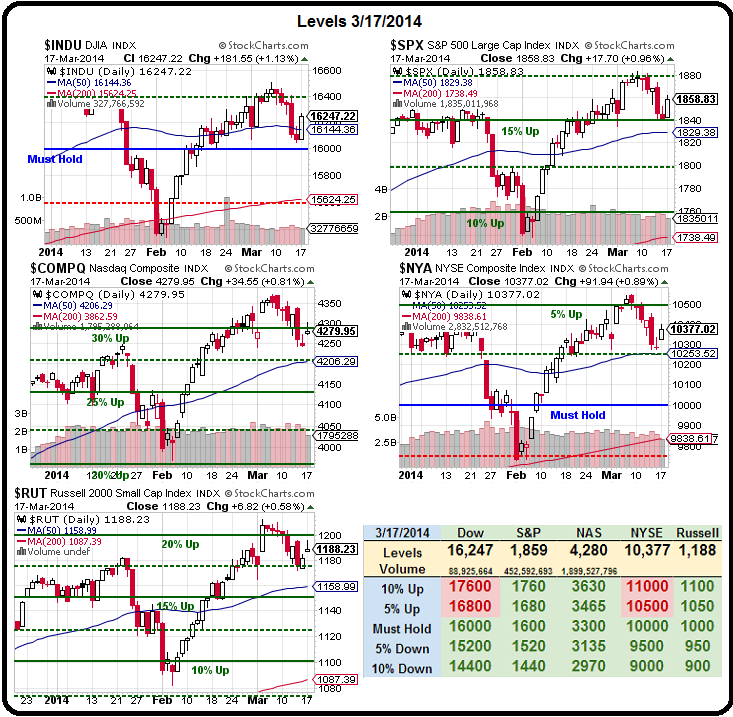

As you can see on Dave Fry's SPY chart, we have an impressive bounce back to 1,859 on the S&P and that's right between our goal lines that we set on Friday morning, where I posted the 5% Rule's™ expected bounce levels:

- Dow 16,200 (weak) and 16,300 (strong)

- S&P 1,852 (weak) and 1,860 (strong)

- Nasdaq 4,275 (weak) and 4,300 (strong)

- NYSE 10,350 (weak) and 10,400 (strong)

- Russell 1,182 (weak) and 1,190 (strong)

Yesterday we got Dow 16,247, S&P 1,859, Nas 4,280, NYSE 10,377 and Russell 1,188 – not bad for numbers we predicted two days before they happened, right? Now we'll see of we can take back those strong bounce lines (all 5) and hold them for 2 closes – that's what it will take for us to pull our CASH!!! off the sidelines. If not – we'd just as soon wait two weeks for earnings before making a larger commitment.

Yesterday we got Dow 16,247, S&P 1,859, Nas 4,280, NYSE 10,377 and Russell 1,188 – not bad for numbers we predicted two days before they happened, right? Now we'll see of we can take back those strong bounce lines (all 5) and hold them for 2 closes – that's what it will take for us to pull our CASH!!! off the sidelines. If not – we'd just as soon wait two weeks for earnings before making a larger commitment.

We had our watch levels in yesterday's post and we're still at Russell 1,185 but now it's S&P 1,855, Dow 16,200 and Nasdaq 4,300 we'll be looking for to be intra-day bullish.

In our Member Chat Room, right at 9:59, things were looking better so we took a poke at some fun bullish option plays on the usual suspects:

-

AAPL Apr $530s at $12, now $10.50 – down 13%

-

GOOG Apr $1,260s at $9.50 , now $9.80 – up 3%

-

CMG Apr $620s at $8, now $10 – up 25%

-

NFLX Apr $445s at $10.50, now $9, down 14%

-

TSLA Apr $250 calls at $10, now, $9 – down 10%

Not such good performance so far but the Futures look good this morning and maybe we'll get a bit more action. If we don't hold the bounce lines – we cut and run on these bullish plays We'll discuss our status later today in our Live Webcast at 1pm and, if you missed Friday's "How to Buy Stocks for a 15-20% Discount" Webcast – you can view that replay HERE. Meanwhile, we'll find ways to keep ourselves amused while we wait for tomorrow's Fed statement (2pm).

Until then, as they say in the Queen song – "nothing really matters."