What an exciting start to the week!

What an exciting start to the week!

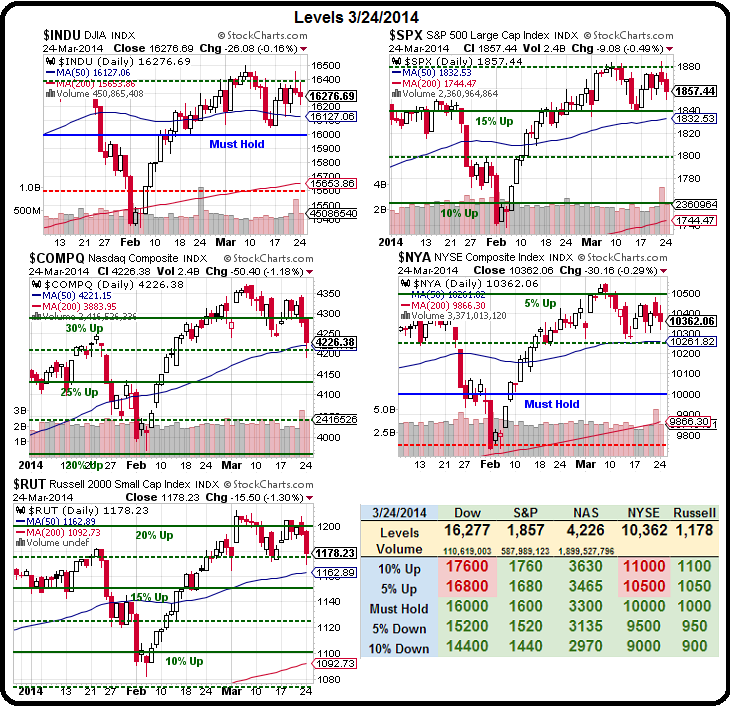

As you can see from our Big Chart, we have the classic "Spitting Cobra" pattern forming with the Nasdaq already breaking sharply lower, but saved by the 50 dma and the 27.5% line at 4,200-4,220.

That's going to be our critical hold this week and we also have to keep an eye on 1,840 on the S&P and 10,250 on the NYSE – whichever way 2 of those 3 go should tell us the story.

Of course we made gobs and gobs of money on yesterday's sell-off in the Russell. It was right there for you in our morning post and we also extensively discussed the Russell as our primary short last week, and in our Live Trading Seminar last Tuesday (and you can watch today's live Webcast HERE at 1pm). Here's a nice chart from Chris Kimble that illustrates our point:

In Friday's post, I noted we had tweeted out a call to short the Russell Futures (/TF) at the 1,200 line (and you can follow me on Twitter HERE) and that day's drop was good for $1,000 per contract, down the the 1,190 line. Yesterday morning, at 8:50 am in our Member Chat Room, I reiterated my call to continue to short the Russell at 1,190 – which would come as no surprise to anyone who read my morning post. The Russell proceeded to fall below 1,170 – good for $2,000 per contract gains less than two hours later.

For the Futures-challenged, we went with a TZA (ultra-short on the Russell) April $14/16 bull call spread at .64 at 9:41 in Friday's Member Chat and those have already popped to .97, up 51% on that small correction in the Russell. THAT is how you hedge! Also in Friday's post, we suggested the NFLX April $400 puts at $6.75 which finished at $28.50 yesterday – up 322% in two days – not bad for a free trade idea! We also laid out this bearish spread on Chiplotle (CMG):

For the Futures-challenged, we went with a TZA (ultra-short on the Russell) April $14/16 bull call spread at .64 at 9:41 in Friday's Member Chat and those have already popped to .97, up 51% on that small correction in the Russell. THAT is how you hedge! Also in Friday's post, we suggested the NFLX April $400 puts at $6.75 which finished at $28.50 yesterday – up 322% in two days – not bad for a free trade idea! We also laid out this bearish spread on Chiplotle (CMG):

- Buy 1 CMG Jan $650/750 bull call spread at $27.50

- Sell 1 CMG April $600 call for $35

That spread netted a credit of $7.50 ($750) and finished the day yesterday with the spread at $23 but the April $600 calls were only $22 for net $1, up $8.50 ($850) in 48 hours is a gain of 113% – also not bad for a free trade idea, right?

In our Premium Chat Room, we also picked FAS April $85 puts at $1.04 (now $1.19, up 14%), XRT April $87 puts at $1.70 (now $2.50, up 47%), Natural Gas Futures long at $4.30 (now $4.365, up $650 per contract), Dow Futures (/YM) short at 16,250 (made $500 per contract at 16,150), S&P Futures (/ES) short at 1,865 (made $1,000 per contract at 1,845) and Nasdaq Futures (/ES) short at 3,650, which paid $1,500 per contract at 3,575 on yesterday's dip.

This is what we're able to do when we go to CASH!!! and have lots of margin sitting around to play with. Aside from making very nice returns on our side bets yesterday, our Members were happy and relaxed while the market was selling off because we took our bullish money and ran already. If the market bounces back and makes new highs – we'll be happy to get back in – right where we got out. If the market, however, falls to lower lows – we are ready, willing AND able to do a bit of bargain hunting.

We took a poke this morning at CHL ($43) for our Income Portfolio, which we cashed out last week. Our only other trade so far is a long play on RIG, but we're happy to add a few more, as soon as we're sure this drop is a shallow one – which we don't really believe. I'll certainly be looking for at least a couple more to add ahead of our Webcast at 1pm, where we'll review our trades live.

Meanwhile, we're watching and waiting, happily mainly in cash…