After a very ugly week, what's in store next?

After a very ugly week, what's in store next?

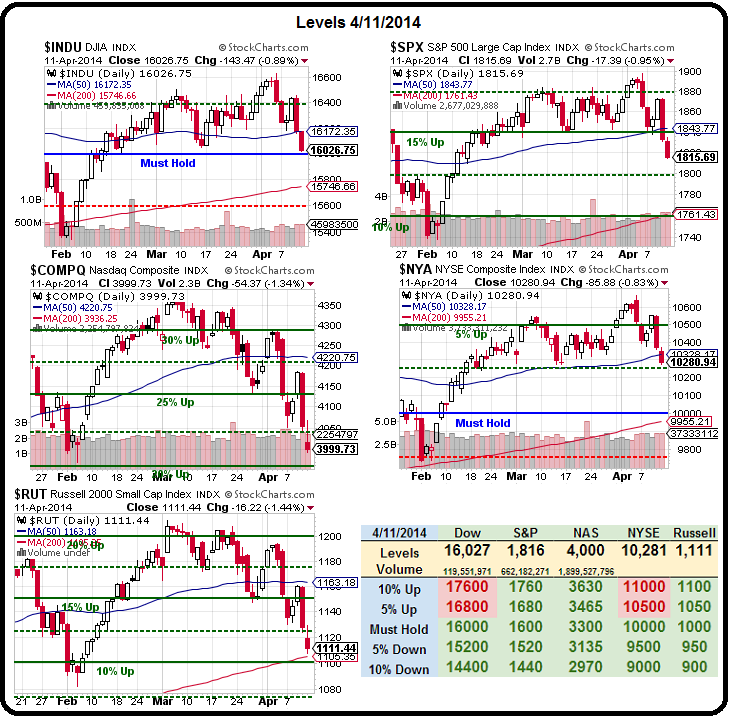

This is one very ugly chart with an almost 10% drop on the Nasdaq and the Russell but that's GOOD news as it's about where we expect the Central Banksters to step in and do something, before things turn more ugly.

That's why we weren't pressing our bearish bets last week and we took our very aggressive TZA and XRT bets off the table in our Short-Term Portfolio and our $25,000 Portfolio because, with the indexes down this far, we expect at least a weak bounce to start the week – the question is – what happens after that?

Very simply, per our 5% Rule™, when the market drops 5%, we expect a 1% retrace and, in the case of the Nasdaq and the Russell, we expect a 2% retrace for a "weak bounce." Also, as you can see on our Big Chart, we have some serious support on the Dow at our "Must Hold" lijne at 16,000. There's pretty much no way it can fail that without a bounce.

The Dow fell from 16,600 to 16,000 and that's only 3.6% but it's a strong support line but, as noted by Dave Fry in his Dow Chart, the real support comes at the 200 dma, at 15,750, and that's 5.1% today but that 200 dma will rise while it waits for the Dow so we can still expect a test at 15,800, which should be 5% by that time, assuming our weak bounce fails this week.

The Dow fell from 16,600 to 16,000 and that's only 3.6% but it's a strong support line but, as noted by Dave Fry in his Dow Chart, the real support comes at the 200 dma, at 15,750, and that's 5.1% today but that 200 dma will rise while it waits for the Dow so we can still expect a test at 15,800, which should be 5% by that time, assuming our weak bounce fails this week.

On our other indexes, we'll be looking for:

- Dow 16,600 to 16,000 is 600 points (3.6%) and we're looking for a 120-point weak bounce to 16,120 and a 240-point strong bounce to 16,240 before we believe any sort of "rally."

- S&P 1,900 to 1,815 is 85 points down (4.5%) so 17 points to 1,832 is weak and 17 more to 1,849 is strong but let's call it 1,850 before we're impressed.

- Nasdaq failed 4,375 and down to 4,000 (8.5%), also a strong technical support line that held up in late Jan/early Feb as well. Keep in mind, when an index is going to fall 10%, the 8% line also provides support on the way down. Same for the 4% drop on a 5% run so these are "bouncy" areas we expect to see some support – unless the market is in a real panic, which it isn't. So, 375 points lost on the Nasdaq gives us neat 75-point bounce lines on the way back up and that's 4,075 and 4,150 we can look for next.

- The NYSE is usually a very reliable index and we're down on that one just 3.6% as well, from 10,670 to 10,275 and that's 395 points so call it 80-point bounces to 10,350 (we like round numbers) and 10,430 to get back on track.

- Finally, the Russell has also fallen 8.6%, from 1,210 to 1,105 and that's 95 points but let's call it 100 and let's look for 20-point bounce lines at 1,125 and 1,145.

So, to sum it up, we're looking, today, for weak bounces at Dow 16,120, S&P 1,832, Nasdaq 4,075, NYSE 10,250 and Russell 1,125 and, by Wednesday, when Yellen speaks at 12:15 and the Beige Book is released at 2pm, we need to see strong bounces at Dow 16,240, S&P 1,850, Nasdaq 4,150, NYSE 10,325 and Russell 1,145. If we hold those through Friday – THEN the drop is probably over.

So, to sum it up, we're looking, today, for weak bounces at Dow 16,120, S&P 1,832, Nasdaq 4,075, NYSE 10,250 and Russell 1,125 and, by Wednesday, when Yellen speaks at 12:15 and the Beige Book is released at 2pm, we need to see strong bounces at Dow 16,240, S&P 1,850, Nasdaq 4,150, NYSE 10,325 and Russell 1,145. If we hold those through Friday – THEN the drop is probably over.

C got us off to a good start this morning with good earnings but let's not get too excited as it's one of many we will see this week. We aren't giving away any more free trade ideas in our morning posts during earnings seasons (you can subscribe to PSW right here) as we don't want our trades to get too crowded but, if the markets do what we expect, you can imagine we'll be having quite a bit of fun making money off the movement we're predicting!

I did mention that JPM earnings play from Monday's Chat Room in Friday's post, that was a net $50 credit per options contract and the May $57.50 calls we sold finished at .55 while the Jan $57.50/62.50 bull call spreads we bought as covers held $1.60 of value for net $110 + the original $50 credit is $160, or a 320% gain on cash in a single week. Now you can see why we like to keep these earnings trade ideas private…

I will tell you we added USO and SCO plays to go short on oil as it tested $104 on Friday and, of course, we're shorting the Futures (/CL) there as well. Doesn't matter how bullish the indexes bounce – people still don't have $4 a gallon to pay for gasoline, which is the inevitable effect of $105 oil.

I will tell you we added USO and SCO plays to go short on oil as it tested $104 on Friday and, of course, we're shorting the Futures (/CL) there as well. Doesn't matter how bullish the indexes bounce – people still don't have $4 a gallon to pay for gasoline, which is the inevitable effect of $105 oil.

Don't forget it's a short week, with a holiday on Friday so make sure you are done with any April options contracts before Thursday or it can get very messy. We'll be reviewing our 5 Member Portfolios and doing a bit more bottom-fishing next week and tomorrow we'll have our Live Trading Workshop Tomorrow at 1pm – you can sign up here if you do want some trade ideas for the week!

Don't get too excited by a weak bounce – we have a lot of earnings to wade through as well as US Housing Data starting tomorrow that might ba a bit disappointing. We also have CPI and, if that's heating up, the Fed may have no choice but to take their foot off the gas pedal.