Did you see the frightened ones?

Did you hear the falling bombs?

Did you ever wonder

Why we had to run for shelter

When the promise of a brave new world

Unfurled beneath a clear blue sky? – Pink Floyd

What were we excited about?

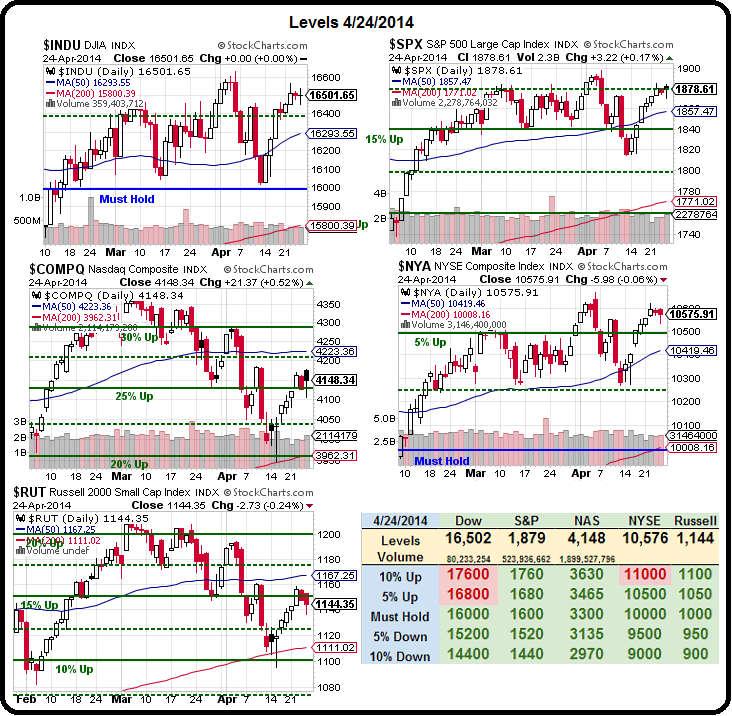

With 204 of the S&P 500 now reporting 68% (139) have beat earnings estimates BUT only 44% (90) have beaten on revenues. It's yet another year of cost-cutting and share buy-backs to boost earnings per share with no actual growth in real earnings yet the market, overall, is up 35% from where it was last year on a 2.9% overall growth in EPS. – THAT'S FRIGGIN' CRAZY!

If we back out BAC, who had the crap fined out of them this Q, then the S&P earnigs are up a more respectable 4.9% but, on the other hand, that includes superstars like AAPL, who dropped $13Bn on the S&P by themselves, and it's very unlikely the rest of the S&P will bring up the curve. In fact, Zacks is now estimating that overall earnings will be DOWN 0.9% for the quarter compared to last year and DOWN 4.6% from last quarter.

No wonder we are seeing the continued exodus of "smart money," who sell in volume into every rally we have. What's getting scary (and keeping us bearish) is that now we aren't even making gains on weak volume. Yesterday's move up was 100% due to AAPL, which gained over 8% on the day.

No wonder we are seeing the continued exodus of "smart money," who sell in volume into every rally we have. What's getting scary (and keeping us bearish) is that now we aren't even making gains on weak volume. Yesterday's move up was 100% due to AAPL, which gained over 8% on the day.

Since AAPL is 15%+ of the Nasdaq, that 8% gain should have popped the Nasdaq 1.2% and the rally in AAPL suppliers should have lifted the index even more. But it didn't. The Nasdaq was only up 0.8%, so it would have been down 0.5% without AAPL's contribution and even further without the rally in suppliers and the sectors that support them.

As I said to our Members yesterday ahead of the bell, Apple's gains are Samsung and others' lossses, NOT an indication of strength in the sector. That's why AAPL is our stock of the year – it's simply a better company in a better position this year than their competitors. Our AAPL trade of the year (see yesterday's post for details), which was added to our Long-Term Porfolio on 12/30, is already at net $69 from an origianl net of $21, so up 228% in just 3 months and well on-track for our 525% target gain.

On 5 contracts in our Long-Term Portfolio, that's a virtual $24,000, helping to push our Long-Term Portfolio up over 10% for the year already. That works out well, since the topic of Wednesday's Live Webinar was "7 Steps to Consistently Making 30-40% Annual Returns" and, here we are, right on track for 40% in our main portfolio for 2014!

Keep in mind, we are still playing the market very cautiously, as we don't trust this market at all, so the bulks of our Long-Term Portfolio and our Income Portfolio are still in cash. We're adding a few companies here and there as they fall (again, see yesterday's post for a few examples or Join PSW and Get These Trades Every Day – LIVE) and, with 3/5 of the S&P still to report, we're fairly certain there will be many more opportunities to add some bargain stocks over the next 30 days.

Keep in mind, we are still playing the market very cautiously, as we don't trust this market at all, so the bulks of our Long-Term Portfolio and our Income Portfolio are still in cash. We're adding a few companies here and there as they fall (again, see yesterday's post for a few examples or Join PSW and Get These Trades Every Day – LIVE) and, with 3/5 of the S&P still to report, we're fairly certain there will be many more opportunities to add some bargain stocks over the next 30 days.

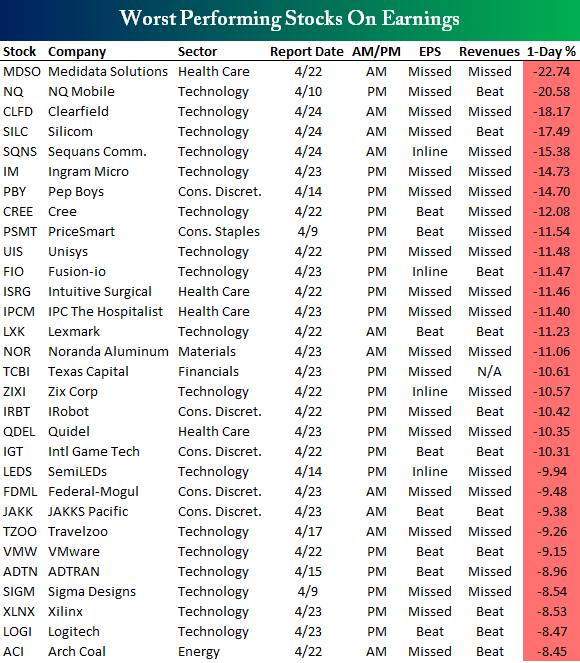

As you can see from the Bespoke chart on the right, there's no shortage of bargains to be had after earnings. Even our beloved IRBT had a bad Q, but it was because of sequestration slowing their military contracts – the consumer segment was gangbusters and we are salivating over the opportunity to jump back in (we sold high) at a discount!

There are a few others on this list we will be picking up (when they form a good bottom) and a few from the bull list we'll be shorting when they fly too high. Speaking of flying to high – our ship finally came in on V and, as expected, guidance was a disappointment and they are down about 4% pre-market. No surprise to us, of course, as we're well aware the bottom 90% consumers are completely tapped out. V is a Dow component and, of course, that means we shorted the Dow Futures in this morning's Member Chat (16,400 on /YM) and we'll see how low we can go today.

Next week we have another 1,000 companies reporting earnings (100 on the S&P) and a ton of data, including a Fed Rate Decision on Wednesday. It's going to be an exciting week and we're short into the weekend because we kick off the week with housing data – and we already know that sucks.

Have a nice weekend,

– Phil