Whenever the manipulators need to boost the markets, they just crash the Dollar.

Whenever the manipulators need to boost the markets, they just crash the Dollar.

And what a dive we've had! As you can see from Dave Fry's Chart, the Dollar is down 7% since last summer and down 2.5% this year and that keeps stocks and commodities 2.5% higher – because we buy them with Dollars.

Keep in mind, at the same time you are buying IBM shares for $200, someone is buying the same shares for 20,400 Yen and another guy is buying them for 340 British Pounds and yet another guy is buying them for 280 Euros.

It's obvious that, if the value of the Pound or the Yen or the Euro changes, the price of IBM in those currencies will change to reflect the currrency valuation but Americans tend not to realize the same thing happens when the Dollar gets stronger or weaker too. Once you do realize this – you have a huge advantage in trading the Futures (and we have a Live Futures Workshop this afternoon at 1pm).

The Fed's easy-money policies keep the Dollar weak (because we're printing another Trillion of them each year and, in this economy, no one is using them – ie. no demand) and that has goosed the market by 7% since last summer, when the S&P was about 1,650 – about 10% lower than it is now.

The Fed's easy-money policies keep the Dollar weak (because we're printing another Trillion of them each year and, in this economy, no one is using them – ie. no demand) and that has goosed the market by 7% since last summer, when the S&P was about 1,650 – about 10% lower than it is now.

That means that 75% of the gains in the S&P since last summer have been the result of a weak currency and have noting to do with a "strong" economy. Now THAT makes sense, doesn't it?

"THEY" had to tank the Dollar to get us over the 1,600 level, which was a very key technical off our consolidated bottom at 800 during the crash. It's no coincidence that we were hitting resistance there in May and pulling back to 1,560 and looking weak in July when, suddenly, the Fed went into a new round of crazy, which led to 6 months of fairly steady value erosion for every single Dollar you have worked for and saved your entire life.

It's kind of a tax on you – the Government has reduced the value (in International Terms) of EVERYTHING you have by 7% in order to transfer market wealth to the top 1%, who own 85% of all equities and, of course, who control pretty much 100% of all corporations, who are able to use their inflated stock prices as collateral to sell or borrow against (or acquire other companies). It's a fantastic game – if you're the one on the top of it!

It's kind of a tax on you – the Government has reduced the value (in International Terms) of EVERYTHING you have by 7% in order to transfer market wealth to the top 1%, who own 85% of all equities and, of course, who control pretty much 100% of all corporations, who are able to use their inflated stock prices as collateral to sell or borrow against (or acquire other companies). It's a fantastic game – if you're the one on the top of it!

It's also a great way for the Government to reduce their debt, which is mainly owed to foreign Governments like Japan and China. A weaker Dollar means our debt, which is priced in fixed Dollars can be paid back with less Yuan, Yen, Pounds and Euros. It's not that simple of course – Japan is racing us to the bottom as they try to devalue the Yen to reduce their own 200% debt to GDP ratio.

It is, however, a fantastic way for our Multinational Corporate Masters to cut our pay by 3.5%, since half of the S&P 500's revenues come from overseas, which means paying us in US dollars that have dropped 7% saves them half of that reduction on their balance sheets and that makes their earnings seem 3.5% higher (depending on how many US employees, of course) than they would be otherwise.

It is, however, a fantastic way for our Multinational Corporate Masters to cut our pay by 3.5%, since half of the S&P 500's revenues come from overseas, which means paying us in US dollars that have dropped 7% saves them half of that reduction on their balance sheets and that makes their earnings seem 3.5% higher (depending on how many US employees, of course) than they would be otherwise.

It's amazing how we villify Putin for essentially doing the exact same thing in Russia as the top 0.01% are doing to America – the only difference is, we haven't invaded Canada yet for their resources – but don't worry, there will be hostile takeovers down the road – look how quickly Blackberry was destroyed. Now we are messing with their oil and gas revenues with our "drill baby, drill" and pipeline policy – just like Putin did with the Ukraine before he invaded (allegedly). Maybe we'll just get the French Canadians to declare themselves a state and then we'll run in to support their right to choose…

As I said above, being aware of currency fluctuations makes us much better Futures Traders. This morining, for example, in our early morning Member Chat, we did a chart review and we had a good discussion about the 5% Rule™ and I pointed out to our Members that the Dollar was down 0.5% this morning and breaking below support, saying:

As I said above, being aware of currency fluctuations makes us much better Futures Traders. This morining, for example, in our early morning Member Chat, we did a chart review and we had a good discussion about the 5% Rule™ and I pointed out to our Members that the Dollar was down 0.5% this morning and breaking below support, saying:

Dollar down to 79.19 is down 0.5% so I guess that's the big, BS news that's propping up the market. Nikkei hasn't reacted much to it yet, still 14,350 so shortable on that line (/NKD) but out if the Dollar bounces.

Overall, I'd say yesterday was low volume BS and we should see more downside today. S&P 1,880 (/ES) is still a good shorting line as is /NQ 3,600 and Dow 16,450 confirmed by /TF below 1,120. If we can't move up on a 0.5% Dollar drop – thats' not a good sign!

Already, as I'm writing this at 8:30, the Dollar is down to 79.10 but that's not stopping the slide in the Futures with the Nikkei at 14,275 (up $375 per contract), S&P Futures (/ES) 1,873 (up $350 per contract), Nasdaq 3,586 (up $280 per contract) and Dow 16,425 (up $125 per contract). That, as we like to say, pays for the Egg McMuffins this morning and that is what I will be teaching you how to do in our Live Futures Trading Workshop at 1pm today.

Already, as I'm writing this at 8:30, the Dollar is down to 79.10 but that's not stopping the slide in the Futures with the Nikkei at 14,275 (up $375 per contract), S&P Futures (/ES) 1,873 (up $350 per contract), Nasdaq 3,586 (up $280 per contract) and Dow 16,425 (up $125 per contract). That, as we like to say, pays for the Egg McMuffins this morning and that is what I will be teaching you how to do in our Live Futures Trading Workshop at 1pm today.

If you already made $1,130 trading 4 contracts in less than two hours this morning – by all means don't bother – I'm sure you have some shopping to do!

We're expecting more downside because, as noted on Dave Fry's SPY chart, yesterday's volume was ridiculously low and Monday's are always to be taken with a grain of salt, so we're throwing out the chart and focusing on the data and the data (earnings, etc) is not any better than it was on Friday, when we decided to move back to more cash – in anticipation of a bigger drop than the 1.25% we hit at yesterday's brief low.

We're expecting more downside because, as noted on Dave Fry's SPY chart, yesterday's volume was ridiculously low and Monday's are always to be taken with a grain of salt, so we're throwing out the chart and focusing on the data and the data (earnings, etc) is not any better than it was on Friday, when we decided to move back to more cash – in anticipation of a bigger drop than the 1.25% we hit at yesterday's brief low.

We're not betting heavily to the downside – we've been burned too often to gamble on that. What we have done is cash out our non-hedged, directional longs at what we're pretty sure was an interim top and we'll see how things go from here. Meanwhile, playing the Futures is one of the many fun things we can do with CASH!!!

Futures allow us to make quick in and out trades with low friction and often we can make a few hundred Dollars very quickly. Occasionally, we get big winners, like last Thursday's call to short the Nikkei (/NKD) Futures at 14,500 and this morning, just 3 sessions later, we're already testing 14,250. At $5 per point, per contract, that's $1,250 for each contract in just 3 days. The call was there, for free, right in the morning post – don't say I never gave you nothin'….

We were also shorting oil at $100 that day and we have had a couple of rides down to $99 and, this morning, we're testing $100 again (/CL). Needless to say we're shorting it again as well. You can play along – it's a free trade idea – maybe you can buy a Membership with the winnings!

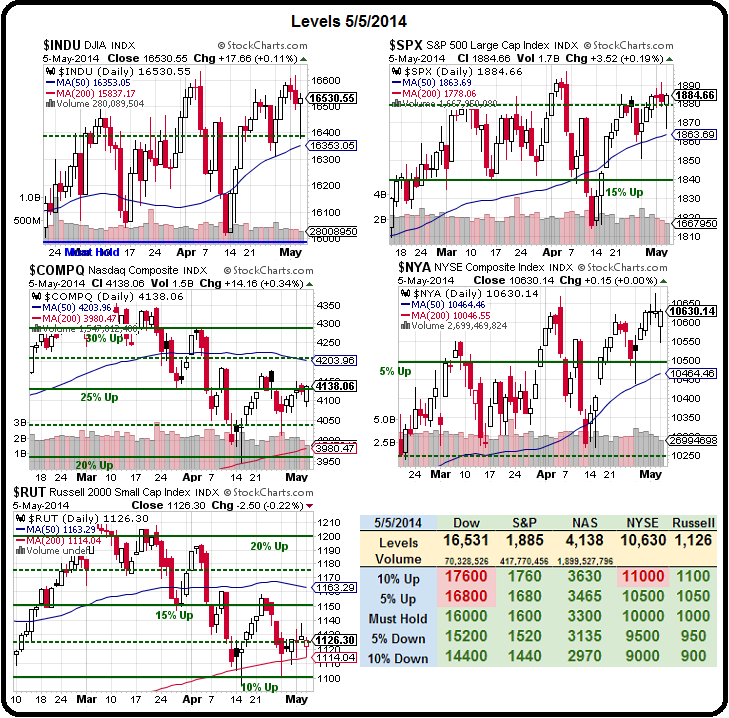

We're still looking for follow-through to the downside. Watch the Russell closely for a breakdown below the 200 dma (1,114) or the S&P below 1,865, which would be $450 per contract on our Futures play!