I hurt myself today

To see if I still feel

I focus on the pain

The only thing that's real – Nine Inch Nails

Were we wrong to cash out?

It's hard to feel bad about taking a 19% profit off the table after just 6 months (in our $500,000 Long-Term Portfolio) but we had another low-volume pump-job yesterday that sent some of the positions we closed up sharply and left us regretting our timing – just a little.

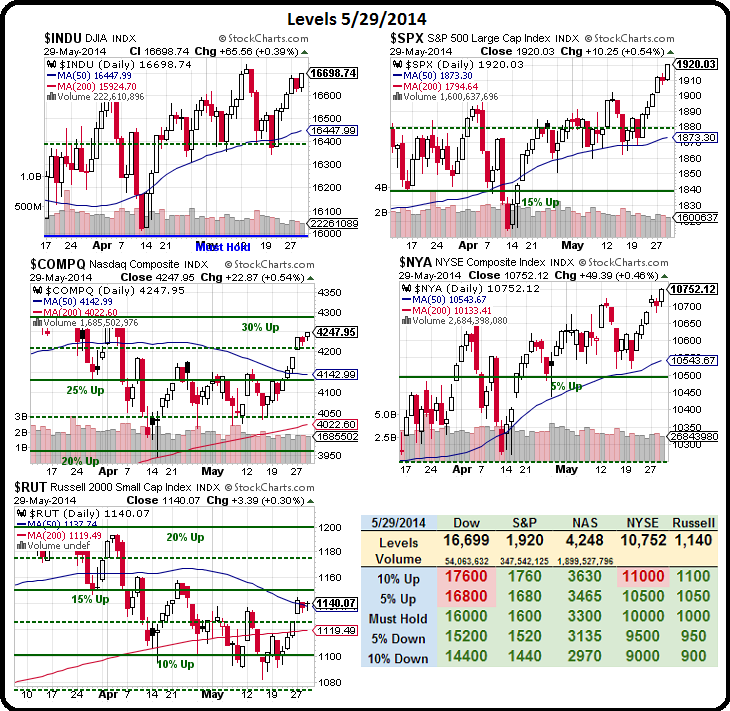

Still, the time to sell your positions is when other people are buying, not while everyone is panicking. We got great exit prices and, on the whole, it was fairly stress-free. S&P 1,920 was our predicted top and we pulled the trigger to take the money and run at 1,910 because, as experience has taught us – it doesn't pay to be greedy!

Last week and this week, I laid out my case for why the economy is not as good as it seems and certainly not good enough to be paying all-time highs for stocks. As you can see from the chart on the left – I'm certainly not the only one who thinks so as the "smart money" has flown out of the market this year, taking advantage of each record high to sell, Sell, SELL!!!

Last week and this week, I laid out my case for why the economy is not as good as it seems and certainly not good enough to be paying all-time highs for stocks. As you can see from the chart on the left – I'm certainly not the only one who thinks so as the "smart money" has flown out of the market this year, taking advantage of each record high to sell, Sell, SELL!!!

We were a little more patient, we moved our Conservative Income Portfolio ($500,000) to cash at the end of March and avoided the April sell-off and have since been buying bargain stocks in that portfolio. We had left our more aggressive Long-Term Portfolio ($500,000) on the table but this last leg of the rally left it up a ridiculous 19% for the year – and that's halfway to our best-case goal so it's a good time to take a break, step back, and see how the market handles early June.

It's not like we can't find anything to do with our cash. In additions to our usual Futures trading, we still have our Short-Term ($100,000), Butterfly ($100,000) and $25,000 Portfolios to play with and, since Wednesday morning's call to cash out our LTP (9:36 am), we've added the following 10 virtual trade ideas in our Live Member Chat room:

It's not like we can't find anything to do with our cash. In additions to our usual Futures trading, we still have our Short-Term ($100,000), Butterfly ($100,000) and $25,000 Portfolios to play with and, since Wednesday morning's call to cash out our LTP (9:36 am), we've added the following 10 virtual trade ideas in our Live Member Chat room:

- 10 SQQQ July $48/54 bull call spread (now $1,300), selling 1 ISRG 2016 270 put for $17.50 ($1,750) for a net $450 credit (bearish Nasdaq play)

- SDS July $26/29 bull call spread at 0.90 (bearish S&P play)

- SCO July $25/28 bull call spread at $1.25, selling $26 puts for $1.10 for net 0.15 (bearish on oil)

- 10 UBNT 2016 $45/55 bull call spreads at $2 ($2,000) (bullish play on Ubiquiti Networks added to our Income Portfolio)

- NEM 2016 $20/25 bull call spread at $2.20 (bullish on Newmont Mining and gold)

- FCX 2016 $30/37 bull call spread at $3.15, selling 2016 $30 puts for $3.20 for a net 0.05 credit entry (bullish on Freeport McMoRan and gold and copper)

- NFLX Aug $340 puts at $10 (bearish play on Netflix)

- Oil Futures short at $104 (bearish play on oil) – already $103 for $1,000 per contract gain and off the table into the weekend (we still have USO puts from a previous position).

- 5 WYNN Jan $240/210 bear put spreads at $17.50 ($8,750), selling 4 July $210 puts for $6 ($2,400) with stops on 2 at $8 ($1,600) and 2 at $10 ($2,000) for net $6,350-$9,950 on the $15,000 spread (bearish play on Wynn Resorts)

- AAPL 2016 $520/600 bull call spread at $47.50 (bullish play on Apple, Inc.)

So, in 48 hours after going to cash, we added back 6 bearish and 4 bullish plays. We're never "ALL" bullish or "ALL" bearish – we hedge but, as you can see from our picks above, we also sell a lot of risk premium on both sides of the table so that, whether the market is up, down or sideways – we're going to have some winners!

So, in 48 hours after going to cash, we added back 6 bearish and 4 bullish plays. We're never "ALL" bullish or "ALL" bearish – we hedge but, as you can see from our picks above, we also sell a lot of risk premium on both sides of the table so that, whether the market is up, down or sideways – we're going to have some winners!

Any idiot can make 20% in a relentlessly up market (see our "7 Steps to Consistently Making 20-40% Annual Returns" video) and we're happy to be that idiot – just not over this particular weekend and, as I told our Members, not until June 10th when, if the market hasn't crashed – we're willing to do some more buying.

If you want a mindless trade that pays for an entire year of a Philstockworld Premium Membership (still just $5,000 before the price increase coming in September) you can try this:

- TZA is a 3x ultra-short ETF tracking the Russell, currently at $16.24. The January $14/21 bull call spread is net $2 ($200 per 100-unit contract) and pays up to $700 (350%) per contract at $21, which is 30% higher on TZA so a 10% drop in the Russell, back to 1,026 would pay the full amount. $2,000 can be risked (10 contracts) to pay back $7,000 and that $2,000 can be paid for by selling a single AAPL 2016 $480 put for $20 ($2,000).

- That gives you $5,000 of upside protection in exchange for your promise to buy 100 shares of AAPL (per contract) for $480, which is 24.4% off the current $635. 100 shares of Apple is, of course $48,000 at $480 and that would use $24,000 of margin in an ordinary account (but only $4,800 of net margin is required for the spread) if you end up buying the stock – so you don't EVER want to make plays like this unless you REALLY want to own the stock you sold puts against at the net price.

This is what we teach you to do at PSW, to hedge you investments, to trade like a hedge fund manager instead of one of the retail suckers who are always paying the premiums we collect. If the market goes down, our TZAs pay off and we'd like to buy AAPL at $480 anyway. If the market goes up, it's very doubtful AAPL goes down and that means this hedge is completely free for the year. Another bonus to the downside is, IF the market tanks and you are forced to buy $48,000 worth of AAPL, you'll likely have a $5,000 profit on your TZA spread to contribute towards it, netting you into AAPL for $430 per share (32% off).

This is what we teach you to do at PSW, to hedge you investments, to trade like a hedge fund manager instead of one of the retail suckers who are always paying the premiums we collect. If the market goes down, our TZAs pay off and we'd like to buy AAPL at $480 anyway. If the market goes up, it's very doubtful AAPL goes down and that means this hedge is completely free for the year. Another bonus to the downside is, IF the market tanks and you are forced to buy $48,000 worth of AAPL, you'll likely have a $5,000 profit on your TZA spread to contribute towards it, netting you into AAPL for $430 per share (32% off).

This is why we are able to make such good returns in our portfolios – we win if it goes up, we win if it goes down, we might even make a little if the market stays flat! You just have to learn to BE THE HOUSE – Not the Gambler…

Have a great weekend,

– Phil