Courtesy of Mish.

Black Knight’s April Mortgage Monitor shows almost 2 million modifications face interest rate resets, and 40 percent of those resets are underwater.

Email News Release

“We have seen a continual reduction in the number of underwater borrowers at the national level for some time now, but modified loans show a different picture,” said Kostya Gradushy, Black Knight’s manager of Loan Data and Customer Analytics. “While the national negative equity rate as of April stands at 9.4 percent of active mortgages, the share of underwater modified loans facing interest rate resets is much higher — over 40 percent. In addition, another 18 percent of modified borrowers have 9 percent equity or less in their homes. Given that the data has shown quite clearly that equity — or the lack thereof — is one of the primary drivers of mortgage defaults, these resets may indeed pose an increased risk in the years ahead.

“From a broader perspective, it’s also important to note that more than one of every 10 borrowers is in a ‘near negative equity’ position, meaning the borrower has less than 10 percent equity in his or her home. This is particularly pronounced in New Mexico and Southern states. At a local level — and we look at both mortgage performance and Home Price Index (HPI) data down to ZIP code granularity — such slim margins in equity can have a significant effect on overall negative equity levels with even slight variations in HPI. So, while the overall situation for underwater borrowers has improved significantly, there are still areas in the country where borrowers are hovering at the edges.”

Mortgage Monitor Charts

April 2014 Summary Data

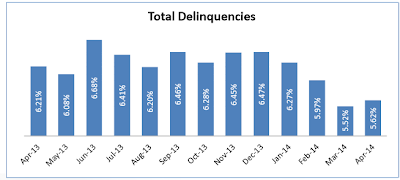

Total Delinquencies

click on any chart for sharper image

New Originations

…