Fake it 'till you make it.

Fake it 'till you make it.

While it was Aristotle who said that "acting virtuous will make one virtuous" (and clearly Aristotle hasn't been to the same charity events/wealth orgies that I have, or he never would have said it), it is our modern Central Banking system that decrees that "acting like the economy is better will make the economy better."

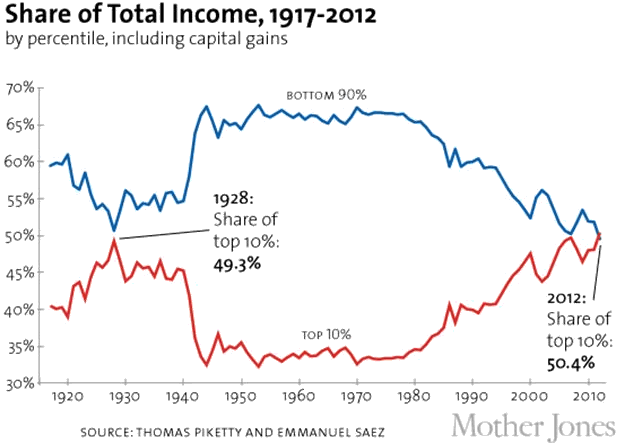

Now, perhaps if they had spent $29,000,000,000,000 by giving 7Bn people $4,142.85 each – we WOULD have a better economy now – but that's not what happened at all, is it? Instead, 70,000 people and corporations (the top 0.0001%) got an average of $414M each while the other 99.9999% of us, especially the bottom 90% actually are now worse off than when the Central Banksters decided to meddle in our affairs in the first place.

The rich are indeed getting stunningly richer with the Forbes 400 (richest Americans) AVERAGING $800M gains in 2013 as the stock market (where most of their money is) rose over 30%. Again – AVERAGE gains of $800M per Billionaire! Once you get past #50 on the list (Google's Eric Schmidt with $8.3Bn), that's AT LEAST 10% of their total net worth added in a single year!

The rich are indeed getting stunningly richer with the Forbes 400 (richest Americans) AVERAGING $800M gains in 2013 as the stock market (where most of their money is) rose over 30%. Again – AVERAGE gains of $800M per Billionaire! Once you get past #50 on the list (Google's Eric Schmidt with $8.3Bn), that's AT LEAST 10% of their total net worth added in a single year!

As I said in our recent trade review "Thank You Sir, MAY I Have Another", if they are just going to keep giving away money like this – we're going to just have to keep taking it (through our many bullish trade ideas) but, at some point, the music will stop and you'd BETTER be able to find a chair fast!

There's a very good reason the Corporate Media is constantly telling you how bad "class warfare" would be – BECAUSE THEY ARE ALREADY WINNING THE WAR AND YOU ARE NOT EVEN FIGHTING!!!

Like any good game of musical chairs, we have no idea when the music is going to stop, so we all have to keep dancing around like nothing is wrong until it does. As I pointed out yesterday, it's very easy to pay $150Bn for Amazon (at $327 per share) with money you just printed because the stock is TECHNICALLY worth something while the money you (a Central Bankster) are printing is quite literally not worth the paper it's printed on.

Like any good game of musical chairs, we have no idea when the music is going to stop, so we all have to keep dancing around like nothing is wrong until it does. As I pointed out yesterday, it's very easy to pay $150Bn for Amazon (at $327 per share) with money you just printed because the stock is TECHNICALLY worth something while the money you (a Central Bankster) are printing is quite literally not worth the paper it's printed on.

Now we are trapped in a cycle because China is printing money and using it to buy up 3% of the World's equities for about $3Tn and, as I noted yesterday, Norway's Central Bank has been converting oil money into 2.5% of all the stock in Europe. How can the US sit by and allow other Central Banks to own everything – don't we love socializing corporations as much as the Communists and Socialists?

While we're not quite at the point where China demands a board seat at Raytheon, GE or Boeing, Chrysler already went to Fiat and other corporations are disappearing in a flurry of M&A activity almost no one can keep track of anymore.

While we're not quite at the point where China demands a board seat at Raytheon, GE or Boeing, Chrysler already went to Fiat and other corporations are disappearing in a flurry of M&A activity almost no one can keep track of anymore.

Softbank (Japan) is buying Sprint and DT (Germany) is grabbing TMobile and that leaves just two American companies (T and VZ) in charge of our nation's telecommunications. Isn't this exactly what anti-trust legislation was supposed to prevent?

In fact, if you look at the above chart of Content Providers, it very closely mirrors that very same Forbes 400 list we started with, doesn't it? Content is indeed king and never has so much of it been in the hands of so very few.

In fact, if you look at the above chart of Content Providers, it very closely mirrors that very same Forbes 400 list we started with, doesn't it? Content is indeed king and never has so much of it been in the hands of so very few.

Of course, at the height of the Dot Com Bubble, $2.7 BILLION was tied up in 10 companies that went bust about a year later and many, many Billions of other Dollars were lost as well – never to be found again – until NOW! Now, just 14 years later, we have AMZN ($150Bn), EBAY ($62Bn), FB ($164Bn), GMCR ($20Bn) LNKD ($20Bn), NFLX ($25Bn), PCLN ($63Bn), TSLA ($28Bn), TWTR ($22Bn) and, amazingly, YHOO ($29Bn) again for a total of $586Bn (200x the mistake of 1999) for 10 companies that don't earn $5Bn (1% or p/e of 100+) between them.

HAVE WE LOST OUR FREAKIN' MINDS??? Apparently so if we think paying AMZN 500 times what it earns in a year for the privilege of owning each one half of one billionth of the company per share that pays NO DIVIDENDS to be a good idea. NFLX seems like a bargain at just 162 times earnings – or at least they will until people realize how much they are spending on content development and customer aquisitions when they miss earnings next month (we're short).

There's a fundamantal flaw in investor understanding of math that has to do with both income disparity and stock valuations. Investors value our modern-day dot-com companies because they buy into the growth story and they feel that, within about 5 years, the growth will be such that the p/e's of those companies comes down to something resembling AAPL (15) or GOOG (28) or CSCO (16) or MSFT (15).

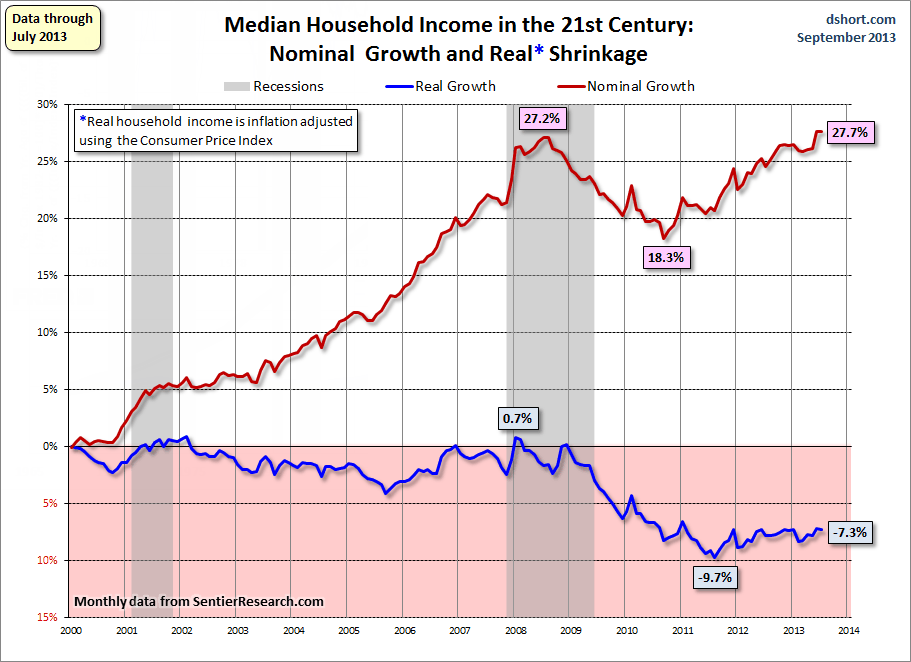

That would be lovely but that means those companies need to earn $25Bn and, the question is, where is that money going to come from? If their plan was to get the money from the Forbes 400 – I would think they might have a chance as those guys just dropped $3.2Tn into their bank accounts but our 10 moden dot-com companies have to get their money from the other 309,999,600 Americans and THOSE PEOPLE are 10% POORER than they were in 1999 – it's not too likely they have $25Bn more to give, not to mention $25Bn in PROFIT is likely to require at lease $125Bn in sales – even at 20% margins (doubtful).

That would be lovely but that means those companies need to earn $25Bn and, the question is, where is that money going to come from? If their plan was to get the money from the Forbes 400 – I would think they might have a chance as those guys just dropped $3.2Tn into their bank accounts but our 10 moden dot-com companies have to get their money from the other 309,999,600 Americans and THOSE PEOPLE are 10% POORER than they were in 1999 – it's not too likely they have $25Bn more to give, not to mention $25Bn in PROFIT is likely to require at lease $125Bn in sales – even at 20% margins (doubtful).

So where will 300M Americans come up with $125Bn a year? That's $416 per citizen and that would be assuming every citizen used every one of those services. Of course, figure globally they only need about $100 per year from the average user – might be doable but who are we taking that money from? Withough economic growth for the bottom 90% – the money has to be taken from one place to be given to another – so who will suffer enough to boost Amazon's earnings 20x and bring them down to a semi-reasonable p/e?

The good news is inflation is on a tear, with CPI up 0.4% this morth – the most since Feb 2013. As you can see from the Nominal Growth line above, even though, IN REALITY, Median Household Incomes in the US have DROPPED over 7% in the past 14 years, inflation has pushed nominal growh up 27%, making things LOOK 34% better than they actually are. Looking 34% better than they actually are is pretty much what the current stock market is all about this year.

Let's enjoy it – while it lasts….