I forgot to talk about something important yesterday.

I forgot to talk about something important yesterday.

Turkey was caught FAKING their trade data, with Prime Minister Erdogan, working with Economic Minister Caglayan LAST YEAR to manipulate their $800Bn economy by sending gold overseas to boost their export numbers. How a team that included Turkey’s economy minister sought to manage the current account deficit, as the gap is called, by juicing exports to Iran is laid out in a 300-page document prepared by Turkish investigators in 2013. Caglayan and his collaborators also came away with tens of millions of dollars in bribes, according to the document, which has been cited in parliament by opposition lawmakers.

The covert efforts that Caglayan and his associates undertook eventually swelled to a multi-billion dollar enterprise that reached from Ghana to China, according to the investigation. Tons of gold flowed from Turkey to Iran, much of it via Dubai. That freed up Iranian money trapped in Turkish banks, in turn boosting Turkish exports.

When the gold trade was foiled by tightening American sanctions starting in July 2013, Sarraf and his collaborators kept exporting. They sent thousands of tons of overpriced — and sometimes fictitious — food onto ships steaming between Dubai and Iran, according to the document.

So what is the REAL Global GDP? Clearly they aren't manipulating the numbers LOWER, so we can assume things are a bit LESS than they might seem. With a 3% downward revision to US GDP over the past 90 days, who knows what surprises lie ahead? We know Russia (8th) is corrupt – what about Ukraine (52), Venezula (31), Pakistan (43) Brazil (7), Mexico (14), Greece (43), Italy (9), Spain (13) (to name a few)? And, of course, let he who is without despicable manipulating, self-interested, lying political bastards cast the first stone:

If you think that's sickening, check this out!

Even if you assume our First World Politicos have our best intentions at heart and are operating above-board at all times (sorry, it took me 5 minutes to write that as I had to stop myself from laughing every couple of words!), that still doesn't mean they aren't, with all the best intentions, screwing things up completely.

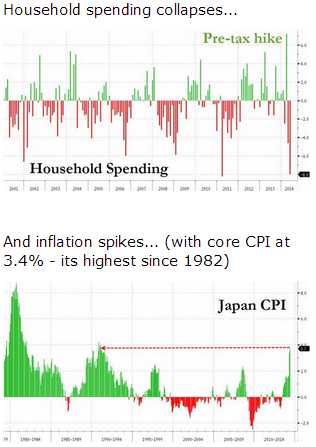

It's not just US Consumers that are pulling back but Japanese Household Spending is in free-fall – even as inflation doubles. There's a special economic term for this condition that was popular in the 70's: STAGFLATION – a stagnant or falling economy mixed wth inflation. At that time, in the US, it was caused by our Vietnam War Debt and Nixon taking us off the gold standard in order to print money.

It's not just US Consumers that are pulling back but Japanese Household Spending is in free-fall – even as inflation doubles. There's a special economic term for this condition that was popular in the 70's: STAGFLATION – a stagnant or falling economy mixed wth inflation. At that time, in the US, it was caused by our Vietnam War Debt and Nixon taking us off the gold standard in order to print money.

Now it's being caused by Iraq/Afghanistan War debt and we're alread off the Gold standard so we've been printing more money the entire time. Nixon's economic idiocy led to Gerry Ford wearing "Whip Inflation Now" buttons and, of course, the GOP blamed it all on Washington outsider Carter, just like they are trying to blame this one on Washington outsider Obama – that's how they get to be back in power!

Well, that and getting a crisis started in one of the oil regions they control (Iran then, Iraq now) so the NeoCons can call the current adminstration weak and scare Americans into voting for the war machine once again – after our all-too-brief flirtation with peace.

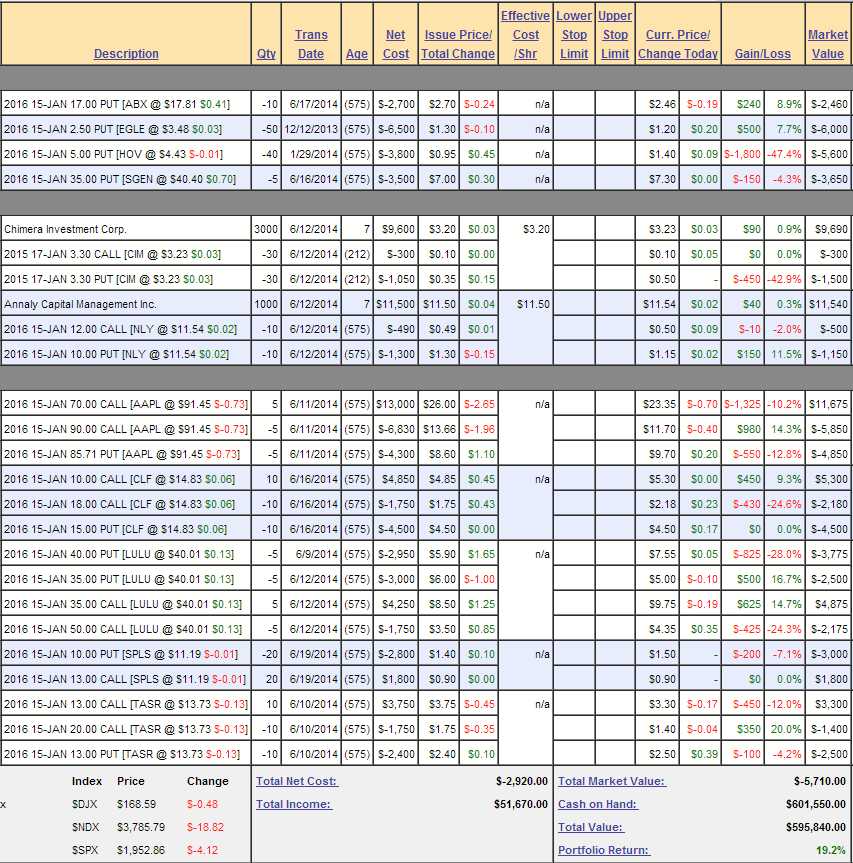

As investors, it's important for us not to care about the human costs of these idiotic policies – we just want to know what the market is likely to do over the next few months. At the moment, we are "Cashy and Cautious" and in our two $500,000 Virtual Portfolios, the Income Portfolio and the Long-Term Portfolio, we are using less than 20% of our buying power currently as we are still waiting for the market correction that never comes.

Our $100,000 Short-Term Portfolio is a bearish offset to our long-term positions but we've managed to keep it even, despite the relentless rally. Our $100,000 Butterfly Portfolio is market-neutral but also lightly committed and our $25,000 Portfolio is almost entirely in cash at the moment as we head into Q2 earnings.

Our $100,000 Short-Term Portfolio is a bearish offset to our long-term positions but we've managed to keep it even, despite the relentless rally. Our $100,000 Butterfly Portfolio is market-neutral but also lightly committed and our $25,000 Portfolio is almost entirely in cash at the moment as we head into Q2 earnings.

Our primary hedge, at the moment, is an October DXD (ultra-short Dow) $25/29 bull call spread but we also sold some July $25 calls for $1.25 and today, at .65 (up 47%), I'm calling to take those off the table as I feel the risk of a collapse is getting stronger and, though I do feel that "THEY" will keep the makets looking pretty into Monday for "window-dressing" at the end of Q2, I am getting very worried as to whether they can sustain this farce even as long as the holiday weekend.

Next week is going to be very thinly traded. We discussed a nice TNA hedge in yesterday's chat and how to portion it for your portfolio. In addition to that, with the Dow back over 17,000, I like DXD (ultra-short Dow) again at $25.60 and you can pick up the August $25s for $1 and sell the August $27s for 0.40 for net 0.60 on the $2 spread. That gives you 233% of upside if the Dow even flinches lower (5% would do it) and, since at Dow 16,000 I'd be bullish but I'd also want a short hedge, we can also sell the Jan $24 puts for $1.10 and that nets us a 0.60 credit and we can stop out if the Russell is over 17,500 with a not so terrible loss.

We'll likely add some of those to our Short-Term Portfolio, though we may decide to just add more DXDs. I do kind of like to hedge with more than one index though and the Russell Small Caps are a good pairing with the Dow Large Caps.

Don't forget, next week is a short week in the US with a half-day on Thursday and markets closed Friday. I know I wouldn't want to be too long on the markets going into a 4-day weekend with Russian Troops in the Ukraine and whatever you call that mess in Iraq. Cashy and cautious indeed!

Have a great weekend,

– Phil