Wheeeeeee – a new record!

Wheeeeeee – a new record!

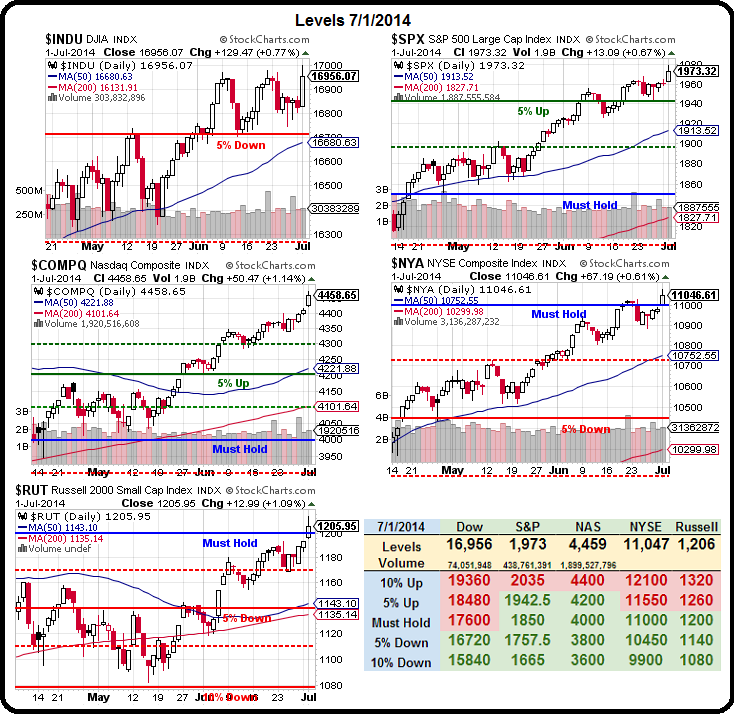

Actually, we shouldn't get too excited as it's a new record every day but it's still fun to celebrate while the all-time highs are lasting. The Dow fell just 2 points shy of 17,000 but ended up 44 points short – that's one we'll watch closely today, along with NYSE 11,000 – a level I have long stated will force us to turn more bullish if it holds.

Unfortunately, with the low-volume holiday trading, we won't be able to confirm these moves until next week but that doesn't bother TA people, who ignore everything but the squiggly lines on the charts and they say RALLY!!! I imagaine this weekend we'll see "Dow 20,000" on a magazine or two but that's still a far cry short of the 36,000 we were promised on the cover of the Atlantic back in January of 2000.

The Dow topped out that month at just under 12,000 so 17,000 is, in fact, good progress but still over 50% short of the level we were supposed to hit 10 years ago and let's not forget that we visited 6,600 first! So, maybe not the right time-frame and maybe not a smoothe ride – but we're heading in the right direction – now.

Not wanted to fight the mega-trends, we went wtih the flow and added Dow laggard IBM on Monday at noon in our Live Member Chat Room with the following trade idea:

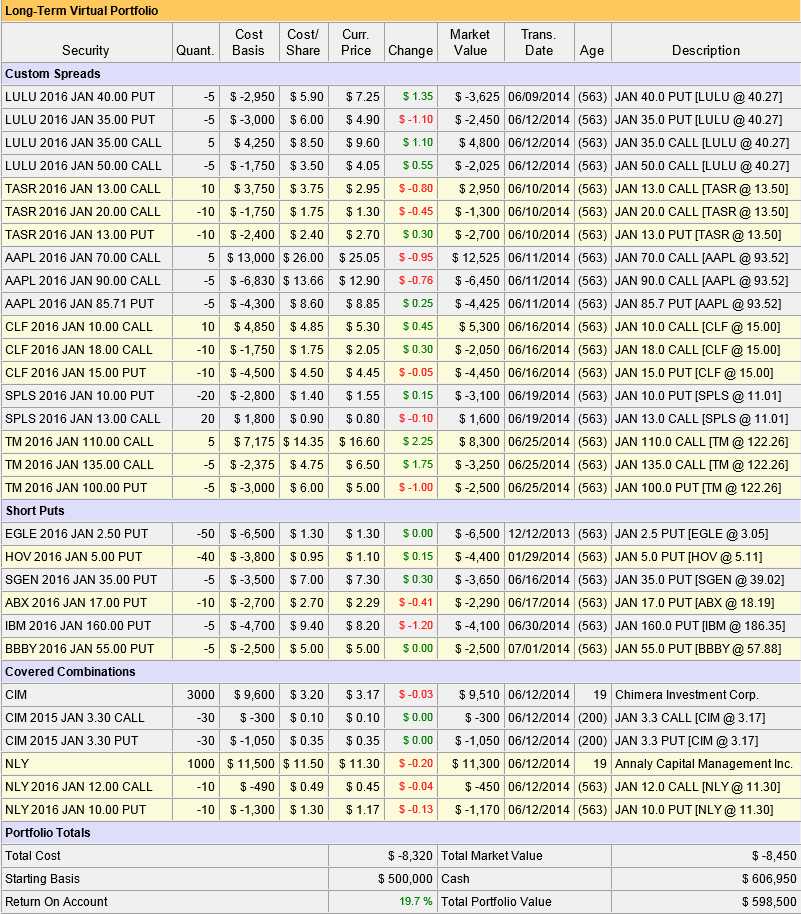

IBM is on our Buy List but not in our Portfolio yet as I was hoping they'd have a weak Q2 and go down a bit but I'm nervous my theory on Watson will gain traction and send IBM back up so let's add 5 short 2016 $160 puts at $9.40 to the LTP and, if IBM goes lower, we'll be happy to sell 10 more and add a bull call spread.

As I noted in yesterday's Live Webinar and as you can see on the chart, our timing was perfect and IBM led the Dow higher in yesterday's rally and the short options we sold for $4,700, closed yesterday at $4,000 for a $700 one-day gain (15%) – who says trading long-term options is boring? The great thing about a trade like this is our worst case would be owning IBM at net $150.60, which is 19% off the current price!

With our $500,000 Long-Term Portfolio, we only have to make one $4,700 trade per month like that one to collect $56,400, better than 10% a year simply for promising to buy stocks –IFF they get cheaper – not a bad strategy. That's also why there's no rush to re-fill our portfolio after cashing out at the end of May.

With our $500,000 Long-Term Portfolio, we only have to make one $4,700 trade per month like that one to collect $56,400, better than 10% a year simply for promising to buy stocks –IFF they get cheaper – not a bad strategy. That's also why there's no rush to re-fill our portfolio after cashing out at the end of May.

We have 29 stocks on our Buy List (Members Only) and another 29 from our LTP before we cashed it out (reviewed here) and now, as you can see, we have $606,950 in cash ready to deploy for whatever bargains come our way as we move into Q2 earnings reports – it's exactly the position we want to be in in the middle of the year.

So "Cashy and Cautious" doesn't mean we're not participating in the rally, we added another 0.7% in June – even as we initiated 12 new positions (which we know "cost" money on our balance sheet as we get started). We also added some hedges to our Short-Term Portfolio which, although a bearish offset to the LTP, has somehow managed to maintain +1.4% in the face of this rally.

As you can see, the S&P volume this week is a total joke and, with a half day tomorrow and a holiday Friday, it's not going to improve for the week. That means it's best to take all the action with a huge grain of salt – I had said to our Members weeks ago that we could go on vacation until July 7th, because nothing really matters until we start getting those Q2 earnings reports.

As you can see, the S&P volume this week is a total joke and, with a half day tomorrow and a holiday Friday, it's not going to improve for the week. That means it's best to take all the action with a huge grain of salt – I had said to our Members weeks ago that we could go on vacation until July 7th, because nothing really matters until we start getting those Q2 earnings reports.

We still have huge concerns that the Global Economy is nothing but a gigantic house of cards that is being propped up by Central Banksters who are hell-bent to enrich all their top 1% buddies before the bottom falls out (again). I would be remiss if I didn't mention a few negatives that concern me today:

China borrowed $250Bn (1.55Tn Yuan) last quarter to fund their economic growth. That's on pace for a $1Tn deficit in an economy that's half our size! The latest filings of more than 4,000 publicly traded non-financial Chinese companies show $2.05Tn of obligations, up over 10% from $1.8Tn at the end of 2012, with the 10 biggest state-owned borrowers accounting for 18 percent of the liabilities.

China borrowed $250Bn (1.55Tn Yuan) last quarter to fund their economic growth. That's on pace for a $1Tn deficit in an economy that's half our size! The latest filings of more than 4,000 publicly traded non-financial Chinese companies show $2.05Tn of obligations, up over 10% from $1.8Tn at the end of 2012, with the 10 biggest state-owned borrowers accounting for 18 percent of the liabilities.

At the same time, local borrowings (regional debt) jumped $2.5Tn in the past 3 years or about 1/3 of China's GDP.

Meanwhile, it's not helping! Komatsu joins CAT in reporting a sharp downturn in Asian demand. Komatsu’s China sales in the two months were about 20 percent lower on the previous year, he said. The nation accounted for 9 percent of Komatsu’s total last year and the company had hoped to grow that to 10 percent this year. Komatsu is projecting a 38% downturn in unit sales for the year ending March 2015. And that's WITH all the stimulus!

Who would have thought Argentina was a bad credit risk after defaulting on $100Bn back in 2001? Apparently not the people who have lent them $240Bn since then and now Argentina is 30 days away from defaulting on that. As with Greece, Cyprus, Iceland, etc. – it's not just "tough luck Argentina" – these ripples quickly spread across the Global Financial community as the suckers who lent them money suddenly realize they are holding worthless pieces of paper (like our currency!).

Who would have thought Argentina was a bad credit risk after defaulting on $100Bn back in 2001? Apparently not the people who have lent them $240Bn since then and now Argentina is 30 days away from defaulting on that. As with Greece, Cyprus, Iceland, etc. – it's not just "tough luck Argentina" – these ripples quickly spread across the Global Financial community as the suckers who lent them money suddenly realize they are holding worthless pieces of paper (like our currency!).

Like moths to a flame, borrowers keep lending at ever-higher interest rates despite the default risk as they are always sure "someone" will ultimately bail them out – even as their lending rates make the payments unsustainable. Argentina has no ECB or Fed and has to rely in the IMF for a life-line and the IMF simply can't afford to bail out a country with a $500Bn GDP (26th in the World). That's double Greece, 25x Cyprus and 50x Iceland!

Meanwhile, in Bulgaria (75th, with a $50Bn GDP), they are still trying to stop a bank run that was apparently started by "social media rumors." If social media rumors can destabilize your financial system, your financial system probably wasn't all that stable to begin with. Of course, things like this may just be a test run for a much larger attack in a much bigger country – I hear Yahoo was just caught "experimenting" with controlling the emotions of their users – what's next?

I've got a lot more but the market just opened so, for now, let's enjoy that rally!

We're long on oil at $104.75 (/CL) and long on gasoline (/RB) at $3.02 in the Futures – that's your free holiday trade idea for the week.