Happy Birthday America!

Happy Birthday America!

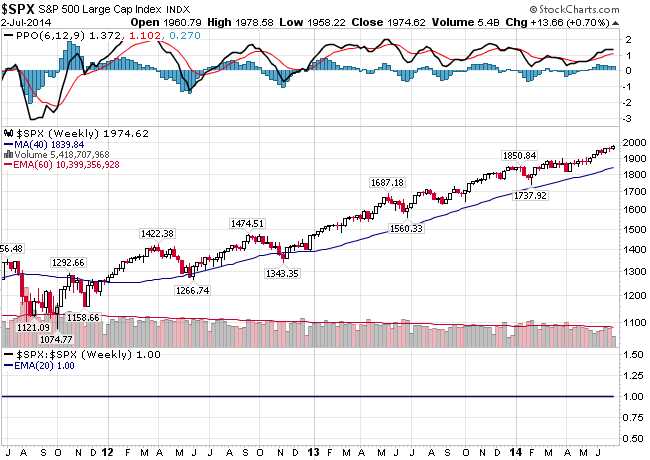

The markets are closed tomorrow and today is a half day but the trend is certainly our friend on the S&P as we haven't been below the 200 day moving average since December of 2011 (except a couple of very brief dips). Though the average volume is about 30% lower than it was back then – it's still an impressive feat.

Of course, if 10% of the market was manipulated before and the manipulators haven't left (they certainly haven't) – even if the level of manipulation remained the same, 30% of the 90% that wasn't manipulated (retail investors) did leave (possibly BECAUSE of the manipulation) and that means now manipulators control 10% of the remaining 70%, a 42% increase in manipulation! Of course we know it's much worse than that because now the Central Banksters perform their own brand of market manipulation. As noted by Salient Partners in a great article about PBOC Manipulation:

The explicit purpose of recent monetary policy is: to paper over anemic real economic growth with financial asset inflation. It’s a brilliant political solution to the political problem of low growth in the West, because our political stability does not depend on robust real economic growth. So long as we avoid outright negative growth (and even that’s okay so long as it can be explained away by “the weather” or some such rationale) and prop up the financial asset values that in turn support a levered system, we can very slowly grow or inflate our way out of debt. Or not. The debt can hang out there … forever, essentially … so long as there’s no exogenous shock. A low-growth zombie financial system where credit is treated as a government utility is a perfectly stable outcome in the West.

So China has indeed learned the most valuable lesson of Capitalism – that money is a meaningless contstruct that can be freely manipulated to fit whatever narrative the Government wishes to spin and that debt is not to be feared, but embraced, especially by our Corporate Masters – because our National Debt becomes their Private Profits!

When you own a store, you want to sell stuff. When a person comes in with money and wants to buy stuff, you don't ask him where he got it (especially if you are HSBC, apparently) – you just take the money. If he robbed someone else, or borrowed himself into unsustainable debt – it makes no difference to your bottom line – you just want to make the sale. Don't feel bad, that's Capitalism!

Of course, Corporate America takes it one giant leap forward and our Corporate Masters have become political activists who push for policies that cause more and more debt and collect less and less taxes to balance that debt and, if they can stir up an occasional war to boost business – so much the better!

After this summer break we head into the first major political election in the US since Corporations last year were given the unlimited ability to contribute to political campaigns. As you can see from the chart on the right, the Koch Brothers' have already (as of April) put $125M into their Americans for Progress Pac, which dwarfs the $40M the Democrats have put away for Congress and the $20M they have put away for Senate races.

After this summer break we head into the first major political election in the US since Corporations last year were given the unlimited ability to contribute to political campaigns. As you can see from the chart on the right, the Koch Brothers' have already (as of April) put $125M into their Americans for Progress Pac, which dwarfs the $40M the Democrats have put away for Congress and the $20M they have put away for Senate races.

What's the difference between the US and China? China doesn't pretend to still have a Democracy. As this country celebrates it's 238th anniversary of "Independence Day," we have never been less free. We are a nation of wage slaves who are held captive by Big Business and spied upon by our own Government, both of whom control the once-independent Judiciary Branch.

As we wait for today's Non-Farm Payroll Report (expected to be 250,000), let's keep in mind that the QUALITY of US jobs has gone completely to Hell over the last decade:

As we wait for today's Non-Farm Payroll Report (expected to be 250,000), let's keep in mind that the QUALITY of US jobs has gone completely to Hell over the last decade:

- 60 percent of the net job losses occurred in middle-income occupations with median hourly wages of $13.84 to $21.13. In contrast, these occupationshave accounted for less than a quarter of the net job gains in the recovery, while low-wage occupations with median hourly wages of $7.69 to $13.83 have accounted for more than half of these gains.

- 53 percent of all wage earners in the United States make less than $30,000 a year.

- 47 percent of unemployed Americans have “completely given up” looking for a job.

- Median household income in the United States is about 7 percent lowerthan it was in the year 2000 after adjusting for inflation.

- One out of every four part-time workers in America is living below the poverty line.

- 76 percent of all Americans are living paycheck to paycheck.

- In America today one out of every ten jobs is now filled by a temp agency.

-

- Only four of the twenty fastest growing occupations in America require a Bachelor’s degree or better.

- In 2007, the average household in the top 5 percent had 16.5 times as much wealth as the average household overall. But now the average household in the top 5 percent has 24 times as much wealth as the average household overall.

- In terms of median wealth per adult, the United States is now in just 19th place in the world.

I'm sorry to harp on depressing items like this, especially into a holiday weekend (and jobs were up 288,000 this month so YIPEE!!!, by the way) but, when Russia used to have Pravda and Izvestia and they would tell the Russian people how great everything was while clearly (to us) things were falling apart – we would ask ourselves "how could they believe such nonsense?" Perhaps the reason is because the Russian people would read something like this and say – "I don't want to hear that crap, I'd rather listen to happy news!"

I'm sorry to harp on depressing items like this, especially into a holiday weekend (and jobs were up 288,000 this month so YIPEE!!!, by the way) but, when Russia used to have Pravda and Izvestia and they would tell the Russian people how great everything was while clearly (to us) things were falling apart – we would ask ourselves "how could they believe such nonsense?" Perhaps the reason is because the Russian people would read something like this and say – "I don't want to hear that crap, I'd rather listen to happy news!"

I'm not here to give you happy news – I'm here to give you real news and, since there's so little of it in the mainstream media, I tend to highlight the darker side of the US economy in an attempt to balance the overall news you are likely to digest. Let's call it a healthy dose of skepticism and remember that I'm still in this country and I love this country and I still hold out hope that this country can be fixed – but not the way it's going now!

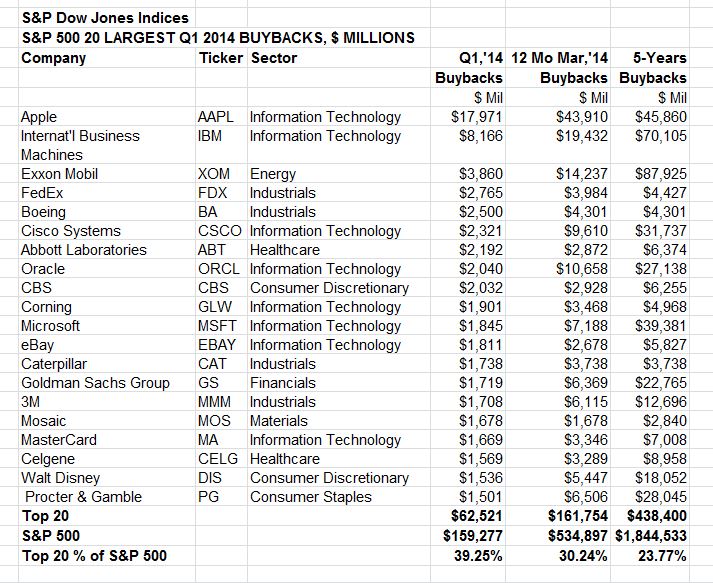

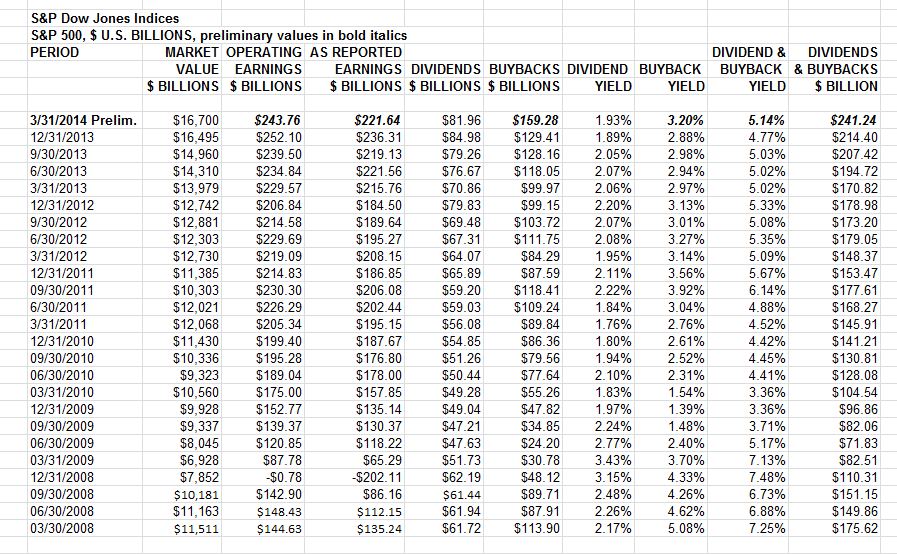

For us rich folks in the top 1%, there's never been a better time to move up to the top 0.01% as money and opportunities are everywhere. Things are so good for the top 0.001% (3,000 richest in the US) that just 20 US Companies were able to spend $62.5 BILLION buying back their own stock in the first 3 months of this year! On the whole, $159Bn was spent buying back S&P 500 stocks in Q1 with $1.8 TRILLION spent in 5 years – reducing the total outstanding amount of shares by 10% (and making earnings per remaining share 11% higher).

For us rich folks in the top 1%, there's never been a better time to move up to the top 0.01% as money and opportunities are everywhere. Things are so good for the top 0.001% (3,000 richest in the US) that just 20 US Companies were able to spend $62.5 BILLION buying back their own stock in the first 3 months of this year! On the whole, $159Bn was spent buying back S&P 500 stocks in Q1 with $1.8 TRILLION spent in 5 years – reducing the total outstanding amount of shares by 10% (and making earnings per remaining share 11% higher).

It's just another form of manipulation, folks. If I'm IBM and I have a $200Bn market cap and I'm making $20Bn in profits then my PE is 10 and I can't make more sales because the economy sucks so I can hire more people or develop new products, but maybe that won't increase my sales – so that's a gamble and I might get fired.

Instead I dip into the corporate kitty and remove $5Bn of our $15Bn in cash and I borrow $15Bn at 3% and use that to buy back 10% of my stock for $20Bn (100M of 1Bn shares).

Instead I dip into the corporate kitty and remove $5Bn of our $15Bn in cash and I borrow $15Bn at 3% and use that to buy back 10% of my stock for $20Bn (100M of 1Bn shares).

The interest on the $15Bn is $450M a year so that comes out of my $20Bn in earnings but now the $19.55Bn that's left is divided by 900M shares instead of 1Bn shares and my earnings go UP from $20 per share to $21.72 per share and VIOLA! – I have boosted "earnings" by 10% and now I (the CEO and board) get more dividends for each of my remaining shares – a "free" bonus!

Is the company STRONGER than it was before I bought back the stock? Not at all – we are selling the same amount and making the same amount but now we have used 1/3 of our cash and taken on $15Bn in debt and we're even making less because we're paying $450M a year in interest on the money we borrowed.

Is the company STRONGER than it was before I bought back the stock? Not at all – we are selling the same amount and making the same amount but now we have used 1/3 of our cash and taken on $15Bn in debt and we're even making less because we're paying $450M a year in interest on the money we borrowed.

In fact, there is NOTHING good about a buyback except in those rare circumstances where a stock gets so cheap that it's worth buying (Bufett's formula).

With a p/e of 10, IBM could argue that buying their own stock was the best use of their money, but it still indicates they are out of ideas or simply unable to grow by deploying available cash – that is NOT a good sign. Similarly, companies that buy out other companies are effectively having the same effect as buybacks because – if there were 2 IBMs with 1Bn shares making $20 per share and one buys the other one for $200Bn, then there would be one IBM with 1Bn shares making $40 per share and the whole S&P would seem to have better earnings per share – even though the total earnings are the same.

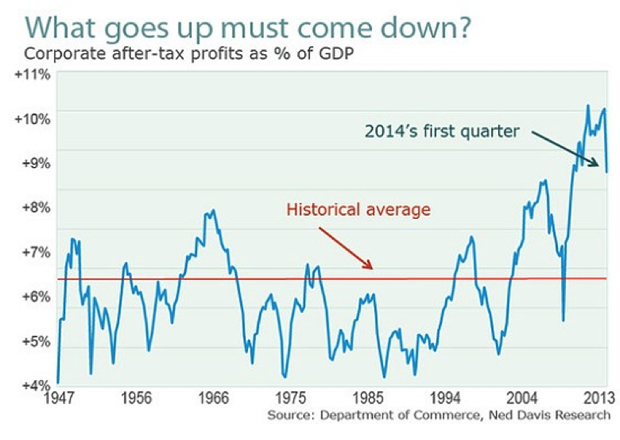

As you can see from the chart above, Q1 PROFITS were falling hard and fast but not fast enough not to be covered up by the removal of so many shares that those profits were divided by – so the S&P LOOKS healthy, even as it declines. As we get our Q2 reports, we'll try to wade through the BS and get a real picture of what's going on but, meanwhile, we just BOUGHT IBM.

After all, it's not like we expect this BS to stop anytime soon – so we may as well go along for the ride!

Have a fantastic holiday,

– Phil