Did you make your $1,000 yesterday?

Did you make your $1,000 yesterday?

You would have if you read yesterday's morning post (subscribe here), where we picked the Russell Futures (/TF) short at 1,160 saying: "If the Russell FAILS 1,160, we'll be happy to flip short for another ride down to 1,150." As you can see, we had plenty of time to get our planned entry at 1,160 and, as we expected, Yellen's speech disappointed and the markets sold off a bit – easy money!

We even flipped back to bullish in the afternoon and, at the beginning of our Live Webinar (1pm), we were able to demionstrate a very quick $250 profit taking the Russell Futures long off that same 1,150 line. In fact, you can see the big volume spike that came with our live call right on the chart!

We even flipped back to bullish in the afternoon and, at the beginning of our Live Webinar (1pm), we were able to demionstrate a very quick $250 profit taking the Russell Futures long off that same 1,150 line. In fact, you can see the big volume spike that came with our live call right on the chart!

This morning, news of a deal between AAPL and IBM has both companies showing 2% gains pre-market. For IBM, that's $5 and that's adding 40 points to the Dow Futures (/YM) pre-market and for AAPL, that's $2 and AAPL is 20% of the Nasdaq so 20% of 2% is 0.4% added to the Nasdaq from AAPL alone pre-market plus a nice effect on the S&P from both of those heavyweight stocks.

Under the agreement, IBM's employees will provide on-site support and service of Apple products inside companies, similar to the AppleCare service that Apple sells to consumers. IBM said it planned to make more than 100,000 employees available to the Apple initiative. It is a rare partnership for Apple, which historically has avoided such alliances.

"This is just the beginning," said Ms. Rometty, citing a statistic that most smartphones inside companies are used only for email and calendar. She said the companies hope to create new, serious business applications.

The companies said Apple and IBM engineers are together developing more than 100 new apps for various industries. The first batch of apps is expected to be available in the fall when Apple releases the next version of its mobile software, iOS 8. "Apple is not an enterprise company, but that's not their DNA. It is IBM's DNA and IBM has had those relationships forever," said Gartner analyst Van Baker. "It's an unlikely combination but a very strong one if they can pull it off."

We're long on AAPL, of course – it was our stock of the year pick for 2014 and, now that they've split, the 2016 $450 puts are now the $64.29s and they are just $1.70. Of course we have to divide the $41 we collected by $7 and that's net $5.85 per split share and that's already a very nice 70% profit.

We're long on AAPL, of course – it was our stock of the year pick for 2014 and, now that they've split, the 2016 $450 puts are now the $64.29s and they are just $1.70. Of course we have to divide the $41 we collected by $7 and that's net $5.85 per split share and that's already a very nice 70% profit.

The rest of the trade (see video) was the (adjusted) $64.29/85.71 bull call spread at $9.28 and we proposed 10 contracts, now 70 contracts, for net $24,000. The bull call spread is already at $15.70 so 70 of those is $109,900 (100 unit contracts) less the $11,900 we'd have to pay to close out the short puts is net $98,000 – up 308% already (4 months after that TV appearance)!

Of course, with AAPL already at $97.50 and on it's way to our $100 target, this spread still has the potential for the full $149,940 pay-offf, so another 50% still to be gained from here. Actually, it's not a bad, conservative way to play AAPL from scratch – if making 50% in 18 months is enough to satisfy you, that is…

See, you don't need to read Philstockworld every day to make money – you can still make 50% in 18 months just picking up our scraps!

Maybe it's a bit early but that makes us 3 for 3 with our Picks of the Year since we started them in 2012 (with BAC). Last year it was also AAPL and we hit our 600% profit target on that one. BAC paid 300% so $10,000 invested in our Trade of the Year in 2012 turned into $40,000 in 2013 and reinvesting that turned into $280,000 this year and, if we flipped all that into AAPL again, that would already be $1,120,000, with another $555,000 expected. Nice work if you can get it!

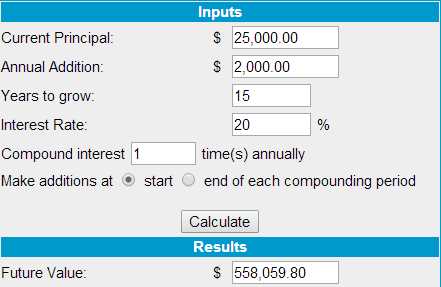

As we discussed in May's "How to Turn $25,000 into $500,000 in 15 Years" – you don't need to put it all on one stock to make some fantastic returns. Even if you had a $250,000 portfolio and put $25,000 into BAC and netted $100,000 back and you took 1/2 of that and put it in AAPL and got $350,000 back and took 1/2 of that and put it into our new AAPL trade, that would now be $1,400,000 with another $700,000 coming (if AAPL holds $85.71).

As we discussed in May's "How to Turn $25,000 into $500,000 in 15 Years" – you don't need to put it all on one stock to make some fantastic returns. Even if you had a $250,000 portfolio and put $25,000 into BAC and netted $100,000 back and you took 1/2 of that and put it in AAPL and got $350,000 back and took 1/2 of that and put it into our new AAPL trade, that would now be $1,400,000 with another $700,000 coming (if AAPL holds $85.71).

At no point was more than 10% of the starting cash at risk (though margin is required and there's the downside risk of owning the stock) yet we are able to turn $25,000 into $2.1M in 4 years by compounding the returns (and making good picks, of course). We don't expect to ALWAYS have a winner but you don't need to go all in to generate some pretty fantastic returns and the rest of your portfolio (90%) can use our more conservative strategies, aimed at getting those consistent 20% returns – as calculated above.

Please keep that in mind before you chase the current rally. We don't NEED to play that game. We can use much more conservative strategies and put up CONSISTENT market-beating returns, year after year. Not only is it profitable – it's much more relaxing!