Wheeeeeeeeeeeeeeeee!

Wheeeeeeeeeeeeeeeee!

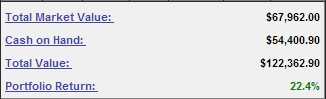

What fun this is! Well, it's fun for us because we were playing for this drop and not only did our bearish Short-Term Portfolio pop 10% yesterday but our bullish Long-Term Portfolio crossed over the 20% line for the first time this year. How is that possible? Because we are using our "Be the House – Not the Gambler™" strategy to SELL premium to suckers who think they know what the market is going to do!

This allows us to make money in any market direction while remaining well-hedged for the downturns. It also allows us to put up these spectacular gains while using less than 50% of our cash – keeping it on the sidelines and ready to deploy when we catch a good bargain on one of our Buy Lists to add to our virtual portfolios. We had not one but two special Live Trading Webinars yesterday for our Members, where we cashed out the XOM puts I mentioned FOR FREE last Friday for a 300% gain.

If you want to get our morning posts delivered to you each day, in progress, at 8:30 each day with access to the full posts pre-market – just sign up right here.

Last Friday I also suggested our SCO (ultra-short oil) longs and that $1,200 position in our Short-Term Portfolio closed yesterday at $3,400 – up a very nice 183% and the SQQQ trade I aslo put up in last Friday's morning post for a net $400 credit (also featured on TV on this Wednesday's Money Show) finished yesterday's session at $1,060 – up $1,400 (350%) in less than a week!

Another hedge we discussed were the TZA Aug $14 calls which were $1.67 on Wednesday (more FREE picks in the morning post), which was already up 153% from 0.66 when I first mentioned them (outside of our Live Member Chat Room) in our July 8th post. As of yesterday's close, they were $2.51 – up 50% from Wednesday and up 280% overall.

The 20 calls we picked as a hedge on July 8th for $1,320, jumped to $5,020 yesterday – a very nice $3,700 gain in three weeks. On Wednesday, we also discussed our larger TZA hedge, which was selling 100 TZA 2016 $12 puts for $3 ($30,000 credit) and buying 100 2016 $13/20 bull call spreads for $1.20 ($12,000) for a net $18,000 credit.

That one was from our July 3rd Live Member Chat Room when one of our Members, Bshing8 had asked me for a suggestion to replace 9,000 shares of TZA he was holding at a $45,000 loss. I'm very happy to say (and Bshing is happy too!) that the spread is already up $28,000 and on track for the full $88,000 gain.

That one was from our July 3rd Live Member Chat Room when one of our Members, Bshing8 had asked me for a suggestion to replace 9,000 shares of TZA he was holding at a $45,000 loss. I'm very happy to say (and Bshing is happy too!) that the spread is already up $28,000 and on track for the full $88,000 gain.

If you read our posts, you know we have been shorting oil since it hit $107.50 back in June and, this morning, it crossed the $97.50 line, which is more than a $10,000 PER CONTRACT gain from our original call. Of course we've been in and out but on July 18th, again right in the morning post for every level of our subscribers, we reiterated those shorts along with a suggestion for USO Aug $39 puts at $1.44, which finished the day yesterday (better today) at $2.69 – up 87% in two weeks!

That suggestion had also been made in that Thursday's post at $1.40 with oil at $102.50 (for a $5,000 per contract gain on those Futures shorts (/CL)). That day's post also carried a winning short trade on YUM that's up 200% now but was closed up 500% before this much bigger sell-off.

So there are TONS of ways for us to make money in a down market and these are just SOME of the free trade ideas we've given away recently in our morning posts. In our Live Member Chat Room, we do this sort of thing every day and we keep various virtual portfolios to help teach BALANCE – probably the most important concept any trader should learn. Balance is what gets us through these little corrections!

So there are TONS of ways for us to make money in a down market and these are just SOME of the free trade ideas we've given away recently in our morning posts. In our Live Member Chat Room, we do this sort of thing every day and we keep various virtual portfolios to help teach BALANCE – probably the most important concept any trader should learn. Balance is what gets us through these little corrections! ![]()

As you can see from Dave Fry's McClellan chart, this long-awaited correction has come so hard and fast that we hit oversold conditions already on the short-term indicator. That's why, yesterday, we began playing for a bounce in the afternoon but, so far, the markets have not been very bouncy. We have Non-Farm Payrolls at 8:30 and MAYBE they can turn us around into the weekend, but I wouldn't count on it.

8:30 Update: Non-Farm Payrolls came in at 209,000 missing estimates of 233,000 and far enough down from last report's 298,000 that unemployment has ticked up (to 6.2%) for the first time in 3 years. Average hourly earnings are up a penny from last month ($24.25) and up 2% since last year while the average workweek remains flat at 34.5 hours. That's $836.62 a week for the "average" worker or $43,504 per year but, of course, that includes CEOs who make $10,000 an hour.

There's nothing particularly alarming here but nothing great either. It's just been so long since we had real job growth (cough, CLINTON!, cough, cough) that we've forgotten what a HEALTHY economy looks like – so we celebrate this mediocrity as if it's some sort of gold-medal performance (which, compared to Bush II, it certainly is).

So, nothing here to make us give up our shorts into the weekend. In fact, I think we may ad a hedge or two in Member Chat – just in case!

Have a great weekend,

– Phil