You've gotta love those trend lines.

You've gotta love those trend lines.

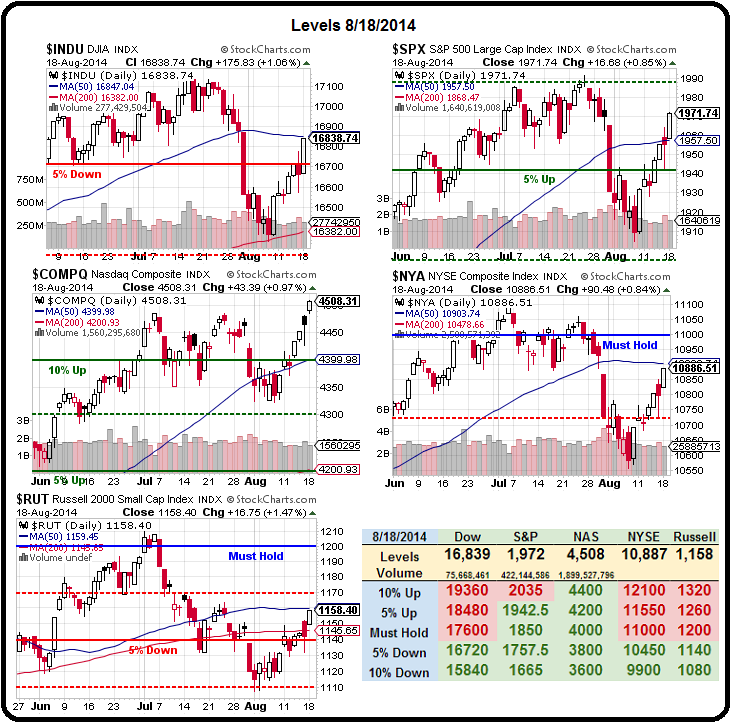

Chart people sure love them and we love chart peopel because they are SOOOOOOOO predictable and predictable behavior is behavior we can bet on and that makes us happy. Today we'll be seeing the 50-day moving averages on the Dow, the NYSE and the Russell all tested at the same time – what happens next will tell us a lot about this rally.

As I pointed out to our Members in our Live Chat Room this morning, though we may be past our bounce levels and though we are now challenging the 50 dmas, we still have 3 of 5 of our Must Hold levels red on the Big Chart – that's not too impressive. Consider what a 50-day moving average is. It means that, over the last 50 days, half the time the index has been above the line and half the time it's been below – so how impressive should it be to see the index back in the middle?

Nonetheless, Chart People believe it's some mystical symbol that gives them a rally signal and half the time they are right – so the religion of TA continues to prosper! As you can see from Dave Fry's SPY chart from yesterday, 75% of yesterday's gain came on no volume as we gapped up in the Futures and the rest of the day's trading was one of the lightest of the year.

Nonetheless, Chart People believe it's some mystical symbol that gives them a rally signal and half the time they are right – so the religion of TA continues to prosper! As you can see from Dave Fry's SPY chart from yesterday, 75% of yesterday's gain came on no volume as we gapped up in the Futures and the rest of the day's trading was one of the lightest of the year.

The reason I like Dave is because he's one of the only TA people who actually pay attention to volume and this volume is total BS. Still, it's enough to stampede the retail suckers back in and God bless them because they throw money at us to sell them the things we liked when they were out of favor.

In May and June, for example, we compiled a Buy List for our Members, which had 29 trades we liked for the rest of 2014. Here's a few that we are done with already:

ABX (5/28) we featured in our June 3rd post – obviously one I like. If you don't want to buy the stock for $15.90 (and we NEVER pay retail at PSW!), then you can sell the 2016 $15 puts for $2.05, which obligates you buy the stock for net $12.95, which is 19% below the current price.

If ABX stays over $15 through Jan 2016, the short puts expire worthless and you simply keep the $2.05 ($205 per 100-unit contract) in exchange for the promise you made – if ABX goes below $15, you may be assigned and own the stock at net $13. Since the net margin on the short puts is just $2.28, the trade returns 90% on margin in 18 months – not a bad inflation hedge, is it?

If you want to get more aggressive, you can add the 2016 $15/22 bull call spread for $2 and you still have a nickel credit but now you have an upside of every penny over $15 up to $22 with a potential return of $7.05 on your 0.05 cash outlay (+14,100%) if ABX gets back to $22 by Jan 2016. Still playable and already in our Income Portfolio.

BRCM (5/20) is one we like to buy whenever they are not expensive. They had a nice sell-off last year and we grabbed them at $25 but it doesn't look like that will happen again – now $30.23. They only pay a .48 dividend (1.5%) so forget that and we can sell the 2016 $30 puts for $4.10 for a net $25.90 entry and leave it at that and, if they weren't already in the LTP (we sold the 2016 $25 puts for $3.10 when it was lower) I'd add it now. (We cashed the LTP since then but those 2016 $25 puts are now 0.85 – up 72% in less than a month)

CIM (new) is a steady play at PSW. It was one of our top 3 picks for 2013 at $2.86 and now, at $3.30, we still like them – mostly because they pay a juicy 0.36 dividend, which is 11% of the current price but even better after we're done giving ourselves a discount on the entry!

On the right is my trade idea from last January's TV appearance on BNN and that net $1.96 entry is well on track to get called away next January for $2.50 (up .54) and, so far, we've collected 0.65 in dividends (there was a special bonus dividend in January). Assuming we collect the June, October and December dividends for .27 before being called away at $2.50, our total return on $1.96 will be $3.42 – a 74.5% return on our investment in just two years.

Now, perhaps, you can see why we love it so much! CIM is not cheap at the moment so this one is a real watch and wait item – especially as they have not created 2016 option contracts on them yet. We can, however, give ourselves a net $2.95 entry while we wait by selling the 2015 $3.30 puts for .35. Even if we never end up owning the stock (if it stays over $3.30), we're still collecting almost the entire dividend amount against just 0.63 in margin. That's a 55% return on margin between now and Dec (7 months).

IGT (5/13) confuses me. They just had good earnings yet they are being treated like dirt because they are in the midst of restructuring. We love it when we can take advantage of a situation by simply being more patient than the current investors!

IGT does pay a .44 dividend and they have expensive options so perfect for a buy/write where we buy the stock for $12.57 and sell the 2016 $10 calls for $3.40 and the $13 puts for $2.80 for net $6.37/9.19 so our WORST case is owning 2x at $9.19, which is 27% off the current price and that makes the .44 dividend 7% while we wait to see if we get called away at $10 for another $3.63 (57%) and, of course, we need to be over $13 to realize the full profit.

If IGT were put to us with the stock at $11, for example – we'd still be up $3.63 on the first batch (which still would have been called away at $10) and our new 1x position would be $9.37 less the .88 dividend we collected over 2 years. Not bad for a bad outcome…

As you can see from the chart, ABX is already at $18.69 and the short 2016 $15 puts are down to $1, up over 50% just 3 months later. The combo with the $15/22 bull call spread was a .05 credit and the 10 in our Income Portfolio paid us $50 to take the position which is already up to net $2,750 – a gain of 5,600% on cash. Not bad considering gold has been essentially flat over the same period!

The BRCM short 2016 $30 puts are now just $1.73, up 58% on their 3-month anniversary. CIM is less exciting as we're playing it for the dividend, not to make money on the stock, per se, but it was one of our trades of the year and you can see from the chart why we love it. The new spread is right on track for the full 56% gain by December and now the options go to March – so we'll look at new trade ideas for them on our Live Webinar Today at 1pm (EST).

The BRCM short 2016 $30 puts are now just $1.73, up 58% on their 3-month anniversary. CIM is less exciting as we're playing it for the dividend, not to make money on the stock, per se, but it was one of our trades of the year and you can see from the chart why we love it. The new spread is right on track for the full 56% gain by December and now the options go to March – so we'll look at new trade ideas for them on our Live Webinar Today at 1pm (EST).

IGT has simple flown out the gates, blowing away our expectations with a 40% pop on the stock alone since our May selection as GTECH also saw the value we saw and bought the whole company. The offer has squashed the premiums on our options and our net $6.37 combo is already at $9.08 (up 42% in 3 months) and good for another $1 (15%) when the deal closes, giving us our full 56% pay-off well ahead of schedule AND we picked up a .11 dividend (1.7%) in June with another on the way!

Our of our 29 Trade Ideas for the 2nd half of 2014, only RIG, HOV and PFE have gone the wrong way on us (so far) for an 89% winning percentage. This morning, in our Live Member Chat Room (you can join us here to get access to these and dozens of other trade ideas every month), I was able to identify 16 that can still be played with only minor adjustments. After all, these are conservative, long-term trade ideas, they're not supposed to run away in 90 days – but sometimes they do…

Our of our 29 Trade Ideas for the 2nd half of 2014, only RIG, HOV and PFE have gone the wrong way on us (so far) for an 89% winning percentage. This morning, in our Live Member Chat Room (you can join us here to get access to these and dozens of other trade ideas every month), I was able to identify 16 that can still be played with only minor adjustments. After all, these are conservative, long-term trade ideas, they're not supposed to run away in 90 days – but sometimes they do…

I wanted to do this quick review to keep things in perspective because we're NOT bearish – we are merely protecting our profits! Our Long-Term Portfolio has $500,000 virtual dollars in it and it is 100% bullish (though less than 1/3 invested, as CASH!!! is our main hedge) and it is up 21% for the year so far. Our Short-Term Portflio is just $100,000 and it is tasked with holding the bearish bets that protect our Long-Term Portfolio BUT we also make other short-term, opportunistic bets and that portfolio is up 30.1% for the year to date.

So, when we talk about being more bearish, we are talking about PROTECTING the massive gains we already have – please keep that in perspective. If we didn't already have $134,000 worth of profits to protect – we would probably be more aggressive on these moves up. Meanwhile, our well-hedged model doesn't stop us from making money. Just two weeks ago, the two portfolios were up "just" $119,000, at $719,000 combined so, even during this market chop, we were able to add $15,000 (2.5%) to our total in two weeks using our "Be the House – Not the Gambler™" strategy.

While it's tempting to make big bets in a wild market like this – I just want to remind everyone that slow and steady does indeed win the race and we don't need to take big chances to make excellent annual returns. At the moment, we're being very cautious – but we're making 1.25% a week while being cautious so please – let's continue to be careful out there!