The Futures are off a bit today and that's no surprise to those of us who have been paying attention to the volume, or lack thereof, as we made our final approach at the 2,000 line on the S&P 500. Jim Cramer was literally foaming at the mouth this week as he and his CNBC co-conspirators herded the sheeple into the markets to participate in the tail end of the rally, where the suckers could hold the bags for their Corporate Masters.

Why am I angry at Cramer today? Because yesterday he committed the same crime he commtted in 2008 that cost so many people their life's savings – he told people not to sell their stocks on a pullback. "Don't take profits" is the message for the viewing public. But, I would ask, if people don't take profits – when will they ever get profits? What kind of stupid message is that? Well, it's the message that leaves you holding the bag while his hedge fund buddies head for the exits. It's not much different than telling one group of people not to leave a burning building while you make sure all your friends are getting out safely.

"This is not just my opinion. I can prove it to you empirically. See, as I was preparing to write my book "Get Rich Carefully," I went over the previous five years of trades made by my charitable trust. And as I reviewed those trades I noticed that far too often, my good judgment would be overcome by excessive skepticism."

If the "proof" Jim is talking about is his Action Alerts Plus, then I'd say you really should think long and hard about following his advice here (via Kirk Lindstrom – who does compete with Cramer):

I guess, sure, Jim legitimately should regret that he wasn't more bullish from 2008 to 2013, when the market popped 200% and his trust gained about 100% but don't you think the lesson Cramer should be taking from that experience is to CUT YOUR LOSSES, not "ride it out"? Had he put the brakes on in 2008 with a 20% loss, instead of a 37.7% loss, then he would have entered 2008 with $11,198.40 and not $8,725 and that same 100% subsequent gain would have had him around $22,400 vs $16,600 – a 35% improvement or 7% PER YEAR!

This is why Warren Buffet's Rule #1 is "Don't lose money" and his Rule #2 is "See Rule #1". We talked about this in our live webinar on Tuesday (replay here) as our goal of the year at PSW is to teach people our "slow and steady" system for investing to CONSISTENTLY make good returns by being the house – not the gambler (see how I work in our videos – pretty clever!).

This is why Warren Buffet's Rule #1 is "Don't lose money" and his Rule #2 is "See Rule #1". We talked about this in our live webinar on Tuesday (replay here) as our goal of the year at PSW is to teach people our "slow and steady" system for investing to CONSISTENTLY make good returns by being the house – not the gambler (see how I work in our videos – pretty clever!).

Slow and steady is winning us the race so far this year as our Long-Term Porfolio finished the day up 22.3% for the year while our Short-Term Portfolio, which hedges the LTP with bearish bets, is accidentally up 35.1% for the year. I say accidentally because, usually, it doesn't do so well in a bull market but we figured out mid-year that this market wasn't going down and made some pretty clever bets to compensate, and now it's turned into a huge winner.

In the STP, we're short the Dow with DXD ($24.40) and short the Nasdaq with SQQQ ($35.70) and short GMCR ($134.73) and WYNN ($196) and XRT ($89.47) and FAS ($106.71) and BIDU ($215) and TSLA ($263) with a few long hedges on stocks we really like to the long side. In short (get it?), we're very short and positioned for a correction at this point.

In the STP, we're short the Dow with DXD ($24.40) and short the Nasdaq with SQQQ ($35.70) and short GMCR ($134.73) and WYNN ($196) and XRT ($89.47) and FAS ($106.71) and BIDU ($215) and TSLA ($263) with a few long hedges on stocks we really like to the long side. In short (get it?), we're very short and positioned for a correction at this point.

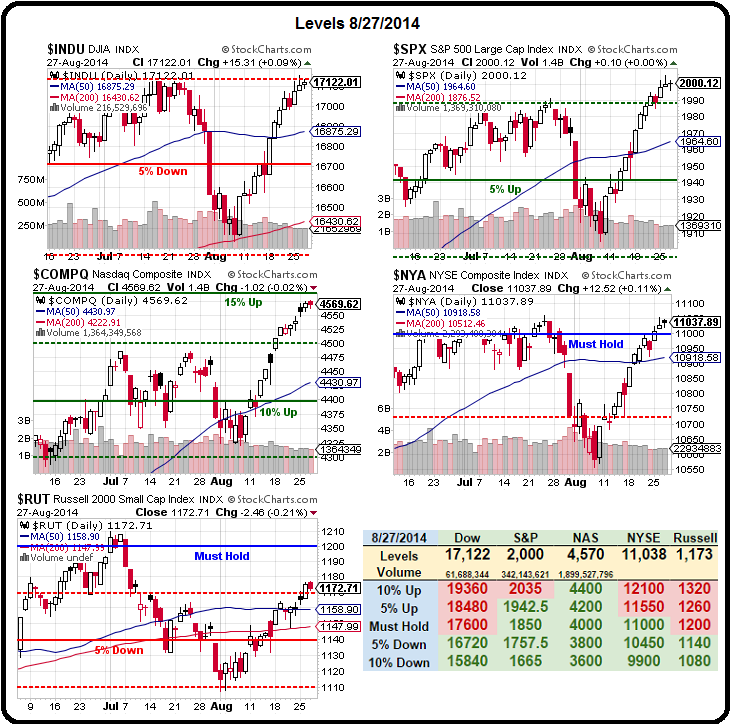

But the point of our hedges isn't to blindly hold on to our long positions in a correction. We have lines on our Big Chart and, when those lines begin to fail – we begin to lighten up. There's nothing wrong with CASH!!! In fact, the Dollar is up 3.6% for the month, keeping pace with the S&P (up 3.8%). There's nothing wrong with gold either and we just added a bullish trade idea by shorting GLL (ultra-short gold) at $87.59.

Our LTP, on the other hand, is 100% long but most of the positions are well-hedged and well in the money, so a little correction isn't going to scare us of – but a big one will! That's the point of the Short-Term Portfolio, it's meant to gain while the LTP loses and that should give us time to get back to cash without taking heavy losses and without having to panic if we get a "black swan" kind of dip, like we did in 2011, when the S&P, after a 22% gain from 2010, lost all of the 18 months worth of gains in less than 3 weeks.

Should we "ride out" these dips? No, we've learned our lessons and are, hopefully better investors now than we were then and that is why Cramer, reinforcing the wrong-headed platitudes of the past, bothers me so much. We have our own Rule #1 at PSW and it's: "ALWAYS sell into the initial excitement" and Rule #2 is "When in doubt, sell half." We also have a Rule #3 and our Rule #3 goes: "If you didn't follow Rule #1 or Rule #2, why are you even bothering to read this rule?"

I wonder how many of our Members are following the rules. Our virtual portfolis are already half cash and we'll be happy to go to 75% cash if we don't like the looks of the market next week. At the moment, we feel pretty confident we can ride out a 5% correction with minimum losses, and that would take us back below our 50 dmas and that would get us bearish until those lines are re-taken.

With the low volume we have this week, 2,000 is a meaningless number and the S&P isn't far enough over 11,000 and doesn't have enough volume to get us more bullish but we did select 11 new candidates for our Buy List in yesterday's Live Member Chat Room (you can join it here) and we'll be HAPPY to join Cramer if this rally has room to run but keep in mind – if you are going to follow his advice and hang on to your positions after our warning levels start flashing – we'll be the people passing you by on our way to the exits.

Be careful out there!