Wow, what a recovery!

Wow, what a recovery!

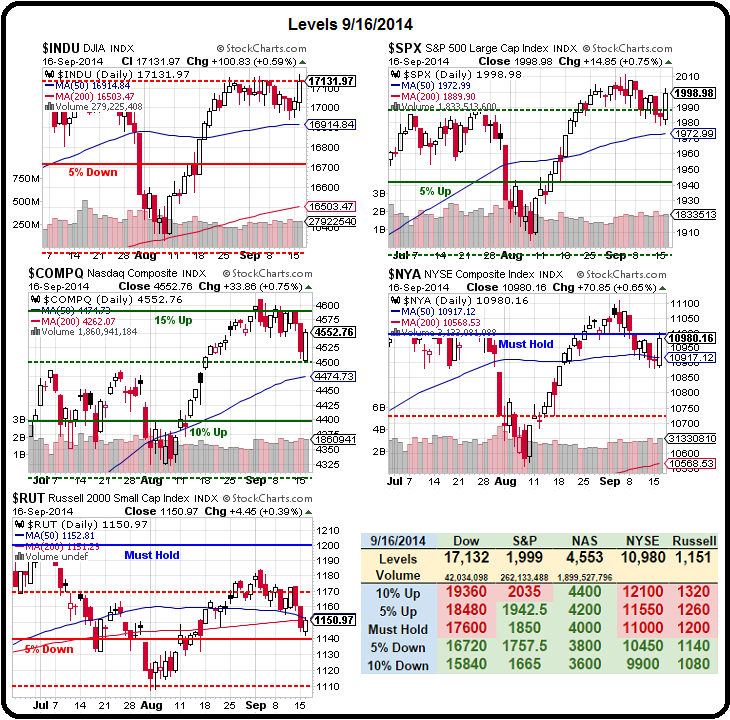

And wow, what complete and utter BS it is. They NYSE is still below 11,000 (our Must Hold line) and the Russell is still below it's 50 dma and we up on less than 10% of the volume (total) that sold off for the last two weeks. But, who cares as long as it paints a pretty picture?

We can thank the Wall Street Journal's Fed Whisperer, John Hilsenrath with yesterday's rally as he wrote not one but TWO articles that whipped traders into a frenzy on his "insider view" that the Fed "may keep the words "considerable time" in its policy statement." Oh, be still my heart! More free money? Really? Will wonders never cease?

Needless to say we took the opportunity to re-short the Dow Futures (/YM) at 17,050 and the S&P Futures (/ES) at 1,993 and the Nasdaq Futures (/NQ) at 4,060 and the Nikkei Futures (/NKD) at 15,950 – all of which we discussed in yesterday's Live Trading Webinar that was, sadly, a Members only affair (but you can join us here).

We also got a chance to short oil at $95 again (a level I published in yesterday's post) and we're thrilled with that and already this morning, it's back at $94.50 for $500 per contract gains. For non-futures players we grabbed the SCO Sept $30s at .25 as a fun play that inventories at 10:30 won't support $95 oil in much the way Fed policies at 2pm won't support these market levels. In fact, here's CNBC's Art Cashin telling you yesterday at noon what I told you pre-market, yesterday morning – BRILLIANT!

Art's actually one of the very few Wall Street analysts I respect (and not just because he repeats what I say), I've followed him since I was a kid – he's a fantastic guy and a lot of what I share with you – I learned from him. As you can see on the Big Chart, the Russell is the laggard and, if the indexes break higher – it's the index we'll go long on but our short bets (TZA) have already paid off very well. We like them long over 1,145 if the above levels are all over because there is very little upside resistance on TF, all the way back to 1,200. On the other hand, a break below 1,140 (-5% on the Big Chart) that sticks is likely to be tragic.

Today we'll be watching our bounce lines (per the 5% Rule™), which are in play all week and it's been a mixed bag so far with:

- Dow 16,980 (weak) and 17,010 (strong)

- S&P 1,985 (weak) and 1,990 (strong)

- Nasdaq 4,560 (weak) and 4,570 (strong)

- NYSE 10,950 (weak) and 11,000 (strong)

- Russell 1,160 (weak) and 1,170 (strong)

In order for us to get bullish again, we want to see NO weak bounces and 4 of 5 of the strong bounce lines taken back. The Nasdaq is at 4,553 and the NYSE is at 10,980 so, if they can cross their next goals, we'll be happy to go long on the Russell at 1,145 (/TF) and we can also play that with TNA (ultra-long Russell), where the weekly $71.50s have very little premium at $1.80 – considering that TNA ($72.42) popped 0.60 yesterday with the Russell up just 0.4%. A 1% move up in the Russell should be a 50% gain on those calls!

Keep in mind – we are SHORT on the market, these long plays are just a hedge (IF we go over our lines, which we DON'T expect) – in case we're wrong and the Fed sprinkles more fairy dust to get us back over S&P 2,000. As with our downside hedges – we look for plays that give us the best leverage but we use very tight stops on the positions we don't agree with and, once they make us some money – we're very anxious to take our profits and run.

In our latest flashback to 2008, RAX announced yesterday that they are not for sale and promptly dropped 20% after hours, losing over $1.4Bn in market cap in less than 5 minutes. That's how much air is under a lot of these high-flying stocks that are up based on nothing but M&A rumors and stock buybacks and giddy analyst upgrades while the underlying business does NOTHING to justify the price increases.

RAX had a p/e of 65 yesterday. With a $6Bn+ market cap they were dropping less than $100M to the bottom line, LOWER than the $105M they earned in 2012. Now we're likely to be testing that blue support line on the chart but that's still 50 times earnings at $32 – no wonder no one is buying them! My warning to one of our Members on 7/2 was particularly well-timed:

RAX/Deano – The trade is fine if you are so inclined to play the stock. I'm not. I don't like them long-term as they essentially sell a commodity (cloud storage) which only gets cheaper over time. Not only that but they are competing with AMZN, who get to go into businesses for negative margins and still get rewarded for trying. I don't see how going private would improve things or who would want to be the ultimate bag-holder for these guys.

BTU ($14), on the other hand, we called a bottom on yesterday, as well as GTAT ($12), TEX ($33) and CLF ($14). For our logic on these trades as well as some excellent ideas on how to play them – come join us in our Live Member Chat room!