So much for 2,000 holding.

So much for 2,000 holding.

Fortunately, our Big Chart kept us cautiously bearish into the weekend and the hedges in our Short-Term Portfolio functioned perfectly, gaining $13,000 on the day and completely offsetting the drop of $8,000 in our Long-Term Portfolio.

That's without our big hedge, DXD, kicking in yet, as the Dow is still over 17,000 but, should it fail, we'll see those STP gains multiply quickly.

For those of you who are not Members, and don't have access to our various Member Portfolios (and you can by subscribing here), we have done our best to prepare you for this drop as well. Last Thursday, right in the morning post, I shared our short stance with the general public, saying

It's going to be crazy into the weekend but, in our Live Chat Room this morning, I said to our Members:

Futures pumped back up to yesterday's highs at 17,125, 2,001.50, 4,080 and 1,156.5 so I like shorting below 17,100, 2,000, 4,075 and 1,155 – short the laggard, out of any of them cross back over – very simple!

That's our plan into the weekend. As I've mentioned before, we're also using DXD ($24 at the time), TZA ($14.68) and SQQQ ($35.26) to hedge our long portfolios – just in case things unravel over the weekend. We also discussed FXI ($40.30) puts earlier in the week as a play on China melting down so PLENTY of ways to profit from the downside.

This morning, the Futures are 17,050 on /YM (up $375 per contract), 1,979 on /ES (up $1,125 per contract), 4,035 on /NQ (up $900 per contract) and 1,116.50 on /TF (up $4,000 per contract) – so that strategy went pretty well.

This morning, the Futures are 17,050 on /YM (up $375 per contract), 1,979 on /ES (up $1,125 per contract), 4,035 on /NQ (up $900 per contract) and 1,116.50 on /TF (up $4,000 per contract) – so that strategy went pretty well.

In last Wednesday's post, we also shorted Oil Futures at $95 and oil fell to $91 yesterday – up $4,000 per contract in less than a week (and these are just the freebies!) while, for non-Futures players (don't worry, we'll teach you!), the proxy was the SCO Sept $30 calls at 0.25 – those expired Friday at $1.20 – up 380% in three days!

In that same morning post (Wednesday), we were playing the Fed and the BULLISH TNA $71.50 calls at $1.80 maxed out at $4.50 the next day (up 150%), well ahead of our 50% goal for that trade. By taking non-greedy exits on our directional bets, we are able to profit from market moves in either direction. We had 4 more bullish trade ideas in that post – but long-term ones that are still cooking.

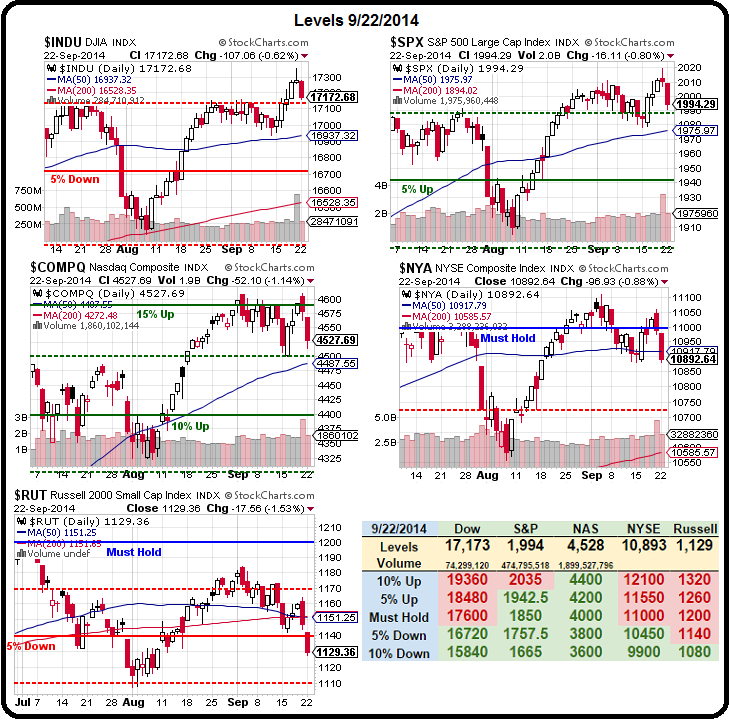

Tuesday (again, right in the main post) we warned you that the Russell was making a death cross and would be our most vulnerable index. That effect can now be clearly seen on the big chart above. At the time, I reiterated our 9/2 Morning Alert, in which I said to our Members:

If, however, you buy just $2,500 worth of the of the TZA Oct $13/16 bull call spread at $1 (25 contracts), they will pay you back $7,500 if TZA goes up about 15% (just a 5% move up in the RUT) AND they don't lose all their money until TZA is down 10% (a 3% move up in the RUT).

Last Monday, for free in the main post, we discussed the FXI Jan $42/38 bear put spread at $1.80, which pays 122% if my theory on Chinese Market weakness pays off. Amazingly, it only took a week and already that spread is at $2.55, up 41% in its first week! These are the kinds of trades we teach you to make at Philstockworld. In fact, we have a Live Trading Webinar at 1pm this afternoon for our Members – you can join us there.

If this post sounds a bit promotional, it's because I want to give our free readers fair warning as we stop giving out free trade ideas during earnings season (just starting) and we'll be raising our Membership fees in October – so this is your absolute last chance to get in at the current prices.

Still not convinced? How about the week before, on 9/11, when I laid out our war case for RTN at $101. Despite yesterday's pullback, they are still at $102.40 but our spread, which was the 2016 $100/115 bull call spread offset by the short 2016 $80 puts at net $1.95 is already up to $2.62 – a 34% gain in 12 days! Why did we make money on a relatively flat couple of weeks – because we SOLD premium and, as the volatility of the stock calmed down, the price of the options we sold got lower too. This is our call strategy in which we teach our Members to BE THE HOUSE – Not the Gambler:

The day before, on Sept. 10th, our Free Trade Ideas were the weekly QQQ $100 calls at 0.40, which made the 50% we were looking for that day, as well as the TZA Jan $15/20 bull call spread we had picked up in that Tuesday's Webinar at $1, that were only $1.08 that morning (and got back to $1) and are now $1.25, up 25% again and a fantastic hedge.

That brings us to our only failed trade ideas (so far) of the past two weeks' posts and it was a short put on GTAT – selling the 2016 $10 puts for $2.25 and CCJ, selling the 2016 $17 puts for $1.90. Both stocks have gone down with the market and the GTAT $10 puts are now $2.80 (down 24%) with the stock at $11.28 and the CCJ $17 puts are still $1.90 (unchanged).

I've been baning the table so hard on GTAT while they dropped that I've already told our Members I'm done talking about them. If I haven't convinced people there's value there, I never will – until, of course, the stock jumps back up but, by then it will be too late. This will be the last free trade idea pre-earnings and though selling the $10 puts for $2.80 nets you in for $7.20 and that seems really good, you can sell the $12 puts for $4 and that nets you in for $8 – just as good with more money in your pocket! In fact, if you are short the $10 puts, I'd roll up and short the higher ones for an extra $1.20.

With $4 in your pocket against a promise to buy GTAT for $12, I think spending $2 on the $10/17 bull call spread is very reasonable. You still have a net $2 credit and a net $10 entry on the stock and, at $17, you would get back another $7 for a $9 gain on a $2 credit (+450%), not bad for 16 months "work"!

With $4 in your pocket against a promise to buy GTAT for $12, I think spending $2 on the $10/17 bull call spread is very reasonable. You still have a net $2 credit and a net $10 entry on the stock and, at $17, you would get back another $7 for a $9 gain on a $2 credit (+450%), not bad for 16 months "work"!

The only other trade idea we gave away that week was on Tuesday, 9/9, ahead of Apple's iWatch announcement (on Monday I just ranted about Market Manipulation and why you shouldn't trust the run-up). That one used the same principle as our RTN trade above, where we sold a lot of premium to suckers who thought they could beat the house:

In case you missed our earlier entries this year, we still love AAPL as a long-term play and you can still sell the 2016 $80 puts for $5 for a net $75 entry and that can be paired with the 2016 $100/120 bull call spread at $5.70 for net 0.70 on the $20 spread so you get almost all of the upside on a move over $100 (with a max profit of 2,757% on cash) and your worst case is you end up owning AAPL at net $80.70, which is 18% off the current price.

Like RTN, AAPL was at $99.08 that morning and is now at $101.06, not much of a move but the same effect has taken the $80 puts down to $4.25 while the bull call spread is now $6.50 for net $2.25 – up 221% in two weeks.

We don't have to be brilliant when we are BEING THE HOUSE!