That's how much our FREE Futures suggestions made between the time I put them in yesterday's morning post (8am) and the close of trading at 4pm. That's not bad for 6 hour's work, is it? As I said in the morning:

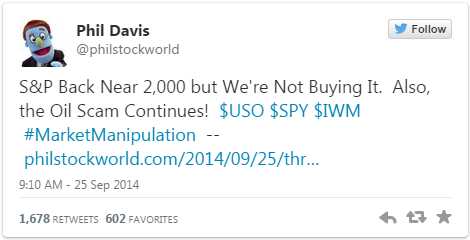

So, you may wonder, why would we want to go against the wishes of two of the most powerful people and short oil ($93.40), gasoline ($2.75), the Dow (17,150) and the Nikkei (16,350)? Well, that's because, as powerful as these people may be – they are still fighting physics in trying to make the markets do things they simply shouldn't be doing.

.jpg) I'm sure ALL the newsletters you follow are able to give you equally profitable advice so, by all means, DON'T SUBSCRIBE HERE – especially ahead of the rate increase in October (sorry, inflation).

I'm sure ALL the newsletters you follow are able to give you equally profitable advice so, by all means, DON'T SUBSCRIBE HERE – especially ahead of the rate increase in October (sorry, inflation). ![]() But, can you really blame us for being pleased that we totally nailed the drop?

But, can you really blame us for being pleased that we totally nailed the drop?

In fact, had you simply joined us on Wednesday and replicated our virtual Short-Term Portfolio, which was only up 53.4% at the time, you would have caught a ride from there to 60% in just two days. Last Thursday, the STP was up only 30%, so that's a 30% ($30,000) gain for the week as our bearish bets paid off and it very much offset the $15,560 decline in our bullish Long-Term Portfolio. So much so that we took some of our shorts off the table to get us more neutral into the morning (as we expect a slight bounce unless GDP sucks).

You don't have to trade the Futures to make great money on your hedges. Our DXD Oct $24 calls jumped from 0.50 on Tuesday (when I reminded you about them in the morning post) to 0.96 at yesterday's close – up 92% in 3 days! That's a good hedge, especially when you consider the Dow only fell 2.5%, so we got 36:1 leverage on that hedge – and THAT is how we balance our portfolios and protect them from sell-offs.

You don't have to trade the Futures to make great money on your hedges. Our DXD Oct $24 calls jumped from 0.50 on Tuesday (when I reminded you about them in the morning post) to 0.96 at yesterday's close – up 92% in 3 days! That's a good hedge, especially when you consider the Dow only fell 2.5%, so we got 36:1 leverage on that hedge – and THAT is how we balance our portfolios and protect them from sell-offs.

Even a straight purchase of TZA (also noted in Tuesday's post – why don't you subscribe?) gained 13% in 3 days, 5:1 leverage without even using options. Our SQQQ suggestion popped from $35.26 to $37.13 for a 5% gain (2:1) and FXI shorts also gained 5% but, of course, we were playing the options for much better leverage (all from Tuesday's morning post) in our Live Member Chat Room.

Now all this SOUNDS very sexy but the real point is to have BALANCED positions so we can make money in up or down markets. What we really care about is the COMBINED gain of our STP and LTP, which went from 22.5% for the year last week to 25% this week as we gained a combined $15,000 overall. Had we been totally wrong and the market had jumped instead, perhaps we'd be down 2.5% instead but the hedging keeps us BALANCED and able to CALMLY make adjustments in any market conditions.

Now all this SOUNDS very sexy but the real point is to have BALANCED positions so we can make money in up or down markets. What we really care about is the COMBINED gain of our STP and LTP, which went from 22.5% for the year last week to 25% this week as we gained a combined $15,000 overall. Had we been totally wrong and the market had jumped instead, perhaps we'd be down 2.5% instead but the hedging keeps us BALANCED and able to CALMLY make adjustments in any market conditions.

More to the point, the gains we make in our Short-Term Porfolio on the way down can flow to the Long-Term Portfolio where we establish positions at a nice, low-cost basis. I mentioned yesterday that we'd been doing some bottom-fishing this week and our Buy List (sorry, Members only) is full of great stocks we can add now that we're back at the bottom of a still-rising channel and we've already started taking advantage of the higher VIX to buy more stocks for a 15-20% discount off their current prices:

When you are not balanced, a sell-off like this leaves you licking your wounds, PSW Members are licking their chops!

Have a great weekend,

– Phil