This is not pretty.

This is not pretty.

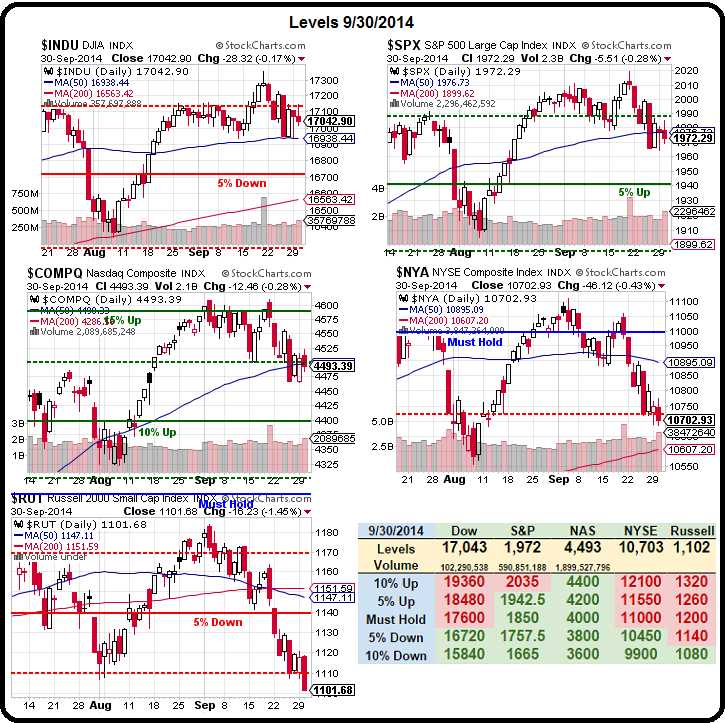

As you can see on our Big Chart, we've failed the 50 dma on the S&P, Nasdaq, NYSE and Russell and the Russell failed its 200 dma long ago. We're still waiting for the Dow to cross below 16,940 and confirm the carnage but we made those bets long ago with our DXD Oct $24 calls, which are now 0.70 (up 55%) from our 0.45 entry back on 9/18.

In fact, we already took 1/2 of those calls off the table at 0.85 last week so, essentially, the remainder is a free put option on the Dow for the next three weeks – with DXD at $24.45, so we gain every penny from here on up as the Dow falls.

That's what hedges are supposed to do, of course. We discussed that in yesterday's Live Trading Webinar, where we also demonstrated a live Futures trade on the Russell (/TF Futures) that made $500 on the 2:30 bounce. That bounce was very easy to predict because THE MARKET IS MANIPULATED and all we had to do was wait for the same fake spike that we get at the end of every quarter, courtesy of the Fed and their fellow Banksters:

What's scary about yesterday's flood of money ($230Bn in two days) wasn't just the size of the pump job, but the ineffectiveness of it. The volume was still anemic and declining shares outpaced advancing shares by almost 2:1 in yesterday's "mixed" trading.

What's scary about yesterday's flood of money ($230Bn in two days) wasn't just the size of the pump job, but the ineffectiveness of it. The volume was still anemic and declining shares outpaced advancing shares by almost 2:1 in yesterday's "mixed" trading.

In reality, it wasn't mixed at all as big traders took advantage of every penny that moved into the market as they told their brokers to sell, SELL!!!

Still, it's not the end of the World just yet – only close to it, and we can still turn this puppy around by holding the line on the Dow as well as Russell 1,100 and Nasdaq 4,500. This market has been amazingly resiliant in 2014 so we're not going to be complacently bearish the same way we (thank goodness) did not let ourselves get complacently bullish this summer.

We have tilted more bearsh in our Short-Term Portfolio (see Webinar replay for trade ideas) but haven't yet found anything in the Long-Term Porfolio or Income Portfolio we're willing to part with (all long-term bullish trades) but, if the gains in the STP fail to keep up with the LTP, we're not going to risk our combined 20%+ gains for the year and we'd rather move to more cash, rather than tempt fate.

We have tilted more bearsh in our Short-Term Portfolio (see Webinar replay for trade ideas) but haven't yet found anything in the Long-Term Porfolio or Income Portfolio we're willing to part with (all long-term bullish trades) but, if the gains in the STP fail to keep up with the LTP, we're not going to risk our combined 20%+ gains for the year and we'd rather move to more cash, rather than tempt fate.

China is still our main Global concern (beating out the European Recession, war in the Ukraine, ISIS, Japan and Ebola) and our FXI hedge is now 100% in the money at $38. That was a free one from the morning post of 8/27, where we grabbed the Jan $42/38 bear put spread for $1.80 with a $2.20 upside (122%) if China weakened as expected. This stuff isn't complicated folks it's just:

A) Read the News

B) Make a trade

In fact, in that same post, I said: "We also picked up long plays on BAC and DBA in our Live Member Chat Room and BAC has already rocketed on the settlement news but DBA is only just making the turn and still makes an excellent play that we'll be adding to our Buy List (Members Only) along with 10 more picks we'll be making this week."

As you can see, BAC took off like a rocket but the DBA trade idea is still playable and our other 10 picks are, sadly, only for our Members (but you can join us HERE and get trade ideas like these every day).

Sadly, if you didn't read yesterday's morning post, you missed your chance on the EWJ Oct $12 puts at 0.20 – those are already up 30% for the day and our currency call (also yesterday morning) to short the Yen at 110 has already given us a retrace to 109.64 (0.325%) for a gain of $32,400 per contract – SO FAR (at $900 per penny, which is why we very rarely play the currency markets – too scary to play when you are not certain).

Sadly, if you didn't read yesterday's morning post, you missed your chance on the EWJ Oct $12 puts at 0.20 – those are already up 30% for the day and our currency call (also yesterday morning) to short the Yen at 110 has already given us a retrace to 109.64 (0.325%) for a gain of $32,400 per contract – SO FAR (at $900 per penny, which is why we very rarely play the currency markets – too scary to play when you are not certain).

The proxy for that trade in the Futures (aside from the EWJ puts) was the short on /NKD at 16,250 (also right there in the morning post) and there we caught a 150-point drop at $5 per point, per contract for $750 per contract gains – not bad for a day's work. And, as I often remind our Members, it is hard work. There is a lot of reading and lot of discussion before we arrive at these trade ideas. Sometimes we get the call right but our timing is off – it certainly keeps us on our toes.

Speaking of timing, gold (/YG Futures) was called long at $1,205 yesterday morning and that line held and we're up to $1,215 this morning and that's $320 per contract and our stop should be $1,112.50 while silver (/SI) was a long at $17.15, popped to $17.40 (up $1,250 per contract) but then fell all the way to $16.85, which was down $1,500 if you were foolish enough not to stop out but now, this morning, back to $17.15 again.

Speaking of timing, gold (/YG Futures) was called long at $1,205 yesterday morning and that line held and we're up to $1,215 this morning and that's $320 per contract and our stop should be $1,112.50 while silver (/SI) was a long at $17.15, popped to $17.40 (up $1,250 per contract) but then fell all the way to $16.85, which was down $1,500 if you were foolish enough not to stop out but now, this morning, back to $17.15 again.

Of course, Futures trading is a very small part of what we do at PSW but it's also the most volatilie and exciting stuff, so it gets a lot of attention. For the most part, we are content to mostly sit back and simply collect the premiums on our Long-Term trades, using our short-term trades and Futures trading to weather these occasional storms.