I told you it was going to be a wild week!

I told you it was going to be a wild week!

Not that you can draw any conclusions from yesterday's low-volume action. The Fed doves have their say for the next two days and then we go into a hawkish nosedive on Thursday and Friday, so this little drama is just getting started. All went according to plan yesterday – per our set-up in the morning post:

As a hedge, for our Member Portfolios, we're favoring SQQQ (now $36.55) and DXD (now $24.52) to protect us from another slide but the real tilt to hawkish doesn't start until Thursday, after the Fed minutes, so we can assume they will be spun bearish from there into the weekend and we'll look to take nice, short positions against any run-up that comes from doveish Fed statements early in the week.

As you can see from yesterday's action, that was the perfect way to play it and our short positions on the Futures gave us several quick victories as it was all downhill from the open until 1pm. Even our oil short gave us a nice $600 win – the one that was right there in the morning post at $89.60 and oil was below $89 by 10:45, less than 3 hours for that trade idea to play out!

That's good because we REALLY needed the money because GTAT, one of our good-sized positions in two of our portfolios, declared a surprise bankruptcy yesterday. Bankruptcies are not supposed to be surprising but this one was and GTAT dropped 90%, essentially wiping out a $25,000 position and costing us 1/4 of our year's profits in the Long-Term Portfolio.

There's an excellent article in Bloomberg and another one from Seeking Alpha outlining what happened and where it stands so I'll spare you the gory details other than to say that this is why we stress diversification and portion control in investing. Even so, GTAT happened to be a stock that got weak and, because management promised a turn-around, we added to our losing position on the initial dip and maxed our allocation and then got burned so quickly that we had no chance to recover. These things do happen in the market – you have to allow for them.

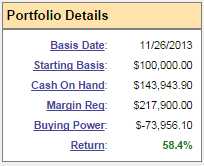

Fortunately, it's been a good year and, despite the heartbreaking loss, our Long-Term Portfolio held on to $68,564 of it's gains (13.7%) and the Short-Term Portfolio is still up $58,403 (58.4%) for a combined $126,967, still ahead of our 20% combined goal for the year. It's a set-back, but certainly not the end of the World.

Fortunately, it's been a good year and, despite the heartbreaking loss, our Long-Term Portfolio held on to $68,564 of it's gains (13.7%) and the Short-Term Portfolio is still up $58,403 (58.4%) for a combined $126,967, still ahead of our 20% combined goal for the year. It's a set-back, but certainly not the end of the World.

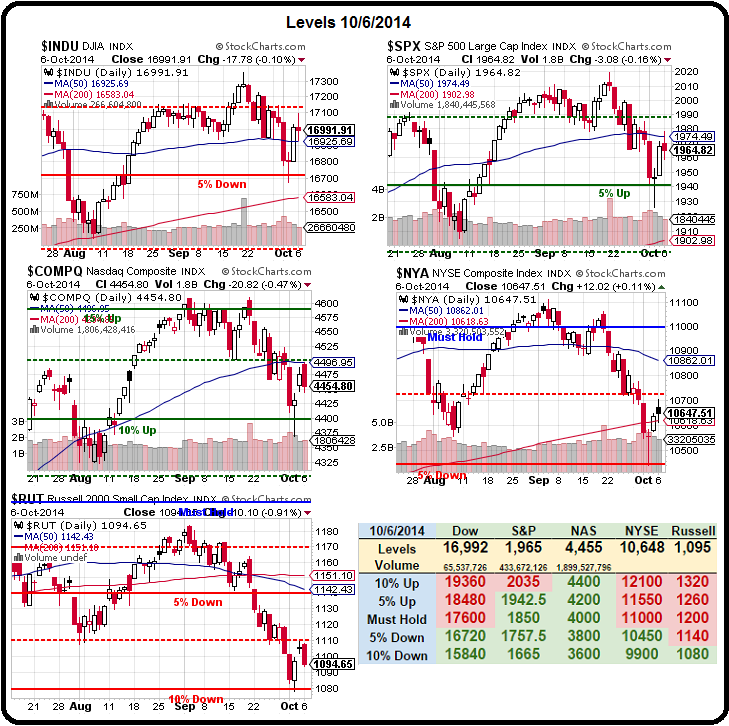

What we're more concerned about, is whether we should be cashing out the rest of the Long-Term Portfolio and that will depend on how the S&P handles it's 50-day moving average at 1,975 – as a failure there can turn things very ugly indeed. As you can see from our Big Chart, the NYSE and the Russell are both down considerably since September 1st (7.5% and 5%) while the Dow, Nasdaq and S&P are down about 2.5% each.

The Nasdaq is still 10% over it's Must Hold level but 3 of our indexes have already failed theirs and, until one of the 3 retakes it, we're certainly going to remain on the bearish side of things. In fact, at the moment, I'm a lot more worried about the Russell failing 1,080 than I am about the S&P at 1,975. If we think of the indexes as tugboats, it wouldn't be possible for the Russell to pull below 1,080 if the entire ship weren't heading in that direction….

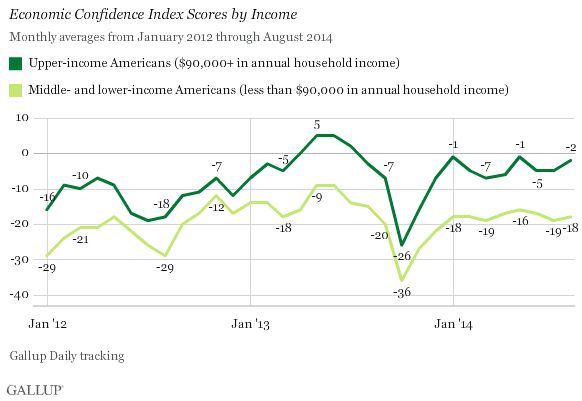

We had more bad numbers out of Germany (see our early morning Member Chat) and France is a disaster and Japan is falling apart along with China and, this morning, we have an Economic Confidence Rating of -15. The only good thing you can say about -15 is that it's better than -50 we hit in the great crash but ZERO is neutral and -15 indicates 65% of the people surveyed feel the economy is currently poor and getting worse.

We had more bad numbers out of Germany (see our early morning Member Chat) and France is a disaster and Japan is falling apart along with China and, this morning, we have an Economic Confidence Rating of -15. The only good thing you can say about -15 is that it's better than -50 we hit in the great crash but ZERO is neutral and -15 indicates 65% of the people surveyed feel the economy is currently poor and getting worse.

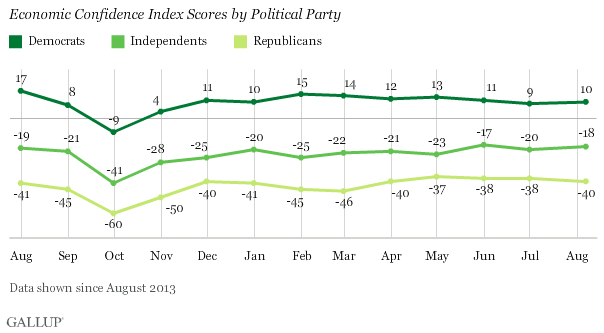

In fact, if it were not for our nation's top 10% (those making $90,000+/yr), things would be very bleak indeed and even those people scored -2%! Still, I'll put a positive spin on this by saying that people are much more confident than they were in the summer of 2012 or last September and, most importantly, Democrats are scoring +10 vs -18 for Independents and -40 for Republican voters.

Why does this matter? Because we have an election in 30 days and, even in those gerrymandered districts that are 90% Republican, 40% of the "loyal" base is very, very unhappy with the economy and, as Clinton said "It's the Economy, stupid!"

Case in point, Senate Minority leader Mitch "Turtle Boy" McConnell is now TRAILING Democratic challenger Alison Grimes by two points. She's gained 6 points since the August poll in a state the GOP didn't even consider to be in jeopardy. It's just one poll but how motivated are the 90% (Ninety Percent!) of Republican voters, who feel the economy is poor and getting worse, going to be to pull the lever to re-elect their local jackasses?

Pollsters rely on "likely" voters but, when the sentiment of your "likely" voters is this atrocious, they may not be turning out to support you in quite the numbers that they thought. As you can see from the chart on the right, the Democrats locked in 13 more "safe" Congressional seats in this cycle while the GOP lost 4 – that's a very bullish trend for the Dems though it's still probably an insurmountable gap to take the House in this cycle but keeping the Senate will be a huge victory for the Dems this year.

Pollsters rely on "likely" voters but, when the sentiment of your "likely" voters is this atrocious, they may not be turning out to support you in quite the numbers that they thought. As you can see from the chart on the right, the Democrats locked in 13 more "safe" Congressional seats in this cycle while the GOP lost 4 – that's a very bullish trend for the Dems though it's still probably an insurmountable gap to take the House in this cycle but keeping the Senate will be a huge victory for the Dems this year.

With 90 swing votes, the Dems would need to take 2/3 of the swing districts BUT, if in the next two years they add 13 more locks while the GOP loses 4 more, it will be 172 to 182 locked up with 81 swingers and THEN we'll have a horse race for the House! 90% of Republican Voters, essentially all but the top 10% that the GOP caters to, are unhappy with the economy.

Whether they are smart enough to connect the dots and realize they are unhappy BECAUSE of their party remains to be seen…