What an amazing recovery!

What an amazing recovery!

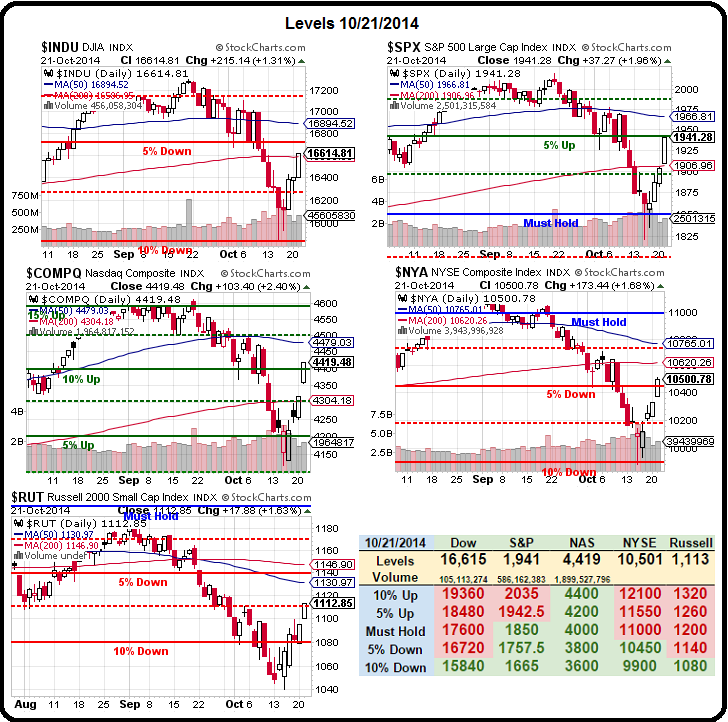

Just one week ago the World was coming to and end and now everyone has their rally caps back on. Investors really are sheep – except I think sheep have better memories… We're still right on plan of dropping 10% and then bouncing 4% (strong bounces) by Wednesday (today) that was initiated on October 6th by our friends at the Fed (see yesterday's post for the summary). For those of you keeping score, our strong bounce predictions for today were:

- Dow 16,466 (weak) and 16,632 (strong).

- S&P 1,878 (weak) and 1,903 (strong).

- Nasdaq 4,280 (weak) and 4,360 (strong).

- NYSE 10,360 (weak) and 10,540 (strong).

- Russell 1,104 (weak) and 1,128 (strong).

The Dow is just 17 points away from our goal and we'll just need the NYSE and the Russell to confirm their bounce lines and THEN we can get bullish again. Meanwhile, we actually got a bit more bearish in our Short-Term Portfolio (also in yesterday's post) as our Long-Term Portfolio popped right back to up 18.1% for the year so we wanted to lock those gains in with the STP, which finished the day up 81.8%, down from 92% in the morning as the markets rocketed.

The Dow is just 17 points away from our goal and we'll just need the NYSE and the Russell to confirm their bounce lines and THEN we can get bullish again. Meanwhile, we actually got a bit more bearish in our Short-Term Portfolio (also in yesterday's post) as our Long-Term Portfolio popped right back to up 18.1% for the year so we wanted to lock those gains in with the STP, which finished the day up 81.8%, down from 92% in the morning as the markets rocketed.

If the rally is real, the Dow should have no problem at all popping our 16,632 line – after all, it jumped 234 points yesterday but stopped dead right at our strong bounce line. The 200 dma on the Dow is 16,586 and the NYSE also stopped just short of it's strong bounce line (10,540) in yesterday's action, but far short of it's 200 dma at 10,620 – which let's you know right there that the 5% Rule™ trumps TA every time!

Earnings have been good so far (cough, BUYBACKS, cough, cough) and why shouldn't they be when $5,000,000,000,000.00 has been pumped into the Credit Market (10%) in order to get our GDP up 1.5% since 2009.

Earnings have been good so far (cough, BUYBACKS, cough, cough) and why shouldn't they be when $5,000,000,000,000.00 has been pumped into the Credit Market (10%) in order to get our GDP up 1.5% since 2009.

You know, I don't mind being robbed by our Corporate Kleptocracy but PLEASE – at least TRY to make efficient use of the money you steal…

It's worth every Dollar of debt the nation took on to the top 1% because they captured over 90% of those gains while wages and wealth for the bottom 90% declined over the same period. Don't worry though kids, the debt burden will be equally shared by all of us because, while wealth distribution doesn't have to be fair at all – don't even think about asking the rich to pay more taxes – that's Commie Talk!

Seriously, it amazes me that, just 5 years later, people seem to have already forgotten all the crap that almost destroyed the country and are ready to vote for the same idiots with the same plan to do it all over again. Even in Kansas, where EVERY state official is a Republican and they have driven the economy completely into the toilet – it looks like the people are going to vote to re-elect some of those morons. As noted in the Washington Post:

GOV. SAM BROWNBACK of Kansas (and the Kochs) says he has come to regret characterizing his policy agenda as a “real live experiment” that would test the efficacy of deep tax cuts to spur jobs and economic growth. In fact, Mr. Brownback’s choice of words was apt. Few if any governors have undertaken such an extreme trial-by-revenue-deprivation in a state so clearly lacking the economic means to withstand it.

Mr. Brownback’s Kansas trial is rapidly becoming a cautionary tale for conservative governors elsewhere who have blithely peddled the theology of tax cuts as a painless panacea for sluggish growth. Most key indicators suggest that job creation and economic growth in Kansas are lagging those of its neighbors.

Like Kansas, the US economy is NOT strong – it is merely stimulated – it's an economy on steriods and investors are betting on it to last for the long haul, and they are not expecting any harmful side effects – no matter how much stimulus we take. Speaking of Kansas and people who need steroids: Did you see the World Series last night? San Francisco kicked their asses!

Like Kansas, the US economy is NOT strong – it is merely stimulated – it's an economy on steriods and investors are betting on it to last for the long haul, and they are not expecting any harmful side effects – no matter how much stimulus we take. Speaking of Kansas and people who need steroids: Did you see the World Series last night? San Francisco kicked their asses!

Without steriods, home runs are down over 10% since the 2006 ban in baseball and the overriding concern in the markets is what will happen to us when the Fed withdraws our economic steriods. As you can see from the Fed's own chart above – the injection has left us bloated with record amounts of debt – so much worse than when the "unsustatianable" debt of 2008 crashed to economy.

What was the solution? MORE DEBT!

Good luck with that…