The bums have been thrown out!

The bums have been thrown out!

Democrats were decimated in the Senate, losing their majority, primarily as angry voters, who still face dire economic situations 6 years after electing Obama chose to CHANGE the last vestiges of his support:

The economy was voters’ most pressing concern as they cast their ballots in the midterm election, with seven of 10 rating conditions poor, preliminary exit polls showed.

The Daily Show

Get More: Daily Show Full Episodes,The Daily Show on Facebook,Daily Show Video Archive

More than five years after the recession ended, ordinary Americans still feel pinched. Wages and incomes haven’t recovered even as corporate profits hit records, stocks have almost tripled and the nation’s output of goods and services grew more than $1 trillion from its pre-recession peak.

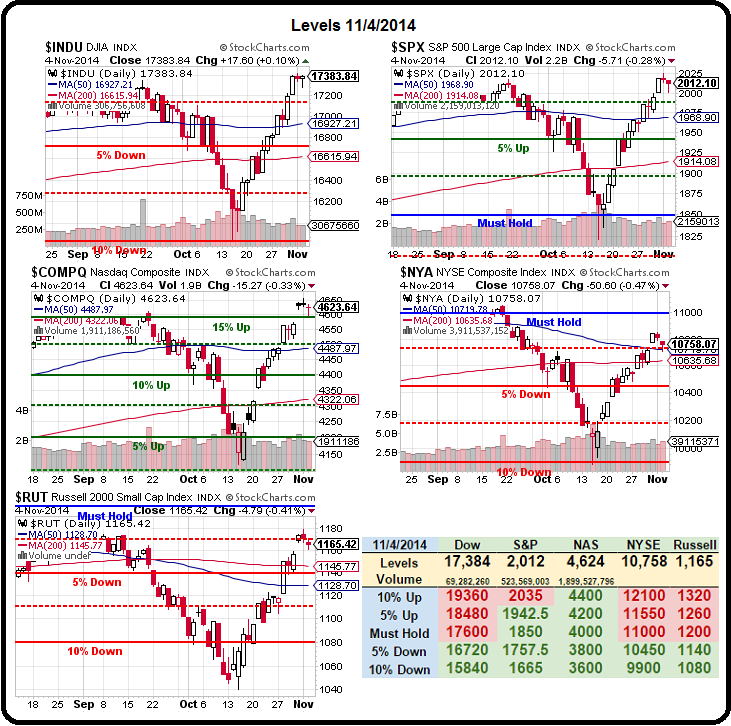

Amazingly, after getting a clear referendum on how awful the economy still is for the average American, the markets are up over half a point in the Futures, with the Dow (/YM) testing 17,400, S&P (/ES) 2,020, Nasdaq (/NQ) 4,175 and Russell (/TF) 1,175.

Amazingly, after getting a clear referendum on how awful the economy still is for the average American, the markets are up over half a point in the Futures, with the Dow (/YM) testing 17,400, S&P (/ES) 2,020, Nasdaq (/NQ) 4,175 and Russell (/TF) 1,175.

Those will be our lines of capitulation if they break to the upside but, by the day's end, I expect cooler heads to prevail and they'll be our shorting lines too.

When there are no fundamental reasons to move up (and no, electing a different bunch of morons doesn't qualify as a fundamental) we look to our technicals and our 5% Rule™ to tell us what to expect. Last time we whipped out the Rule, we used it to chart the move off the bottom in October – now let's see what needs to hold for this rally to continue:

- The S&P held our Must Hold line at 1,850 and hasn't quite completed the 10% move to 2,035 but, using that POTENTIALLY bullish move, we have 85 points and the retrace from 2,035 would be 17 points (weak) to 2,018 (where we are now) and a strong retrace of 34 can be rounded, of course, to 2,000.

- So the point of contention in the S&P will be between 2,000 and 2,018 and we'll see which way we break but, as long as we stay over 2,000, we're only weakly retracing a bullish move (that hasn't happened yet). That's the problem with the 5% Rule™ – it's so good at predicting the Future, you tend to get your tenses confused!

- The Dow has never made it to the Must Hold line at 17,600 so we've never had a reason to get gung-ho bullish, even on the technical side. Our last dip took us to the -10% line at 15,840 so, like the S&P, we'll assume a bullish channel and chart the upside resistance of an anticipated 1,760-point move and that's 350 (gotta round huge numbers) so the weak retrace is 17,250 and a strong retrace is 16,900, which means the Dow stays bullish as long as 17,250 holds.

- The Nasdaq has been our sky-high leader, fueled by AAPL and other high-flying tech names this year. 4,600 is the 15% line and 4,800 is 20% over the Must Hold so our lead tug-boat simply needs to hold 4,600 to drag the laggards over their Must Hold lines. If that happens, we flip bullish but, if the Nasdaq fails 4,600, it's a 600-point run with 120 (4,480) and 240 (4,360)-point retraces – very nasty and 4,480 just so happens to be the 50 dma now. See how neatly that all works out?

- NYSE is the most important index as it's broad and hard to manipulate. Unlike the Dow, it has flirted with the Must Hold line but hasn't held it for long. The last dip was a perfect 10% drop back to our -10% line at 9,900 so we'll assume bullish intentions to 11,000 and that's 1,200 points so the retraces are 240 points to 10,760 (exactly where we are now) and 10,520 (strong retrace).

- The Russell is our craziest index, having fallen more than 10%, to 1,040 but, to be fair, that was from 1,180 in Sept, not 1,200, which it hasn't seen since July. We'll ignore the noise and look at the move from 1,080 back to 1,200, which is 120 points and that gives us 24-point pullbacks to 1,176 (weak, and right where we are this morning) and 1,122 (strong), which is also around the 50 dma and must hold for the RUT to stay bullish.

Whatever your political leanings, let's keep the emotions out of our trading this week and watch those lines. We'll be looking for some bullish upside plays if we break higher, back to TNA for some fast money is most likely but we'll see what sticks today first.

If it's a real rally, the Dow should have no trouble at 17,500 and should be able to get to 17,600 before there's any serious pullback and, if that doesn't happen – the rest of our lines will tell the tale.