Courtesy of Sabrient Systems and Gradient Analytics

After displaying a classic V-bottom reversal to what turned out to be a quick and anemic attempt by the bears to bring about a real correction, bullish fervor is becoming contagious, especially as the traditionally strong holiday season approaches. Indeed, the brief selloff was snatched up as a buying opportunity as I predicted it would, but my concerns about the market consolidating and struggling to hit new highs before year end were quickly dismissed. So, with nothing but blue skies overhead, will the party simply roll on?

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

Bulls are back in control. The S&P 500, Dow Jones Industrials, and NASDAQ 100 each have surged well above their respective round-number millennium resistance levels — 2,000, 17,000, and 4,000 — while the broader NASDAQ Composite is getting within sight of challenging the 5,000 level (last seen during the heights of the Internet bubble) and the Russell 2000 small caps are eyeing the 1,200 level once again.

And why not? Unemployment recently fell to 5.8%, GDP is growing better than 3%, interest rates remain low, corporate earnings reports continue to come in slightly better than expected, stock buybacks continue while capital investment is returning, the overblown worry about an Ebola pandemic in the U.S. has subsided, and ECB and BOJ are taking the baton from the Federal Reserve in the way of liquidity programs. (And keep in mind, the Fed is not unwinding its balance sheet, so maturing securities are being reinvested.) Moreover, the 10-year U.S. Treasury bond yield closed Friday at 2.31%, with little impetus for it to rise anytime soon.

With a forward P/E of about 16, when you compare the S&P 500 earnings yield of about 6.3% with the 10-year Treasury yield, the spread is about 4% versus the historical norm of about 3%. So, there is plenty of room for higher equity valuations. Also worth mentioning, ConvergEx reported in their Morning Briefing that using the 30-year averages of comparative price ranges, U.S. stocks still look cheap relative to both oil and gold, despite the huge price drops in those commodities.

The reaction to the mid-term elections last week also seems to have been a positive catalyst, either because Republicans are seen as more business-friendly, or because a Republican-controlled Congress with the Democratic president will create a welcome gridlock, or possibly for both reasons.

The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, closed Friday at 13.12. After spiking above 30 earlier in the month (for the first time since November of 2011), it has settled back down below the important 15 threshold.

Although I labeled the early-October pullback a buying opportunity given the fundamental underpinnings of the market, I fully expected volatility to continue for a time and was surprised by its quick disappearance — as were many hedge fund managers. David Einhorn of Greenlight Capital (a long/short value-oriented activist equity fund) is just one who was frustrated by the short duration of October’s market turmoil, and his portfolio dropped -3.7% during Q3.

Yes, investors have moved to full risk-on mode, which we really haven’t seen since last year. But I don’t think bulls will be able to maintain such unbridled enthusiasm for long, and a more cautious flight-to-quality mentality likely will return soon. Moreover, I expect some technical consolidation to set in over the near term, despite the approaching holiday season. Now is not the time to go all-in speculative.

By the way, with seven weeks to go in 2014, Sabrient’s annual Baker’s Dozen portfolio of 13 top picks for the year holds a strong lead among the firms tracked by a third-party performance tracking site. Our annual portfolio also outperformed the other portfolios over the prior two years since this site began tracking us. Baker’s Dozen represents a sector-diversified group of stocks based on our Growth at a Reasonable Price (GARP) quant model and confirmed by a rigorous forensic accounting review by our subsidiary Gradient Analytics to help us avoid the landmines. Top performers include Southwest Airlines (LUV), NXP Semiconductors (NXPI), Actavis plc (ACT), ARRIS Group (ARRS), Jazz Pharmaceuticals (JAZZ), and Archer-Daniels-Midland (ADM).

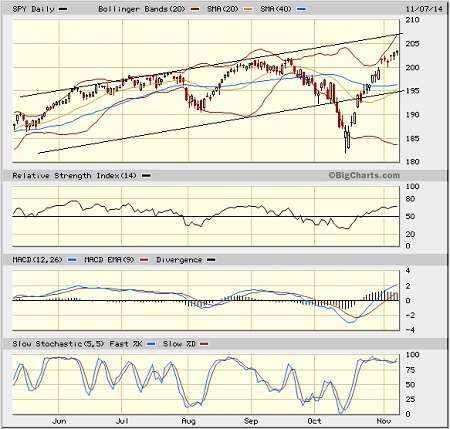

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed Friday at 203.34 and set a new 52-week high. The V-bottom was quite sudden and obvious in retrospect, but hardly anyone expected such a radically bullish reversal when it appeared that October volatility was setting in for a spell. As I said in my previous article (two weeks ago), such a scary selloff and spike in volatility often is indicative of a capitulation selloff, particularly when the fundamental picture is still positive, and in such cases a fast reversal is not unusual. Oscillators RSI, MACD, and Slow Stochastic are all overbought now, but not overwhelmingly so and could move higher still. Overhead resistance at the convergence of the 100-day and 50-day simple moving averages offered only a couple of days of mild resistance, and even the $200 price level barely caused a brief pause. At this point, I think it is likely that the 200 price level will be tested for support during a technical consolidation phase before the market can make a concerted attempt to move much higher.

The Russell small cap index led the reversal and is now firmly above all of its moving averages, adding further credence to the risk-on thesis. Its 50-day SMA is still below the 200-day, though, so we will see if the 50-day can find its way back up. As a first step, the 20-day already is in the process of crossing up bullishly through the 50-day. However, the MSCI emerging markets index tried to bounce but was turned back by resistance from the important 200-day SMA.

Latest sector rankings:

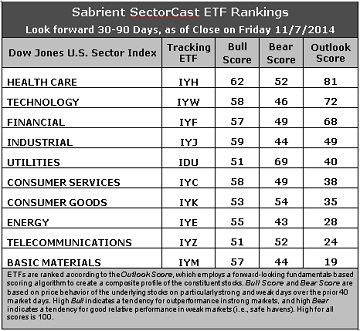

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Technology has ceded the top spot to Healthcare, which clocks in with an Outlook score of 81. Healthcare is one of the only sectors (along with Utilities) seeing net positive revisions to its earnings estimates among sell-side analysts. The sector also displays a strong forward long-term growth rate, solid insider sentiment (buying activity), and good return ratios. Technology is now in second place with a score of 72. Although Tech stocks continue to get hit with downward earnings revisions, the sector overall displays the best combination of factor scores in the model, including the strongest return ratios, a good forward long-term growth rate, and a low forward P/E. Financial remains in third with a score of 68, and it still boasts the lowest (most attractive) forward P/E. Rounding out the top five are Industrial and Utilities. Notably, Energy has been battered mercilessly with earnings downgrades from Wall Street as oil prices have continued to weaken, but it still boasts the second lowest forward P/E, and in fact Sabrient continues to find compelling valuations among many energy stocks.

2. Basic Materials takes the bottom spot this week as sell-side analysts continue to hit the sector with reductions to earnings estimates. Materials stocks also display low insider buying activity and poor return ratios. Telecom remains in the bottom two and continues to score among the worst on most factors in the Outlook model.

3. Looking at the Bull scores, all sectors are scoring above the 50 threshold. Healthcare again displays the highest score of 62, while Utilities and Telecom score the lowest at 51. The top-bottom spread is now 11 points, reflecting high sector correlations during particularly strong market days, i.e., highly correlated risk-on behavior. It is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold, rather than the all-boats-lifted-in-a-rising-tide (risk-on) mentality that dominated 2013. Also displaying strong Bull scores are Industrial, Technology, Consumer Services/Discretionary (a.k.a., Cyclicals), Basic Materials, and Financial, which are traditionally economically-sensitive sectors that should have the highest Bull scores in a healthy market.

Note: ConvergEx reported that correlations among the ten sectors of the S&P 500 have risen to an average of 85% over the last 30 days, compared to 75% just three months ago.

4. Looking at the Bear scores, Utilities again displays the highest score with a robust 69 this week, as one would expect for this traditionally defensive sector. Utilities stocks have been the preferred safe havens on weak market days. Energy displays the lowest score of 43, followed closely by Materials and Industrial. The top-bottom spread is now 26 points, reflecting low sector correlations on particularly weak market days. Again, it is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points. Also displaying Bear scores above 50 are Consumer Goods/Staples (a.k.a., Non-cyclicals), Telecom, and Healthcare, which along with Utilities are traditionally defensive (or all-weather) sectors that should have the highest Bear scores in a healthy market.

5. Healthcare displays the best all-around combination of Outlook/Bull/Bear scores, while Basic Materials is the worst. Looking at just the Bull/Bear combination, Utilities is the leader, followed by Healthcare, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Energy is still the worst, indicating general investor avoidance during extreme conditions.

6. Overall, this week’s fundamentals-based Outlook rankings still look bullish to me, despite the slight drop in Technology and the rash of earnings downgrades. The top four sectors are all economically-sensitive (or in the case of Healthcare, all-weather), and they also display the highest Bull scores. Also encouraging is the strong showing of Industrial and Consumer Services/Discretionary (a.k.a, Cyclicals). Keep in mind, the Outlook Rank does not include timing or momentum factors, but rather is a reflection of the fundamental expectations of individual stocks aggregated by sector.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), indicates a bullish bias this week, and it suggests holding Healthcare, Technology, and Industrial (in that order, for those portfolios that might be due for rebalance). (Note: In this model, we consider the bias to be bullish from a rules-based trend-following standpoint because SPY is above both its 50-day and 200-day simple moving averages.)

Other highly-ranked ETFs from the Healthcare, Technology, and Industrial sectors include PowerShares Dynamic Pharmaceuticals Portfolio (PJP), iShares PHLX Semiconductor ETF (SOXX), and SPDR S&P Transportation ETF Trust (XTN).

For an enhanced sector portfolio that enlists some top-ranked stocks (instead of ETFs) from within the top-ranked sectors, some long ideas from Healthcare, Technology, and Industrial sectors include Alexion Pharmaceuticals (ALXN), Actavis plc (ACT), Skyworks Solutions (SWKS), Applied Materials (AMAT), Landstar System (LSTR), and FedEx Corp (FDX). All are highly ranked in the Sabrient Ratings Algorithm and also score within the top two quintiles (lowest accounting-related risk) of our Earnings Quality Rank (a.k.a., EQR), a pure accounting-based risk assessment signal based on the forensic accounting expertise of our subsidiary Gradient Analytics. We have found EQR quite valuable for helping to avoid performance-offsetting meltdowns in our model portfolios.

However, if you prefer to maintain a neutral bias, the Sector Rotation model suggests holding Healthcare, Technology, and Financial (in that order). And if you prefer a defensive stance on the market, the model suggests holding Utilities, Healthcare, and Financial (in that order).

IMPORTANT NOTE: Some readers have been asking for more specifics on how to trade our sector rotation strategy based solely on what I discuss in my weekly newsletter. Thus, I feel compelled to remind you that I post this information each week as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I may or may not update the information each week. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted — but not necessarily on the days that I happen to post this weekly article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ETF and stock ideas mentioned here as a managed portfolio.

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.