Testing 2,040 on the S&P.

Testing 2,040 on the S&P.

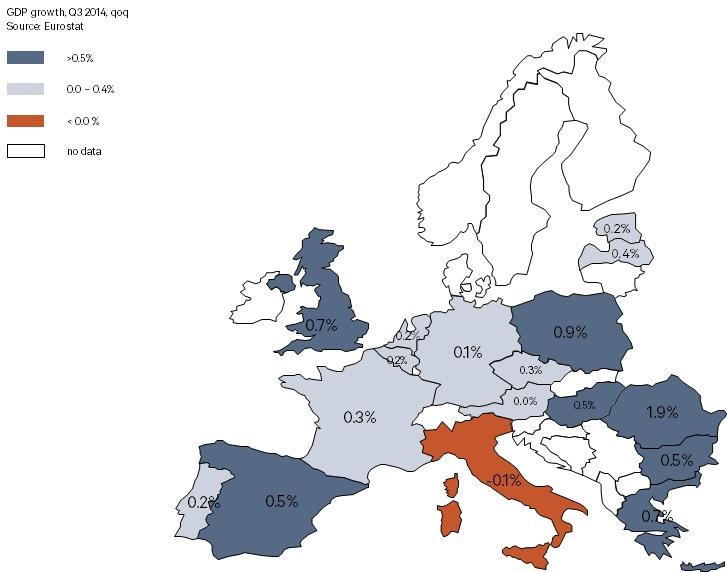

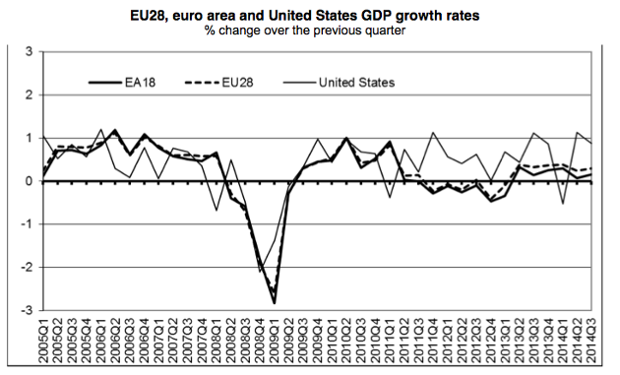

That's what we're doing while oil is at $74.50, copper is $3, and gasoline is $2. The Eurozone's GDP was out this morning and Germany's GDP is up 0.1%, avoiding Recession by a whopping 0.2% and France has pulled into the lead, up 0.3%, less than 1/10th of the US growth trend. Forecasts going forward are for the whole Eurozone to grow 0.1% in Q4 – the smallest miss puts them back into Recession.

The euro area’s fragile "recovery" has been in peril since economic malaise took hold of countries in the region’s core. With the revival stuttering and inflation close to the lowest level in five years, the European Central Bank has deployed unprecedented stimulus and urged governments to invest and deliver structural reforms to support growth.

Italian GDP fell 0.1% in the three months, marking the 13th consecutive quarter in which the Euro region’s 3rd-largest economy failed to grow. The Bank of Italy said yesterday that the country needs to avoid a “recessionary demand spiral” due to the “persistence of economic difficulties, which have been exceptional in terms of duration and depth.”

Meanwhile, the Euro is down 11% since May, now just $1.24 buys you one and you get 116 Yen for a Dollar, which is why our Dollar index is now popping 88 and putting massive pressure on commodities, which are also suffering from weak demand. This, of course, is collapsing Russia's commodity-based economy (along with the sanctions), with the entire Russian Stock Market's value falling below that of just Apple, Inc.

Meanwhile, the Euro is down 11% since May, now just $1.24 buys you one and you get 116 Yen for a Dollar, which is why our Dollar index is now popping 88 and putting massive pressure on commodities, which are also suffering from weak demand. This, of course, is collapsing Russia's commodity-based economy (along with the sanctions), with the entire Russian Stock Market's value falling below that of just Apple, Inc.

Tempting though it may be, we're not shorting the US markets while the rest of the World is swirling down the drain. Shorting US equities has been a suicide play for the past 5 years. Of course we have our bearish hedges but our main hedge is CASH!!! going into the holidays. Let Santa have his rally – we're out!

That's not to say we can't make a little cash with some side bets. For instance, yesterday, in our Live Member Chat Room, we loaded up on /TF (Russell Futures) shorts at 1,190 and, by 11:40 yesterday, those contracts were already up $2,500 each – not bad for "sitting on the sidelines"…

That's not to say we can't make a little cash with some side bets. For instance, yesterday, in our Live Member Chat Room, we loaded up on /TF (Russell Futures) shorts at 1,190 and, by 11:40 yesterday, those contracts were already up $2,500 each – not bad for "sitting on the sidelines"…

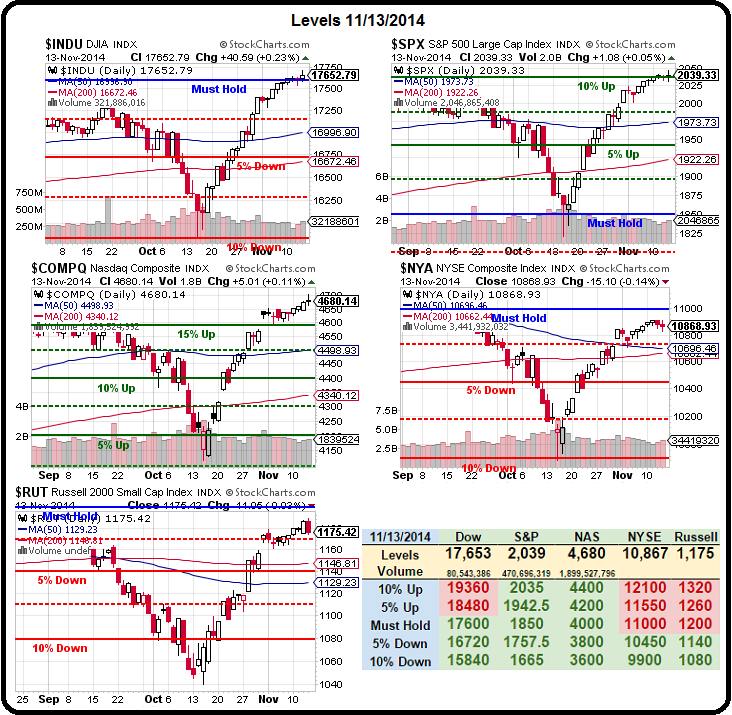

At 11:07, we added /ES (S&P Futures) shorts at 2,040 and we got a very quick 10-point ride down that was good for $500 per contract. We got the pop we expected into Yellen's comments at 12:15 but all she did was disappoint and we got a chance to re-load and ride the Futures down again into the afternoon – before the final pump into the close.

That closing pump got the S&P back to 2,039 but still a point shy of the 2,040 goal we predicted would be the overshoot on the S&P (above 2,000) in Las Vegas last weekend at our Live Conference. 2,035 is the +10% line on the S&P from our Big Chart, per our 5% Rule™ but we made some adjustments for the Dollar strength and got to 2,040 for the top of this run – and here we are! Now what?

That closing pump got the S&P back to 2,039 but still a point shy of the 2,040 goal we predicted would be the overshoot on the S&P (above 2,000) in Las Vegas last weekend at our Live Conference. 2,035 is the +10% line on the S&P from our Big Chart, per our 5% Rule™ but we made some adjustments for the Dollar strength and got to 2,040 for the top of this run – and here we are! Now what?

Now we don't know is what. Over 2,040, we're in uncharted territory and we hadedge the possibility yesterday with a bullish TNA spread for our Members at 3:27, which seemed like a good idea after the Russell had such an awful day. We also sent out a Top Trade Alert to short the Nikkei at 17,500 (we also like /NKD Futures short there too) using the Jan $12 puts at 0.55 – those could pay off big if Japan data is week into Thanksgiving.

Per Zacks: The rebound from the late-September/early-October sell-off has been very impressive. Global growth fears were the dominant driver of the pullback. But market participants were able to convince themselves that the U.S. economy wouldn’t require outside help to sustain its growth momentum. And U.S. data has broadly been helpful, with the labor market steadily firming up as this morning’s low initial jobless claims numbers show and the outlook for business and consumer spending improving.

Per Zacks: The rebound from the late-September/early-October sell-off has been very impressive. Global growth fears were the dominant driver of the pullback. But market participants were able to convince themselves that the U.S. economy wouldn’t require outside help to sustain its growth momentum. And U.S. data has broadly been helpful, with the labor market steadily firming up as this morning’s low initial jobless claims numbers show and the outlook for business and consumer spending improving.

We have to keep in mind, however, that the stock market’s sharp rebound hasn’t been concentrated in sectors that we would typically associate with excessive bullish sentiment. The list of top-performing sectors this year includes Medical, Utilities and Consumer Staples. Transportation, Aerospace and Tech have been stellar performers as well, but the strength in the defensive health, utilities and staples stocks shows that investors aren’t being overly exuberant.

It's a tough time to play the market but it's a good time to take a vacation and, fortunately, we've had a fantastic year so our plan is to coast into the holidays mainly in cash and sure, we'll have our fun with Futures trades and directional bets like TNA and EWJ but, for the most part – we're happy to sit back and just watch the show as we close out 2014.

Have a great weekend,

– Phil