Higher and higher we go!

Higher and higher we go!

The rest of the World seems a bit tired but the S&P, Dow and Nasdaq are like the energizer bunnies of the Global Indexes as they keep going and going and going…

Earnings don't matter, Fed policy doesn't matter, news doesn't matter – IT just doesn't matter! – and that's something I haven't had to say since the bad old days before the last crash. Still, here we are again, just 6 years after a catastrophic market collapse – ignoring wave after wave of negatives as if they JUST DON'T MATTER.

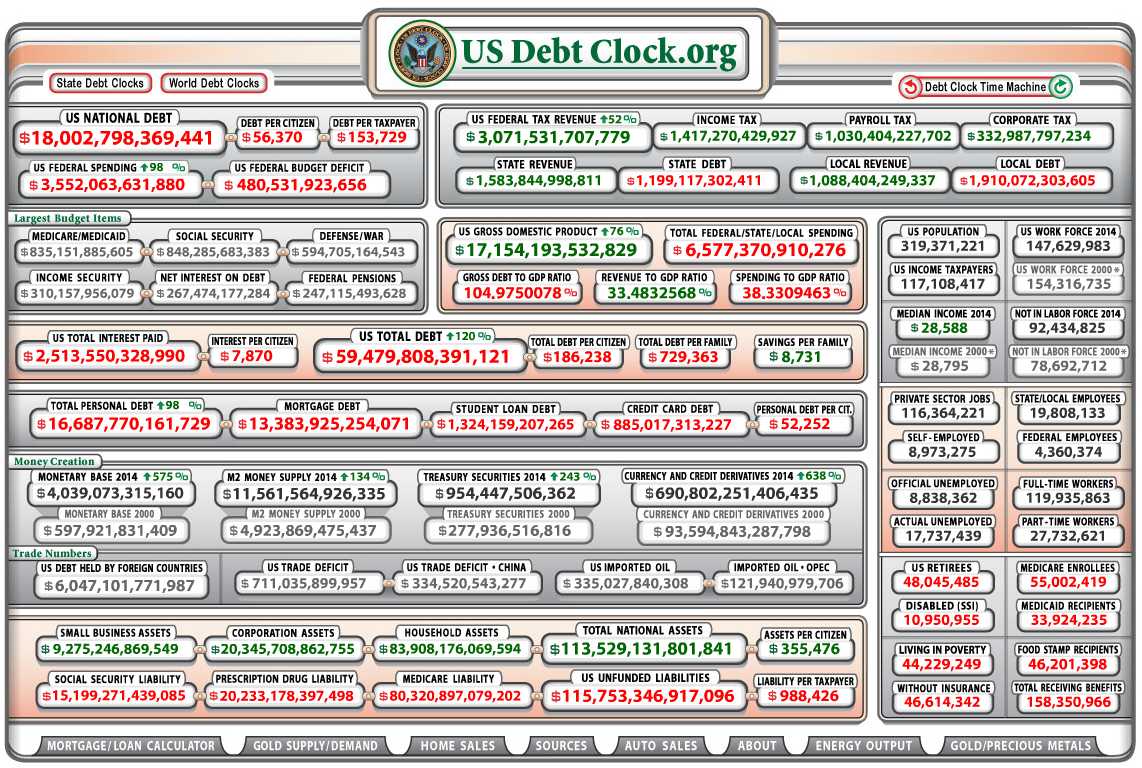

Well, it's true in a way, nothing really matters – until it does. For example, did you know, on Friday, that our nation's debt passed the $18Tn mark? Even I was surprised by that one as our debt just topped $17Tn last November so adding another Trillion in a year seems kind of quick, don't you think? Don't worry though – there's 150M workers so all we have to do is each come up with $113,333 each and we're all sqare.

Well, it's true in a way, nothing really matters – until it does. For example, did you know, on Friday, that our nation's debt passed the $18Tn mark? Even I was surprised by that one as our debt just topped $17Tn last November so adding another Trillion in a year seems kind of quick, don't you think? Don't worry though – there's 150M workers so all we have to do is each come up with $113,333 each and we're all sqare.

If we DON'T all come up with a quick $113,333, then we may have a problem as the interest on $18,000,000,000,000.00 at even just 2% is $360Bn per year, which by itself is $2,400 for each working American. The reason the top 1% tell us not to worry about the debt is because $2,400 isn't very much to people who earn $2M+ per year but, for those of you earning the average $48,000 a year – it's 5% of your salary.

Notice the projection for the next 6 years takes us to $23Tn and let's say interest rates head up to 4% – then, suddenly, the annual interest is about $1Tn per year and that's now $7,500 per working American – just to pay the interest! We could default, but there goes your Social Security as we've already robbed that lock box of close to $3Tn to fund our (so far) $18Tn debt.

We'd also be defaulting on the $5Tn the Fed has lent us. So screw them, right? No, actually the Fed merely lends us our own money out of Treasury, who ultimately bear any losses incurred by the Fed. No wonder they are so happy to spend money over there – no consequences!

Amazingly, though, we're not the ones about to default. That honor goes to Venezuela, where Credit Default Swaps (remember those?) have escalated to $2,567 per $10,000 (25.67% of the debt), indicating an 83% probability of default (fuzzy math applies) – almost 10x worse than Russia ($354) and more than 10x Portugal (202). Even more amazingly, Japan isn't on that list, even though they are 260% of their GDP in debt and growing twice as fast as the US.

Now, maybe you don't care whether Venezuela goes belly up as they are Godless Socialists (actually they are pretty religious down there, so just Socialists) but we cared about Greece and Greece's GDP is just $250Bn, $130Bn less (33%) than Venezuela, which is also bigger than Singapore ($276Bn), Hong Kong ($263Bn), Ireland ($210Bn) and 30x bigger than Iceland, who managed to kick off the last global collapse – the one no one seems to remember.

Now, maybe you don't care whether Venezuela goes belly up as they are Godless Socialists (actually they are pretty religious down there, so just Socialists) but we cared about Greece and Greece's GDP is just $250Bn, $130Bn less (33%) than Venezuela, which is also bigger than Singapore ($276Bn), Hong Kong ($263Bn), Ireland ($210Bn) and 30x bigger than Iceland, who managed to kick off the last global collapse – the one no one seems to remember.

Of course, as you can tell from the cartoon above, Venezuela is doing the same thing every other major country is to help their economy – they are giving money to the top 1%. That's another reason the top 1% tell you not to worry about the deficit – that's where their free money comes from!

Our own top 1% are paying 50% less taxes than they were when I was born in 1960 and, as you can see from the debt clock above, our Top 1% Corporate Citizens are doing even better – contributing just 10% to the tax base. That's 1/3 of what they paid 50 years ago which leave the burden of the other $2.7Tn squarely on the shoulder of our bottom 148,500,000

Our own top 1% are paying 50% less taxes than they were when I was born in 1960 and, as you can see from the debt clock above, our Top 1% Corporate Citizens are doing even better – contributing just 10% to the tax base. That's 1/3 of what they paid 50 years ago which leave the burden of the other $2.7Tn squarely on the shoulder of our bottom 148,500,000 suckers workers.

Fortunately for those of us in the top 1%, the beautiful sheeple don't complain (in fact, they just voted Republican of all things!) and the fleecing will continue until they have nothing left to give. We're getting close – as you can see from the anemic levels of holiday spending but we haven't gotten everything yet so it's not time to go too heavily short on the market – yet.

We made a great call on Japan's Nikkei Index in yesterday's Live Webinar (1pm), where we called for a 5 unit conviction short on the Futures (/NKD) between 17,800 and 17,850 for an average entry at 17,830 on 5 contracts. We went all the way to 17,900 overnight but then, as expected, crashed back to our 17,700 target for a gain of $650 per contract or $3,250 on the set – not bad for a day's work!

We made a great call on Japan's Nikkei Index in yesterday's Live Webinar (1pm), where we called for a 5 unit conviction short on the Futures (/NKD) between 17,800 and 17,850 for an average entry at 17,830 on 5 contracts. We went all the way to 17,900 overnight but then, as expected, crashed back to our 17,700 target for a gain of $650 per contract or $3,250 on the set – not bad for a day's work!

For the Futures-challenged, we still liked EWJ short ($11.80 at webinar time), using the Jan $12 puts at 0.45 as a proxy. I still feel good about that one, as well as a re-entry on /NKD today – as long as the Dollar stays under 89 (now 88.91).

Otherwise, we remain "Cashy and Cautious" but we do like our RIG (see this morning's Member Chat) on the long side after looking over their presentation from last week.