I'm sorry but I will brag about this.

I'm sorry but I will brag about this.

What other newsletter gives you a trade idea Wednesday morning that makes you $1,500 by the end of the day? It's not a rhetorical question – if there is one, I'd love to feature them here at Philstockworld, along with our other fantastic authors. I'm not talking about some vague, Jim Cramer BUYBUYBUY, SELLSELLSELL kind of trade either – I'm talkiing about a specific trade idea that makes you bags of money instantly.

In yesterday's morning post (7:40 am), my trade idea was:

If you need a fresh horse, /ES (S&P Futures) are testing 2,050 and it would not be good for them if they break and, of course, we still like /NKD (Nikkei) Futures short at 17,600 with a 17,300 goal (goes with the EWJ puts).

The result of the /NKD (Nikkei Futures) trade is above and, actually, we overshot our goal and got past 17,200, which is actually a $2,000 gain on each contract. By the way, for those of you who are not Members (and shame on you as you can join here) and don't attend our Live Futures Trading Workshops, a Futures contract is not much different than an option contract – it's just a bet on the direction of an index or commodity with a lower friction cost.

In fact, the margin requirement for each /NKD contract is $4,400 and similar for the other indexes – that's what's required to make these trades. The S&P contracts (/ES) paid $50 for each point and that index fell to 2,025 for a lovely $1,250 per contract gain as well.

In fact, the margin requirement for each /NKD contract is $4,400 and similar for the other indexes – that's what's required to make these trades. The S&P contracts (/ES) paid $50 for each point and that index fell to 2,025 for a lovely $1,250 per contract gain as well.

Today, we're expecting a 0.5 to 1% bounce before we head lower again, but we're not making an official call because we're not sure. As I often tell our Members during our futures trading seminars – they key to making money on the Futures is NOT playing them 90% of the time – tempting though it may be.

We also discussed a portfolio hedge in yesterday's morning post, using the TZA Jan $12/14 bull call spread at 0.70 offset with the sale of the Jan $12 puts at 0.45 for a net of 0.25 per contract. Each 100 contract lot was $25 in the morning and finished the day at $59 – up 136% in a day! That kind of hedge can really take the sting out of a market pullback, right? And the funny thing about the TZA hedge is that 136% ($59) is still just 1/4 of it's $200 potential.

If you had results like this – wouldn't you brag about it? And I'm not even talking about our more than 100% gains on EWJ and FXI puts. It's not so much to brag that I'm doing this as it is to point out that this is the way to hedge your portfolio.

If you had results like this – wouldn't you brag about it? And I'm not even talking about our more than 100% gains on EWJ and FXI puts. It's not so much to brag that I'm doing this as it is to point out that this is the way to hedge your portfolio.

We can take small, leveraged positions like these and offset fairly large losses in our bullish portfolios – it's a very valuable tool for any investors to learn how to use – my job is to motivate you to take the time to learn how to use them.

You don't have to be a VICTIM of the whims of the market. Good hedging strategies can help you take control of your portfolio and make you money in up or down markets. As I noted, we didn't jump in long today, even though we expect a bounce, because we already have plenty of long positions in our Long-Term Portfolio – our needs are primarily to cover on days we think the market is heading lower – like yesterday (and Monday, when I also gave you winning hedging strategies).

In fact, on Monday, /NKD was at 17,925 in the morning and we had been shorting since 18,200 and I said, right in that post for our Members:

Notice how we were just under our 18,100 target at 10:30 last night and already, this morning, we're bouncing off our first support line at 17,900. 200 points on /NKD is $1,000 PER CONTRACT – not bad for a night's work. As I noted in Thursday's post, overall we're expecting a 900-point correction, back to 17,300, which would be good for a total of $4,500 per contract.

So it's goaaaaaaaaaallllllllllllllll!!! at $4,500 PER CONTRACT in 3 days for our Members and again, I'm not really doing this to brag but to MOTIVATE you to take the time to learn how to trade the Futures and how to hedge your portfolios so you can make more money – isn't that why you are reading all these Financial sites in the first place?

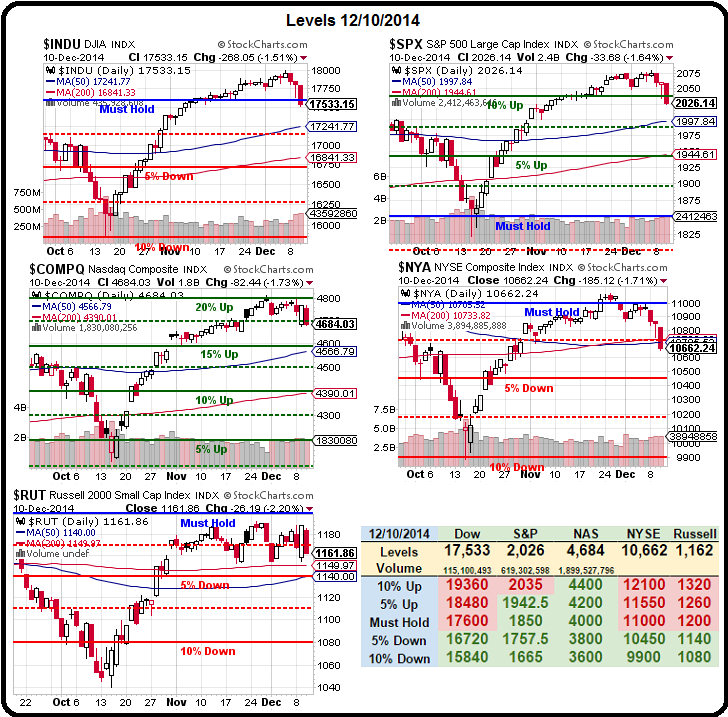

Now, you may wonder how we knew last Thursday that the Nikkei could make us $4,500 at 17,300 when it was racing to the sky and that, my friends, is thanks to a combination of our usual FUNDAMENTAL ANALYSIS and the application of our trademarked 5% Rule™ (see, there was the trademark!). The 5% Rule™ allowed us to make the following predictions for the indexes in our Live Member Chat Room:

- Dow 18,000 (17,991 was the high) to 17,700 is about 2% but the run was from 16,000 to 18,000, so 2,000 points means 400 points is a weak correction, so we're looking for 17,600 and 17,200 below that.

- S&P bounced off 1,850 to 2,070 so that's 220 points and we'll call a retrace 45 points to 2,025 and then 1,980, which is a number that comes up a lot.

- Nas 4,200 to 4,800 was a ridiculous 600 points (14%) and we look for whopping 120-point retraces to 4,680 and 4,460… On /NQ, the intra-day fall is from 4,325 to 4,220 so 105 points leads to 20-point bounces to 4,240 (weak) and 4,260 (strong).

- RUT's run was from 1,050 to 1,190 for a big 140 points so 28-point retraces to 1,162 and 1,134 and we bottomed out at 1,155 so not at all impressed until we're back over 1,162 and THEN we need to see a weak bounce off that.

- NYSE has always been 11,000 or bust – now 10,792.

As you can see from yesterday's finishes, we hit our primary targets on the S&P, Nasdaq and Russell within a COMBINED 5-point error out of 7,872 total points, that's within 0.06% – not a bad prediction system, right? The Dow is always too silly to bet and there are no Futures on the NYSE, which is why we didn't bother with them but it's that same 5% Rule™ that tells us to expect, at most, a 0.5-1% bounce and then a continuation to our secondary (strong) retrace levels.

As you can see from yesterday's finishes, we hit our primary targets on the S&P, Nasdaq and Russell within a COMBINED 5-point error out of 7,872 total points, that's within 0.06% – not a bad prediction system, right? The Dow is always too silly to bet and there are no Futures on the NYSE, which is why we didn't bother with them but it's that same 5% Rule™ that tells us to expect, at most, a 0.5-1% bounce and then a continuation to our secondary (strong) retrace levels.

Now, I can only tell you what's going to happen in the markets and how you can make money playing it, – that's the extent of my powers – the rest is up to you. Learning how to play the Futures and how to hedge is a PROFESSION, not a hobby and it takes a commitment to LEARN these strategies but, as you can see from our hundreds of Member Testimonials on our promotional pages – it's well worth the effort!

No more free picks this week, the TZA trade can still go from $59 to $200 per contract (+238% more) – don't blame me if you missed it at $25!

Be careful out there.