Courtesy of Jean-Luc Saillard.

We had an interesting discussion on Phil’s Stock World last week regarding trades around the oil sell off and a possible rebound. Some of the members where looking at different instruments (leveraged and non-leveraged) and that perked my interest enough that I wanted to do some back testing around these instruments.

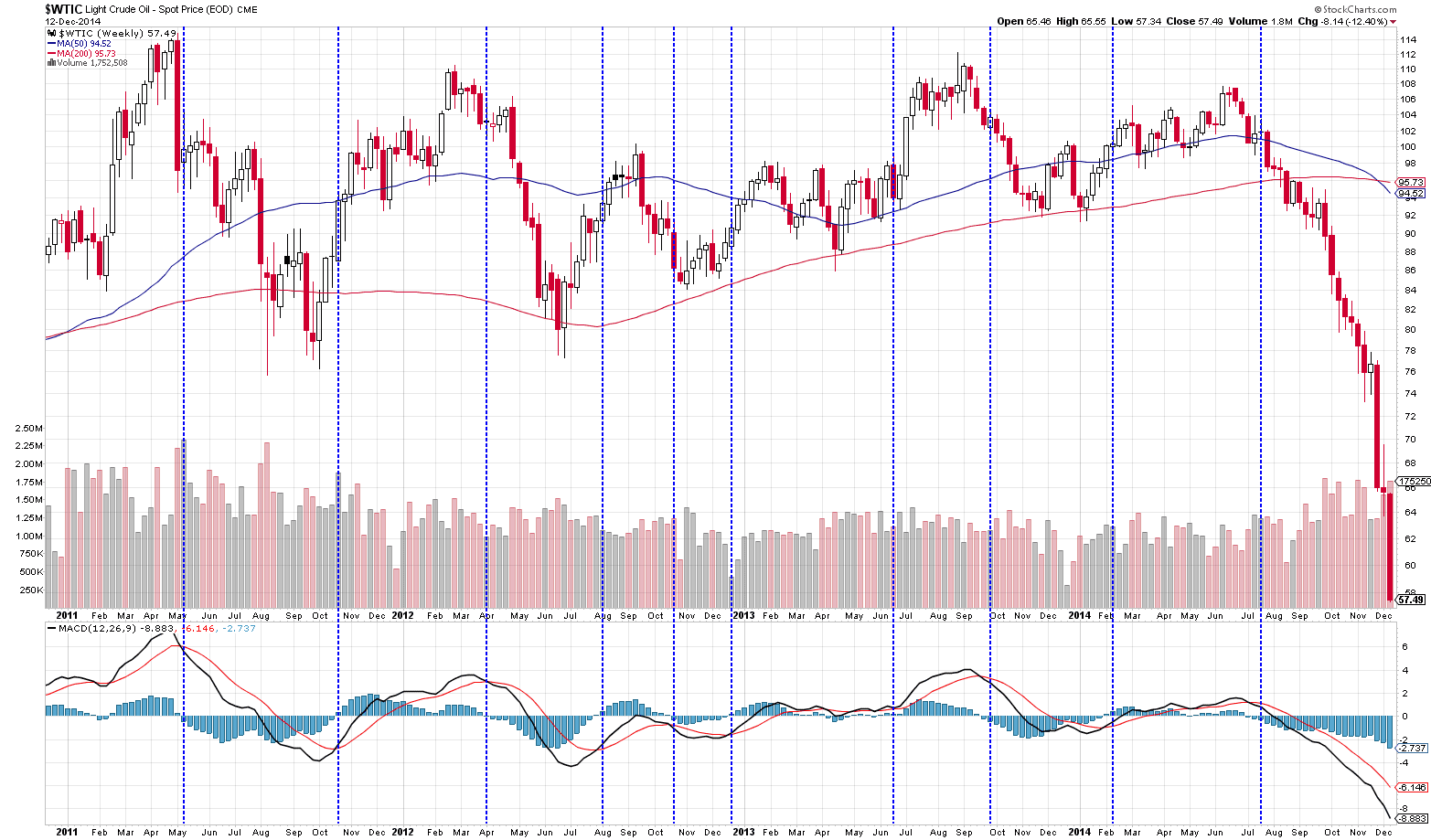

In order to do some testing, I needed to first look at some signals that could be used for trades. In order to keep it simple, I settled on MACD in a weekly view. This might not be the ideal indicator (it’s lagging), but it’s gives good enough signals for the purpose of our testing. Here is the chart that I generated:

The vertical lines indicate the weeks where we reverse our position from long and to short and vice-versa. There are some pretty good signals there and once again as usual in trading, it comes down to position size and managing your stops. The instruments that I wanted to backtest are ETFs. Some are leveraged 2x or 3x, others are non-leveraged. There are ETF build around oil futures like USO and the leveraged UCO and SCO while others hold energy company stocks like XLE and OIH. There are also leveraged versions (long and short) of Oil and Gas industry – DIG and DUG. While not exact replicates of OIH, they perform in similar ways sometimes as we will see.

Looking at long terms results using non-leverage ETF, we get the following performance chart:

The first fact that appears on this chart is that USO makes a very bad proxy for a long term oil position. Even though oil is now down as compared to its 2006 levels, USO is down 50% more. It’s most likely the result of decay from having to roll futures from month to month. So, even if you have a long term bullish view on oil, it is tough to justify using USO as a proxy. It’s clear that on a long term basis, XLE (green) makes the better proxy. The only issue is that like most US equities, it seem to have overextended itself since mid-2013 when it somewhat disconnected with oil prices. The oil services ETF (OIH – pink) seems to have a close correlation, but suffered in 2011 and 2012 and didn’t recover. However, it has not been as bad as USO and might possibly have the most ground to make up on recovery.

Overall though, as with many commodities, oil is better traded than invested in. The choices are to trade futures on short term charts (down to minutes) or longer term with proxies on weekly chart like the one above.

For this study, I want to concentrate on the following periods because they show some interesting results:

Period 1: May 9. 2011 to October 24, 2011 – Short

Period 2: October 24, 2011 to April 2, 2012 – Long

Period 3: September 30, 2013 to February 10, 2014 – Short

Period 4: February 10, 2014 to July 21, 2014 – Long

Period 5: July 21, 2014 to Today – Short

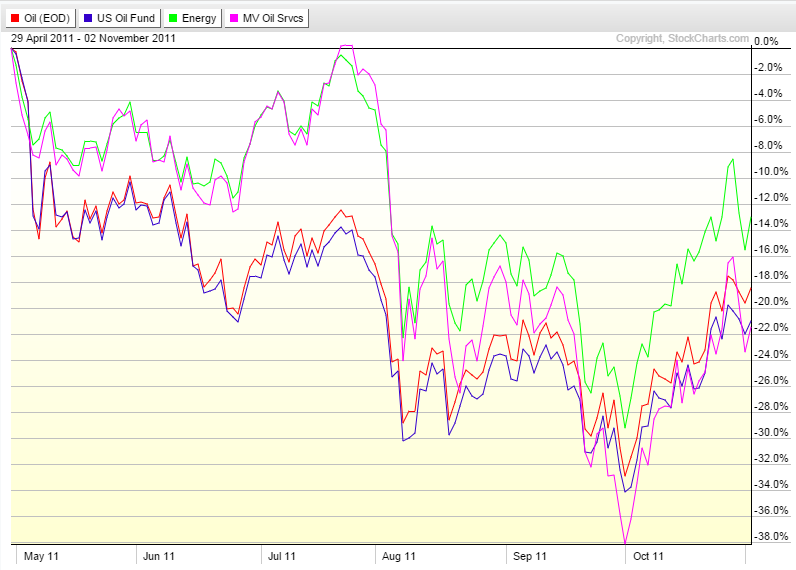

Results for Period 1 – Short

During that period, oil was down as much as 32% and finished the period down about 18%. Interestingly enough, the non-future based ETF XLE and OIH lagged the downside move but abruptly caught up in August 2011. But this also a month where the overall market suffer a large loss so looking at oil only doesn’t convey the complete picture. In essence, XLE and OIH are proxies for equity market with a strong influence from oil it seems. On the other hand, for that short term period, USO makes a pretty faithful proxy, down only a couple more percent that oil itself.

The following chart adds the leveraged short ETF:

Clearly, SCO is a winner in the long run, up about 27% at the end of the period while oil is down 20%. Managing your position with some stops could have yielded some very interesting gains, but even 27% is a nice returns for 6 months. But it does seem that decay takes a bite out of the returns in the long run as the 2x ETF doesn’t return that percentage in the end. But overall, some nice gains. DUG pretty much follows OIH but the mix is not perfect as the final return of 10% doesn’t reflect the losses in OIH.

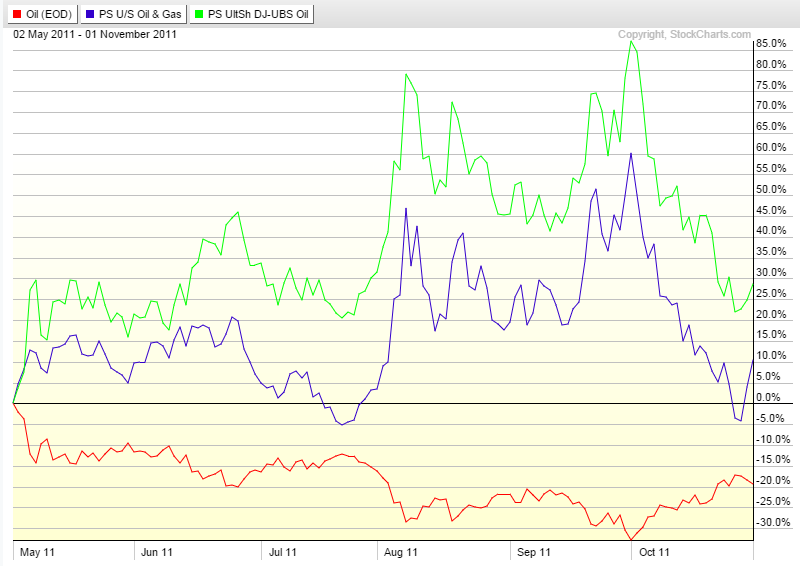

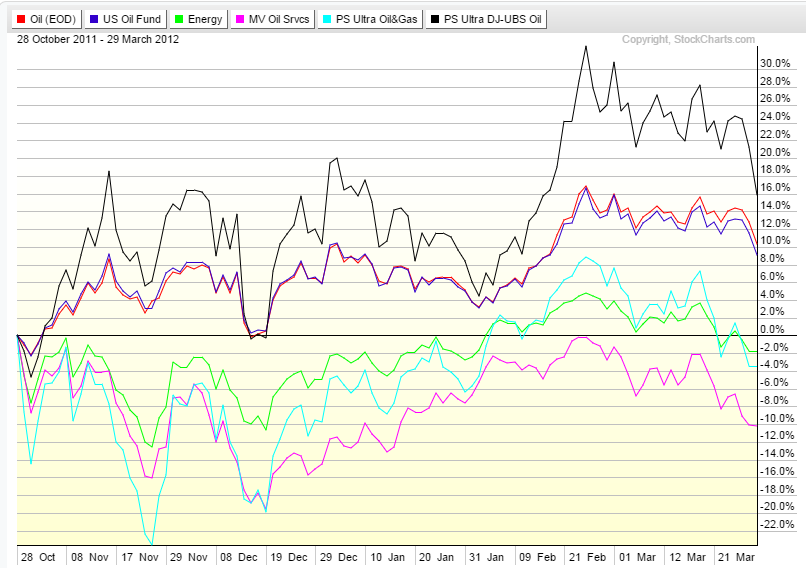

Results for Period 2 – Long

During this period, oil is up about 12% and again, USO is a faithful proxy, only down over 1% as compared to oil for the same period. XLE and OIH on the other hand recovered slower, following the equity markets. It was actually the beginning of a downtrend for OIH as outlined above.

Adding the leveraged ETF, we get the following results:

Double-leverage with UCO this time is again the winner and could have yielded some good returns with good position management. But there again, the decay associated with leveraged ETF is starting to make a difference at the end, with the 2x ETF yielding only about 1.5x the underlying instrument. But 16% return over 5 months is not bad! $10,000 invested in the 2x leveraged ETF at the beginning of Period 1 would have returned $14,732.00 at the end of Period 2 (less than one year). And that is without additional leverage like options! DIG doesn’t make a very good proxy at all because it is plagued by the poor performance of the oil industry in general.

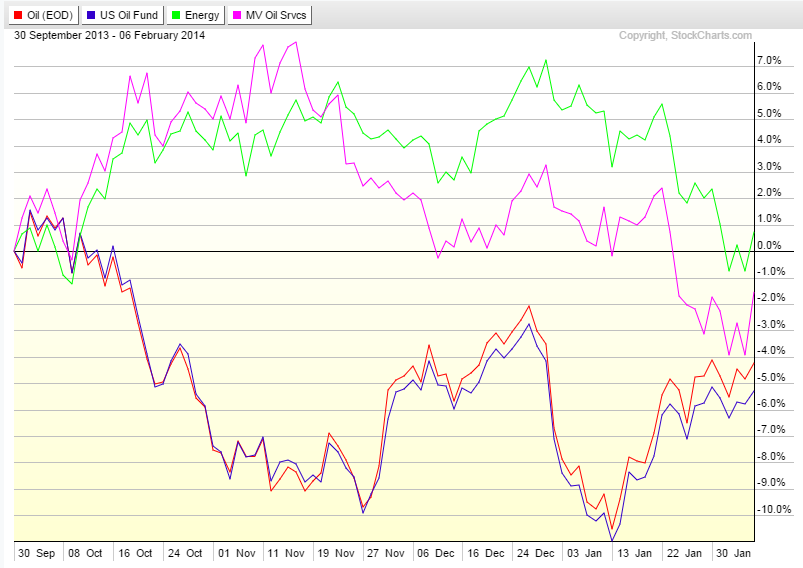

Results for Period 3 – Short

Once again, we see a disconnect between the industry based ETF like XLE and OIH and the price of oil. USO proves again to be a good proxy for short term periods. As seen in the long term chart at the beginning of the article, OIH is overall more sensitive to the oil prices than XLE. It’s partially the case because XLE is made up of integrated oil giants like XOM or CVX who can partially benefit from lower oil prices with their chemical divisions.

Adding the short leverage ETF, we get the following results:

Not surprisingly given the fact that XLE and OIH stayed somewhat above water, DUG performed opposite what it was expected. SCO is a winner again and again, we can see the results of decay toward the end of the period.

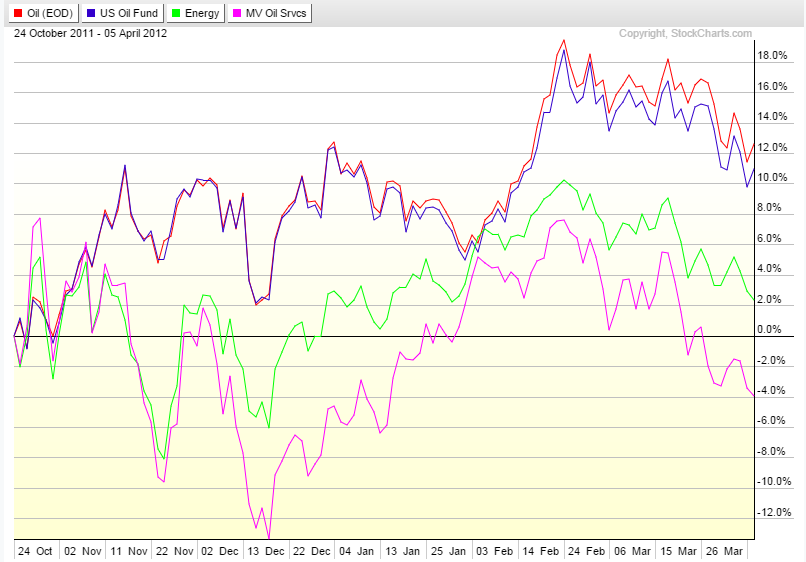

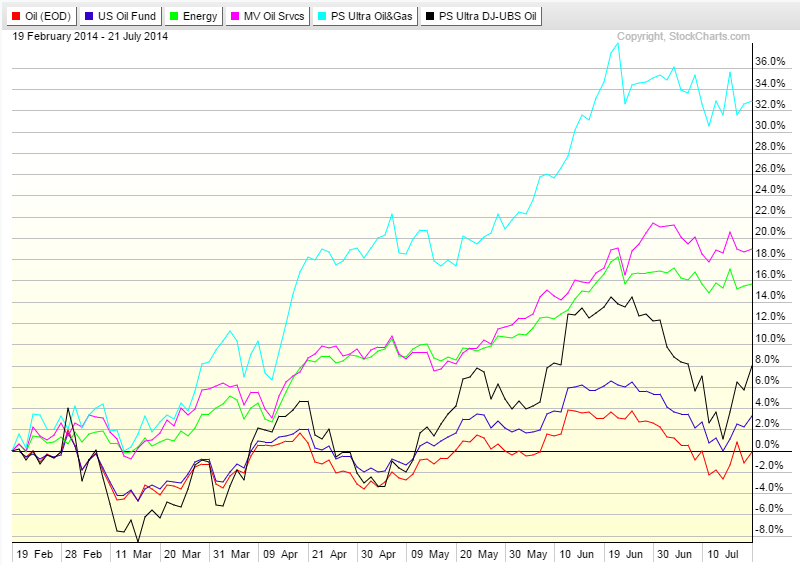

Results for Period 4 – Long

Some very interesting results in this period. The signal tells us to go long but in fact, oil prices stay flat. For some reason, USO actually outperform the underlying commodity but we would need to look to see if oil prices were in contango or backwardation to have a better idea since USO is based on futures with various expirations. XLE and OIH take off about 20% in that time period, but probably influenced by the equity markets rather than oil prices.

The results with the leveraged ETF is as follows:

As expected given the performance of OIH and XLE, DIG takes off like a rocket and returns over 30% in 5 months. But even UCO shows a profit of close to 8% despite oil being flat.

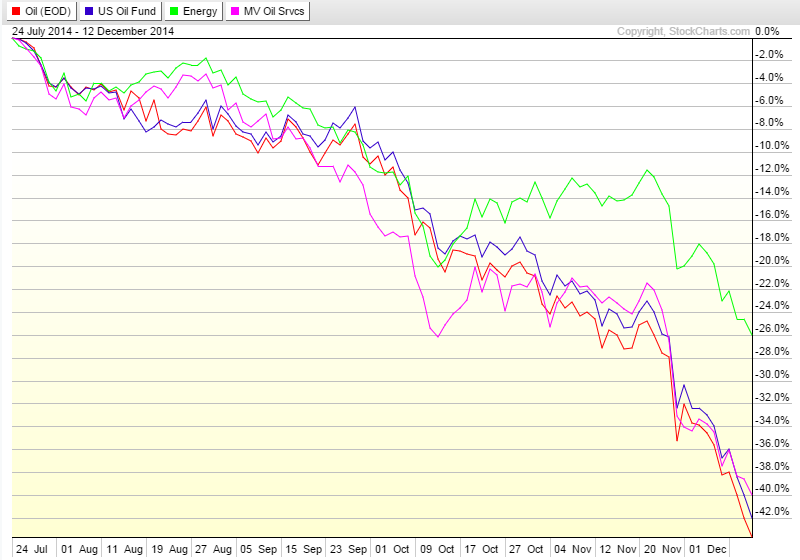

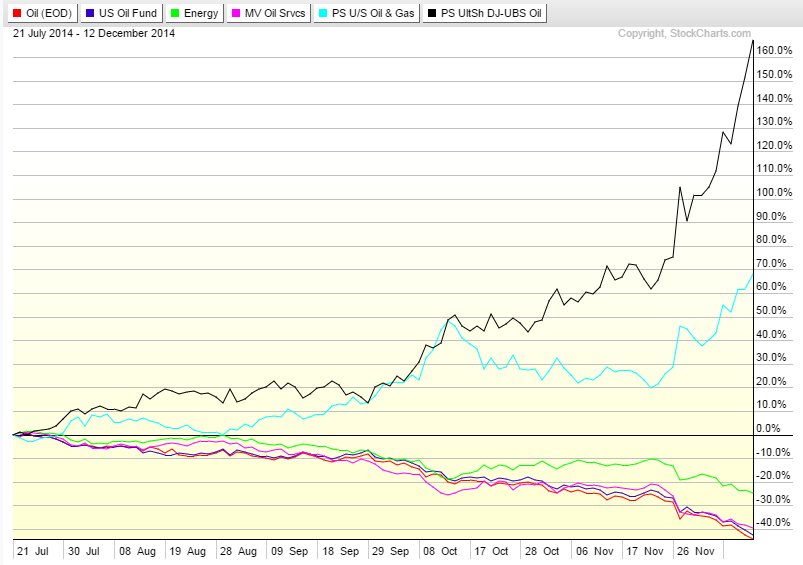

Results for Periods 5 – Short

The current period shows a large down move by oil, down over 42% in 5 months. Clearly not a standard correction! This time, OIH follows the price of oil almost step for step. USO is again a decent proxy although showing more resilience at time. XLE is clearly supported by a strong equity market.

The results with the leveraged ETF is shocking:

Sure, decay might take a bite out of the performance eventually but who cares with a current return of 160%! DUG is also showing a nice return following the disappointing OIH.

Conclusion

As pointed out above, I don’t see oil as a long term investment, more like a trading instrument. But rather than dealing with futures which require a full time trading job, I wanted to explore some possible proxies that would allow for more simple and still profitable trades. USO is generally seen as the best proxy for oil and it does prove to be that way for medium term trades. If you are bullish oil on the long term though, USO is not the instrument you want as it does decay with the underlying futures. For long term investment, you are probably better off with XLE although OIH could see more appreciation in the medium term since many of its components are currently very cheap. But not without risks as some could face difficult times financially if oil doesn’t recover quickly.

For medium term trades, you probably should look at the leveraged oil ETF like UCO and SCO. They clearly show some great results over multiple months but do suffer from decay as well. As it is, they should not be seen as long term trading instruments. DIG and DUG show potentially good returns, but as proxies for XLE and OIH rather than the oil price itself.