Uh-oh!

Uh-oh!

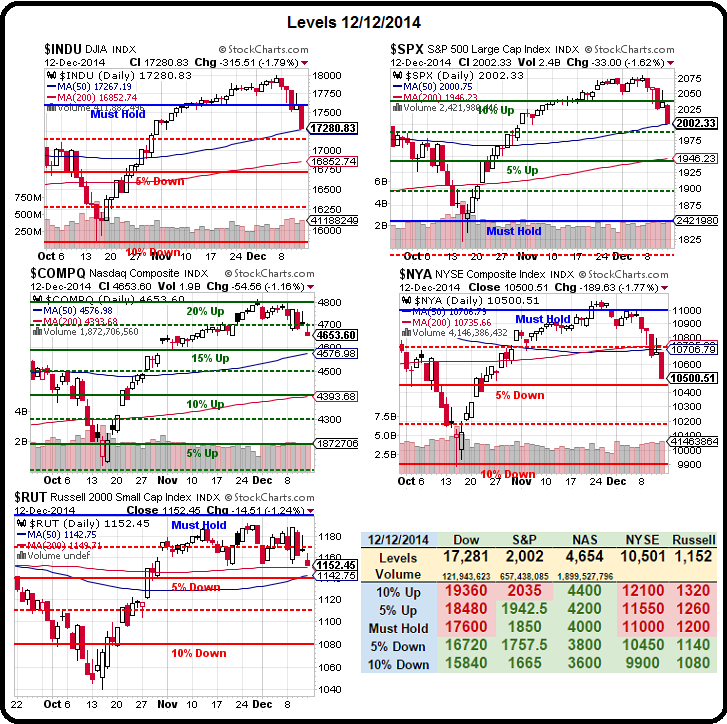

The Russell 2000 (we're short) went negative for the year on Friday. How long until the other indexes begin to follow? Even with incredibly low oil prices ($56.25 overnight lows) the Transports just gave up the 20% line, less than two weeks after giving up the 25% line. The Dow (we're short) itself is up just over 4% for the year now, S&P 8.5% and Nasdaq 11.5% (we're short them too).

The question before us now is – "How low can we go?" So far, we're not even close to the drop we just had in October. For the Transports, that would be a tragic 15% drop from where they are now, as they led the rally off those lows.

The other indexes are about 10% above those levels and we'll see if Santa has completely forsaken the markets over the next couple of weeks but the technical damage is done and fear has come back to the markets with the VIX rocketing up to 23 on Friday, settling into the close at 21.

That's going to make is a fantastic time for us to sell some long-term options and we'll be looking into our "Secret Santa's Inflation Hedges" next weekend in a post but during the week in our Live Member Chat Room. We don't do them every year, the last time we called for inflation was back in 2011, when our 5 hedges averaged over 200% returns for the year – THAT's the way to hedge against inflation!

As we were discussing in Member Chat this weekend (thanks ZZ), we may be approaching a Bondocalypse, the likes of which we haven't seen since the collapse of the bond market in 1994. While the MSM is burying the news, the 2-year notes are now at a level not seen since 2011 (when we last became justifiably concerned about inflation) with expectations of Fed Funds climbing to 1.375% by the end of next year – up over a point and all the way to 2.875% at the end of 2016!

Such a rapid (and necessary) rise would CRUSH the bond market, where people have sold 10-year notes for less than 3% annual interest. A move like that could knock the value of 10-year notes down by 20-30% in short order. That then, would flood the money with notes for sale and each note holder would have to offer better and better rates to potential buyers to dump their notes, driving up future borrowing costs in a vicious cycle.

Now, ordinarily a weak bond market is good for stocks and we still hold plenty of LONG-TERM bullish positions but we do expect a short-term correction – kind of like the one we are in the middle of at the moment. Whether we continue to fall now or get propped up into the end of the year and fall in January remains to be seen but there is a drop comming in the near future – and it will be a bullish event if the October bottoms form support.

Now, ordinarily a weak bond market is good for stocks and we still hold plenty of LONG-TERM bullish positions but we do expect a short-term correction – kind of like the one we are in the middle of at the moment. Whether we continue to fall now or get propped up into the end of the year and fall in January remains to be seen but there is a drop comming in the near future – and it will be a bullish event if the October bottoms form support.

As you can see on our Big Chart, we have a lovely 5% correction on the NYSE already and how it handles the 10,500 line will be critical this week. If that breaks – they all will. The Russell has to prove it can stay positive for the year – half a point away at the moment and the Nasdaq MUST HOLD that 10% line, at 4,550 – still 100 points below where it is now.

That's encouraging because, for the Nasdaq to fall 2.5%, AAPL would have to fall below $100, which is very doubtful (now $110). AAPL is in contention for our Stock of the Year yet again in 2015, so we'd be THRILLED if it got cheaper but 10% down from here would be a hell of a trick. It's equally unlikely that the Dow fails 17,000, about 500 points (3%) over where it began 2014. It should, in the very least, provide good enough support for a bounce back to test the 17,600 Must Hold line (which it did not hold last week!).

Still, we must reamin a bit bearish with 3 of our 5 major indexes below their Must Hold lines so we stay "Cashy and Cautious" into the holidays. You know, what we planned to do at the end of September (and updated on Thanksgiving). I do love it when a plan comes together…

Still, we must reamin a bit bearish with 3 of our 5 major indexes below their Must Hold lines so we stay "Cashy and Cautious" into the holidays. You know, what we planned to do at the end of September (and updated on Thanksgiving). I do love it when a plan comes together…

We're testing a lot of support lines today so we're expecting those 1% bounces still but keep in mind that, when they failed on Friday, they failed BIG TIME (as we foretold), so DON'T GET EXCITED until we see one of those Must Hold lines retaken and be VERY AFRAID if we get another red box on our Big Chart.

The Fed gets their final at-bat of the year on Wednesday at 2pm and Yellen speaks at 2:30 and it's not likely she'll head back to Santa's workshop without spreading a little sunshine on the markets. That's another reason we're not banking on a big sell-off ahead of the Fed this week.

The Fed gets their final at-bat of the year on Wednesday at 2pm and Yellen speaks at 2:30 and it's not likely she'll head back to Santa's workshop without spreading a little sunshine on the markets. That's another reason we're not banking on a big sell-off ahead of the Fed this week.

Globally, things can still take us down. Just this morning, Japan had a very surprising drop in the confidence of their manufactureres. Despite the strong election showing of Abe's party this weekend and despite the tremendous reduction in fuel prices and despite the very weak Yen (great for exporters). If all those things aren't going to help – I don't know what will.

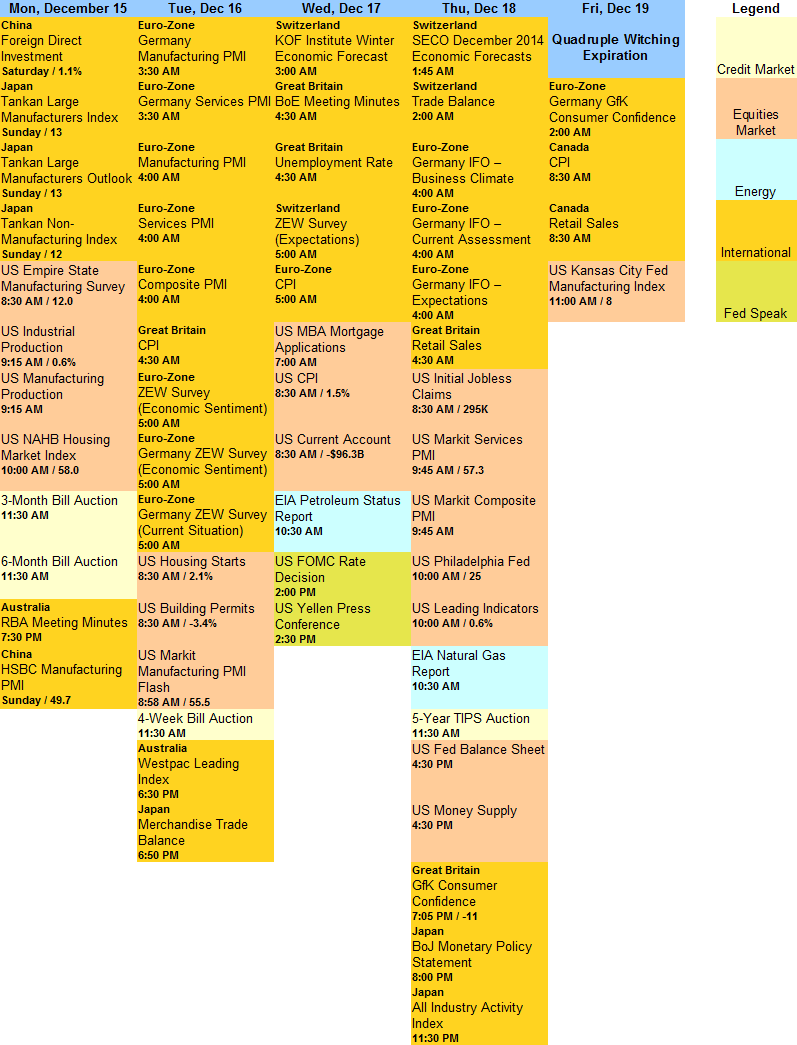

We get a lot of PMI data this week as well as CPI and Euro-Zone Expectations along with US Housing Data and the NY, Philly and KC Fed data as well. Very busy and very interesting coming into the last shopping week before Christmas: