Courtesy of Jean-Luc Saillard.

Following my post on gold and proxies, I wanted to investigate another instrument where proxy ETF get some interesting results – the VIX. To begin with, here is a quick interpretation of the VIX from Wkipedia:

http://en.wikipedia.org/wiki/VIX

The VIX is quoted in percentage points and translates, roughly, to the expected movement (with the assumption of a 68% likelihood i.e. one standard deviation) in the S&P 500 index over the next 30-day period, which is then annualized. For example, if the VIX is 15, this represents an expected annualized change, with a 68% probability, of less than 15% over the next 30 days; thus one can infer that the index option markets expect the S&P 500 to move up or down 15%/√12 = 4.33% over the next 30-day period.[6] That is, index options are priced with the assumption of a 68% likelihood (one standard deviation) that the magnitude of the change in the S&P 500 in 30-days will be less than 4.33% (up or down).

The price of call and put options can be used to calculate implied volatility, because volatility is one of the factors used to calculate the value of these options. Higher (or lower) volatility of the underlying security makes an option more (or less) valuable, because there is a greater (or smaller) probability that the option will expire in the money (i.e., with a market value above zero). Thus, a higher option price implies greater volatility, other things being equal.

The VIX is very important as it does give us a window on the traders’ sentiment. It’s not perfect as with many indicators, it lags since it derives from a reaction to current conditions and therefore does not necessarily reflect what will happen in the future. It is a matter of fact, the VIX which is supposed to measure volatility suffers itself from excessive volatility making it difficult to trade.

Speaking of trading, you cannot trade the VIX directly but you have to use futures if your broker offers it or options. Trading options on the VIX is notoriously risky as they do not track the VIX itself (which is not traded) but futures. Here is a good article on VIX options:

http://sixfigureinvesting.com/2010/01/trading-vix-options/

The alternative to trading futures and options are ETFs and many of them have been constructed around VIX futures. Here are the ones that I am investigating in this post:

Long:

TVIX – VelocityShares Daily 2x VIX ST ETN (leveraged)

VXX – iPath S&P 500 VIX ST Futures ETN

UVXY – ProShares Ultra VIX Short-Term Futures (leveraged)

VXZ – iPath S&P 500 VIX MT Futures ETN

Short:

XIV – VelocityShares Daily Inverse VIX ST ETN

SVXY – ProShares Short VIX Short-Term Futures

My first look at long term performance was most revealing and what led me to write this post. I had some inkling about at least one ETF, VXX as I write extensively about it on

Phil’s Stock World. However, I was not aware of the extent of the problem for some of these ETFs.

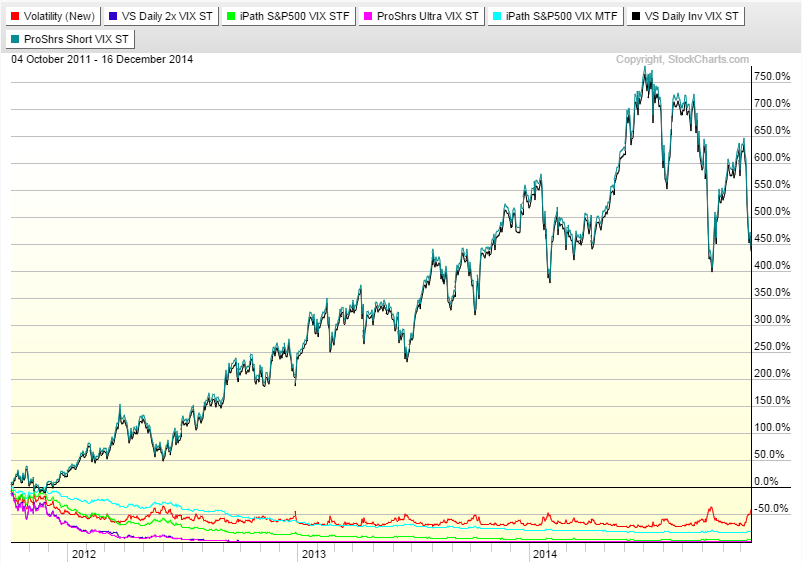

Looking at the earliest date where all these ETF existed, here are the performances:

Clearly, the VIX has lost 50% since that date so it is expected that long VIX ETFs will suffer. But they just don’t suffer, they get obliterated. Looking closely at the results, some of these ETFs are now worth around 1% of their original value and it’s a matter of fact, some of them have been reset a couple of times already. On the other hand, short VIX ETFs have done tremendously well, up about 450% in about 3 years. And some good stops strategy would have yielded much better gains.

To be faire, let’s look at a period where the VIX ended up higher than at the beginning of the chart:

So now we see a period where the VIX is 60% higher at the end of the period than it was when we start tracking performance and yet long VIX ETFs are once again killed with the leveraged ETFs suffering catastrophic losses. Short VIX ETFs still show a profit despite the fact that the VIX is actually higher.

Looking at the underlying instrument, it’s easy to understand the problem. The VIX shows some quick spikes up followed by long quiet periods where it loses value. As opposed to stocks (well most of them at least), there is no possible long term appreciation of the VIX. It is basically an indicator. It cannot be used as a long term investment instrument. It is meant to be traded over short term periods. The problem with all these ETFs is that like some that we looked at for oil, they are constructed around futures which need to be rolled over from month to month and suffer from decay if the underlying instrument does not go in the direction of the ETF. And since the VIX itself cannot be relied to go up over long time periods, these long ETF have no chance in the long run.

Let’s look at shorter term scenarios to see where some of these ETFs could be used as trading substitutes. Let’s first pick a short term period where the VIX goes lower and look at the performances:

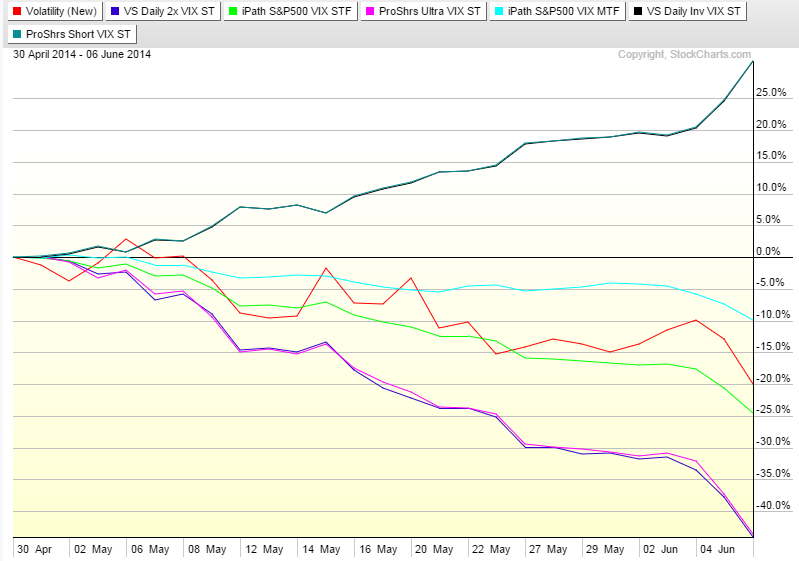

Over this time period (about 5 weeks), the VIX loses 20% of its value. The short ETFs do their job and gain close to 30% over that time period. I suspect that they have very similar holdings as they move so close to each other in the short term. I could not pick one over the other.

Clearly, the leveraged VIX ETF lose much more, over 40%. Somewhat expected when you are leveraged 2x. VXX loses more than the VIX itself, but once again, it’s only decay doing its work there. VXZ seems to be holding up better and it did in fact get the best performance of these long ETFs in the long term. Not sure why and I don’t have the exact holdings to make comparisons.

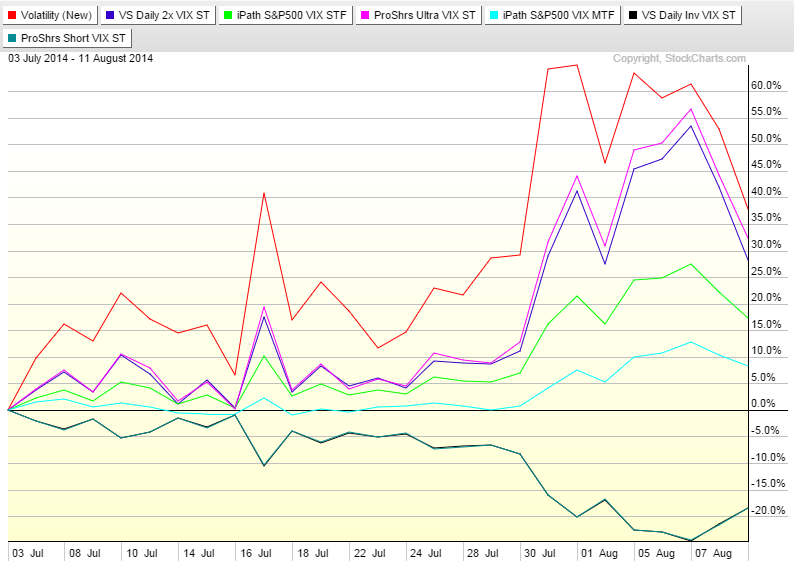

Now lets look at a period where the VIX gains value:

This chart does explain quickly the long term results. Even though the VIX is up 37% over that 5 weeks period, the short ETFs are only down 20%. But look at the long ETFs! What is going on with the leveraged ETFs – they barely keep up with the VIX and end up 5 to 10% lower. Looking at the results over a down period, you would expect them to over perform when the VIX goes higher. But that is not the case. Looking at the standard ETFs, they lag the underlying instrument by 20 to 30%. Not what you would expect either. Very disappointing.

So, if these long ETFs cannot keep up when the VIX ramps up but lose more value when the VIX goes down, what is the point in even owning them for the long run. Even in the shorter run, they don’t seem to perform as expected. Short ETFs clearly outperform on both sides on the equation. They seem to match the VIX on the down side and are more resilient when conditions are not ideal. This does explain the long term results given the fact that the VIX goes down for longer periods.

Conclusion

This post looks at periods covering weeks at a time, not hours. In addition, I have looked at only a couple of periods. This is not an exhaustive study. Maybe a topic for another post. In the case of the leverage long ETFs, my feelings are that they are better treated as trading instruments for periods of hours to days. They clearly underperform the underlying instrument by a wide margin in the long term. The only drawback is that these instruments are not ideally suited to be used as hedges for a larger portfolio where the holding period has to be measured in weeks. There has to be better alternatives.

The short VIX ETFs make an interesting case of longer term investment. It’s difficult to say if the last 3 years are indicative of what we will see in the next 3 years. But even at higher levels, the VIX still follows a nice pattern of quick burst higher and quieter periods thereafter which benefits these short ETFs. In any case, they also seem to make more reliable trading instruments as they mimic the moves of the underlying instrument better.