Reminder: Pharmboy is available to chat with Members, comments are found below each post.

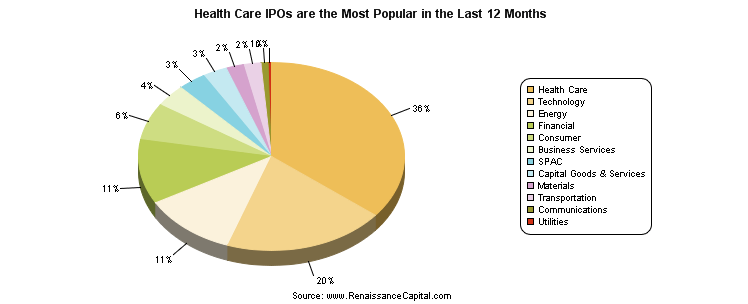

PSW Members – well, what a year for biotechs! The Biotech Index (IBB) is up a whopping 40%, beating the S&P hands down! The healthcare sector has had a number of high flying IPOs, and beat the Tech Sector in total nubmer of IPOs in the past 12 months. What could go wrong?

Phil has given his Secret Santa Inflation Hedges for 2015, and since I have been trying to keep my head above water between work, PSW, and baseball with my boys…it is time that something is put together for PSW on biotechs in 2015.

Phil has given his Secret Santa Inflation Hedges for 2015, and since I have been trying to keep my head above water between work, PSW, and baseball with my boys…it is time that something is put together for PSW on biotechs in 2015.

Cancer and fibrosis remain two of the hottest areas for VC backed biotechs to invest their monies. A number of companies have gone IPO which have drugs/technologies that fight cancer, including JUNO Therapeutics (JUNO), Bellicum Pharmaceuticals (BLCM), Kite (KITE), Immune Design (IMDZ) in 2014. On the other side, fibrosis can be a side effect of cancer as well as involved in a host of other diseases (IPF, NASH). Fibrosis is less understood, and therefore can be harder to treat, and yet a number of high flying companies have been bought due to their drugs (GILD buying Arresto, Roche buying Intermune), and therefore fibrosis remains a very hot area. One company in this space that just IPO'd is Fibrogen (FGEN).

Cancer Company to Consider

JUNO Therapeutics (JUNO): Juno was founded on the backs of cancer researchers at Fred Hutchinson Cancer Research Center, Memorial Sloan-Kettering Cancer Center and Seattle Children’s Research Institute. With more than $300M in funding, the stock IPO'd at 45% above its original midpoint, making it the year's second highest premium behind Castlight Health. The company raised $265 million, giving it a >$2 billion valuation. This made it the largest biotech IPO in at least 15 years both by deal size and market cap. What Dendreon could have done had it picked the right cancer to use its techology!

JUNO's technology is chimeric antigen receptor, or CAR-t for short. CAR-t technology is where the persons own T-cells (a white blood cell) are harvested and modified to fight cancer cells. The technology has tested positive early on:

- JCAR015, Juno's lead candidate, is a treatment for acute lymphoblastic leukemia (ALL). JCAR015 treatment gave complete remission in 24/27 patients (89% remission rate). These results garnered an FDA breakthrough therapy designation last month, which promises an expedited regulatory review.

- JCAR017, in development for ALL and non-Hodgkin lymphoma (NHL),

- JCAR014, which is undergoing early studies on various B cell malignancies. From an oral presentation, patients receiving defined composition products, responses were observed in 6/10 (60%) evaluable NHL patients, and 2/2 evaluable CLL patients, complete remission occurred in 11/11 (100%) patients and complete molecular remissions occurred in 9/11 (82%) patients with ALL.

There are two big hurdles for Juno, and that is competition and manufacturing. The company's closest competitor is Novartis (NVS), which is developing its own CAR-t therapy alongside the University of Pennsylvania. In addition, another T-cell modification company, Kite Pharma ($KITE), which had its own successful IPO in June for $140 million. Bluebird Bio (BLUE) is backed by Celgene, has its own CAR-t technology, so Juno does not have a clear coast to sail alone in the space.

The other challenge ahead is manufacturing, an this is where the management team enters. CEO Hans Bishop is from Dendreon! If anyone knows how to meet the manufacturing needs, it is Mr. Bishop! Put JUNO on your radar, but do not buy into the hype just yet.

Fibrosis Company to Consider

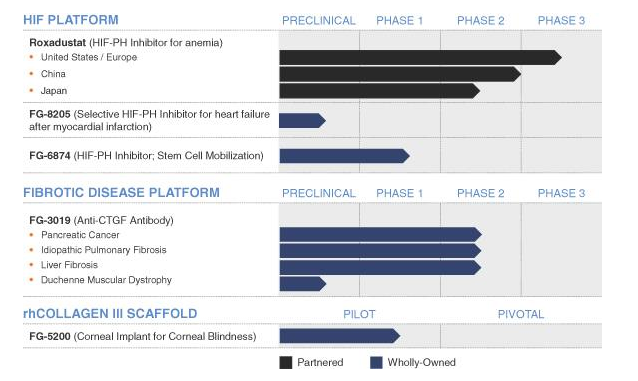

FibroGen (FGEN): The company has been around for about 20 years, and has several clinical trials ongoing in anemia and fibrosis. On the anemia front, the most advanced program, is FG-4592. FG-4592 is in Phase III clinical trials for the treatment of anemia caused by chronic kidney disease (CKD). The compound is an orally administered small molecule inhibitor of hypoxia-inducible factor (HIF) prolyl hydroxylase activity. By stablizing HIF, the body will produce erythropoietin (aka, Epogen – Amgen's stallwart). Some data are due to read out in 2015.

Its next drug candidate in the pipeline is FG-3109, which is in Phase II clinical trials for treating idiopathic pulmonary fibrosis (IPF), liver fibrosis and pancreatic cancer. FG-3109 is a mAb to connective tissue growth factor (CTGF). Early data showed 23% of patients with improved fibrosis with significant p values for in forced vital capacity (FVC – improved lung function). This is the first IPF treatment to show improved fibrosis. Roche/ITMN is believed to treat scarring (really unknown what its mechanism of action is).

FGEN is a takeout candidate due to the fibrosis component alone – Astra? Astellas?. Anemia is a big market, but with biosimilars coming to market, the competition is stiff. Any positive data that comes out of this program only bolsters their takeout chances for fibrosis. With a market cap of $1.5B, it is small compared to ITMN's buyout by Roche. Join us in the daily chat to find out when our options or stock play comes to life.

Happy Holidays!

– Pharm