Yes, I've been watching the Lego Movie with my kids but it does sum up the mood in the markets as we finish up the week with MORE FREE MONEY from our Chinese masters. That's right, In order to keep the party going, the PBOC has set their non-bank deposit rate to ZERO, essentially allowing their financial institutions to lend exponentially more money as ANYTHING can now be counted as a deposit and used for leverage – AWESOME!

This AWESOME flood of new money into the global markets sent the Shanghai Composite up 2.77% this morning. Hang Seng is closed and Europe is closed but our markets are open and our Futures are up a bit but we'll short the Russell (/TF) yet again under 1,208.50 as it would be awesome if it fell back to 1,200 again and made another $850 per contract.

More Free Money finally woke gold up and it popped $25 overnight, back to $1,200 per ounce and silver is back over $16.20 and that's awesome because we're long on both. Oil is still just $56.20 with an awesome opportunity to go long on USO ($21.05) still available (we're already long through June – see Tuesday's post for our reasons why).

More Free Money finally woke gold up and it popped $25 overnight, back to $1,200 per ounce and silver is back over $16.20 and that's awesome because we're long on both. Oil is still just $56.20 with an awesome opportunity to go long on USO ($21.05) still available (we're already long through June – see Tuesday's post for our reasons why).

We're telling you how to get your own share of the FREE MONEY folks – they are just giving it away to rich folks like us who can afford to play the market. In our Long-Term Portfolio, for example, we're going to double down on our USO 2017 $23 calls, now $4 to bring our total to 50 long contracts. It would be awesome if USO just got back to $30, which have been the lows of the past few years – as that would drop $35,000 back in our pockets – a nice way to offset rising gas prices over the next couple of years.

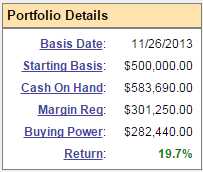

Our entire Long-Term Portfolio has been awesome, up $83,690 as we prepare to close out the year but surprisingly dwarfed by the 60% gain in our Short-Term Portfolio, which we pair with the LTP to provide generally bearish balance as we navigate through the year. Both portfolios are very much in cash and we'll actually be disappointed if January doesn't give us a nice sell-off – and another buying opportunity.

Our entire Long-Term Portfolio has been awesome, up $83,690 as we prepare to close out the year but surprisingly dwarfed by the 60% gain in our Short-Term Portfolio, which we pair with the LTP to provide generally bearish balance as we navigate through the year. Both portfolios are very much in cash and we'll actually be disappointed if January doesn't give us a nice sell-off – and another buying opportunity.

AAPL is our AWESOME Trade of the Year for 2015 and, as our Members know, we sent out our Top Trade Alert for AAPL along with BHI as an alternate just last week as an update to our 12/3 trade idea. It's awesome when stocks get cheaper and we get better entires – that was the case with BHI, as well as some of our other materials plays.

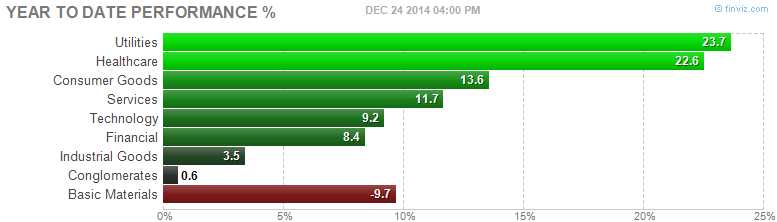

If the economy is as awesome as the pundits are saying, we're going to have some real growth in the materials sector at some point – though there's certainly no sign of it now, with Materials down 9.7% on the year (and 20% in 6 months), scraping the bottom of the performance chart for 2014:

Meanwhile, we watch and wait. Mostly we're waiting for January earnings reports so we can figure out where this 5% GDP growth ($800Bn) came from. You would think $800Bn would be something people would have noticed BEFORE the GDP report came out but it sure wasn't reflected in Q3 earnings so we'll be looking closely at who is making all this money that's being reported.

For perspective's sake, $800Bn is double WMT's annual sales, and 4x what AAPL ships in a year. $800Bn is 5x GM or Ford's output – but I'm sure we'd notice if they tossed another 50M cars on the road (and gas prices sure aren't reflecting it).

For perspective's sake, $800Bn is double WMT's annual sales, and 4x what AAPL ships in a year. $800Bn is 5x GM or Ford's output – but I'm sure we'd notice if they tossed another 50M cars on the road (and gas prices sure aren't reflecting it).

It can't be anything made out of gold or copper or silver or anything that uses natural gas or oil and Heath Care costs are down, so it's not likely to be drugs and movie revenues are flat and print is dead… Really, I'm very curious to see WHERE $800Bn was added to our economy.

Until then, we'll keep it "Cashy and Cautious" – just in case this whole house of cards collapses ahead of schedule. There's plenty of fun things we can do with cash and it's so much easier to enjoy the holidays when you don't have to worry about your market positions, isn't it?

Have a great weekend,

– Phil