Nasdaq 5,000!

Nasdaq 5,000!

There's a level we haven't seen since the Dot-Com days. After 15 years, we're back over 4,800 for the first time and it would be a real shame to fly so close to the sun without getting a chance to melt our feathers at 5,000 once again, wouldn't it?

While I doubt we'll get there by the end of the year (tomorrow), 2015 would have to be a serious disappointment if we can't make 200 more points (5%) on the Nasdaq. AAPL is once again our Stock of the Year for 2015, so we do expect it to happen – as AAPL is about 15% of the Nasdaq but, heading into the holidays, we're SHORT on the Nasdaq as we don't like that HUGE gap down to the 40-MONTH moving average at 3,750, which not at all coincidentally is a 50% retracement of the current stimulated run-up.

What will bring the Nasdaq back to Earth, I can't say for sure but, like the Ghostbusters, we shall CHOOSE the form of the destructor and it will come for us. There are SO MANY potential ways the markets can sell off: Oil, Russia, Greece, China, Climate, Liquidity, Deflation, Inflation – these are all problems that are going on in different parts of the World that we are, for the most part, ignoring at the moment.

Don't get me wrong, we can ignore problems for quite a long time. We're very good at ignoring problems and even pretending they don't exist (cough, global warming, cough, cough) in order to just get on with our lives and avoid dealing with things. Baseball, apple pie and burying our heads in the sand like ostriches is the American way these days and I'm not saying we should buck the trend – let's just make sure we're aware of it.

We're still long-term long and will remain so until the Fed(s) run out of money (or the ink they use to print more money with) but, short-term, we're well-hedged for a correction over the next 60 days that could take us halfway to that 3,750 mark (back to perhaps 4,250) as a NORMAL CORRECTION after such a massive run-up without one. Notice in 2000, we stopped right around that 3,750 line and bounced back up – THEN we crashed and burned…

We're still long-term long and will remain so until the Fed(s) run out of money (or the ink they use to print more money with) but, short-term, we're well-hedged for a correction over the next 60 days that could take us halfway to that 3,750 mark (back to perhaps 4,250) as a NORMAL CORRECTION after such a massive run-up without one. Notice in 2000, we stopped right around that 3,750 line and bounced back up – THEN we crashed and burned…

We might avoid a catastrophe this time. At the moment, the Nasdaq's combined p/e is about 22 vs. 100 at the top of the Dot-Com Bubble. GMCR is one of the Nasdaq's big leaders, up 34,000% since the crash and MNST is up 41,000% (so caffine drinks are a good place to be) while GILD is up "just" 42x over that period and AAPL only 24x. MSFT is still 6% shy of it's March 2,000 high, CSCO is 58% below, as is YHOO, which topped out at $110.

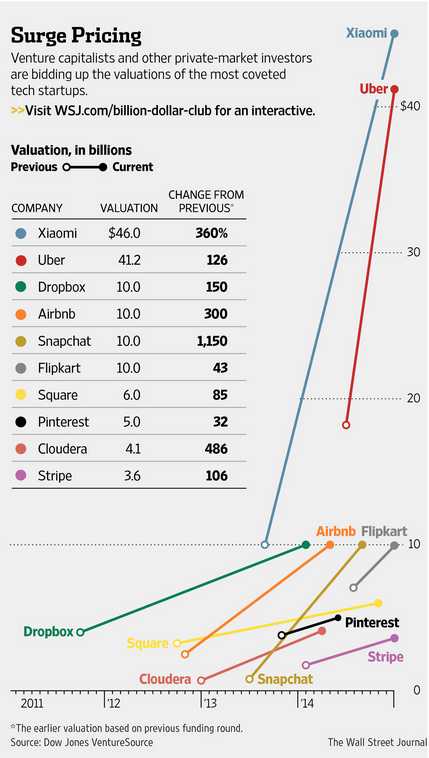

It's not the big cap tech names I'm worried about but the start-ups that, in the past two years, have seen 70 IPOs valued at over $1Bn, with 40 of them this year – that's double where we were in 1998 and 1999. Xiaomi was just valued at $46Bn, just off Facebook's $50Bn tag in 2011.

It's not the big cap tech names I'm worried about but the start-ups that, in the past two years, have seen 70 IPOs valued at over $1Bn, with 40 of them this year – that's double where we were in 1998 and 1999. Xiaomi was just valued at $46Bn, just off Facebook's $50Bn tag in 2011.

Just the top 10 start-ups listed in the WSJ's chart on the left are valued at $146Bn and, if we assume $1.5Bn avg for the other 60, that's another $90Bn, so call it $250Bn – that's a LOT of money for 70 companies with not even $1Bn in profits between them.

Yet investors just can't seem to stop themselves from throwing money at these companies. We're no better – just yesterday, in our Live Member Chat Room, we went back into GSVC ($8.71), which invests in a basket of tech start-ups and is back at levels we had bought them for ahead of the Twitter IPO in 2013.

Since then, GSVC has come down along with TWTR but they hold plenty of other interesting start-ups, including Uber's rival, Lyft as well as Dropbox and many others.

Our biggest mistak in 1999 was thinking YHOO $100 was ridiculous. We missed the last $200 part of the run-up, silly as it may have been. The whole Nasdaq gained 100% in 1999 – even though people knew it was nuts while it was happening. Options give us a way to participate in silly upsides while limiting our downside risk and our hedges let us make money on those downsides too – so we're looking forward to 2015 – it's going to be interesting times indeed.

Just because things are ridiulous – doesn't mean we can't enjoy them.