Wheeee, that was fun!

Wheeee, that was fun!

As you can see, we've already come very close to re-testing our December lows but we were happy enough with the gains on the TZA calls (that I mentioned yesterday morning) that we cashed in our April $13 calls at $2.20, up 0.50 (29%) from the morning open – another nice way we help you hedge against the downside at Philstockworld.

By taking off our largest, shortest-term hedge at 12:10 in our Live Member Chat Room, we flipped our Short-Term Portfolio much more bullish as well as adding $22,000 (for 100 contracts) to our pile of cash. That left our Short-Term Portfolio up 92.2%, gaining another $10,500 for the day while the market fell (as we predicted, of course). By using layered hedges in our portfolio, we are able to take advantage of quick drops while still maintaining longer-term protection.

While it's nice to make 29% when the market drops 1.5%, that was nothing compared to our suggestion to go long on Natural Gas Futures (/NG) at $2.825 as we got not one, but TWO entries at that level with TWO 10-cent moves of +$1,000 each.

While it's nice to make 29% when the market drops 1.5%, that was nothing compared to our suggestion to go long on Natural Gas Futures (/NG) at $2.825 as we got not one, but TWO entries at that level with TWO 10-cent moves of +$1,000 each.

Even better, in the Live Webinar we invited you to at 1pm, we entered 10 Oil Futures Contracts and I demonstrated our technique that worked the net basis down to $47.50 and, this morning, we stopped out of that set with a $10,000 gain – not bad for a FREE Webinar!

As I said, we can teach anyone how to do this (just check out our testimonials) but it's not a trick – you actually have to learn our techniques and practice. As I said yesterday, it's just a combination of using sound Fundamentals to identify market opportunities combined with good trading techniques that take advantage of those opportunites. This morning, for example, we called the top on oil in our Live Member Chat Room at $48.60, then got back in at $48 and now (7:48), it's back to $48.40 for another $400 PER CONTRACT gain in one hour.

This is why we love playing the Futures, it's a profession worth learning as you can make $400 an hour once you get proficient at it. For our portfolios, we made aggressive adjustments to our long plays on USO and UCO, which is the lesser-known Ultra-Bullish ETF on oil. I already sent out a UCO trade idea as a Top Trade Alert, so I can't tell you the options trade if you're not a Member, but buying the ETF around $8.16 should give you a nice return between now and July.

Aside from expecting a move back up in oil (see Dec 23rd post for that premise – today is finally the day we were waiting for) we are expecting bounces in our indexes per our 5% Rule™. That's why we ditched our TZAs, but we do stand ready to take a new and aggressive spread (see yesterday's Live Member Chat) in case these lines fail:

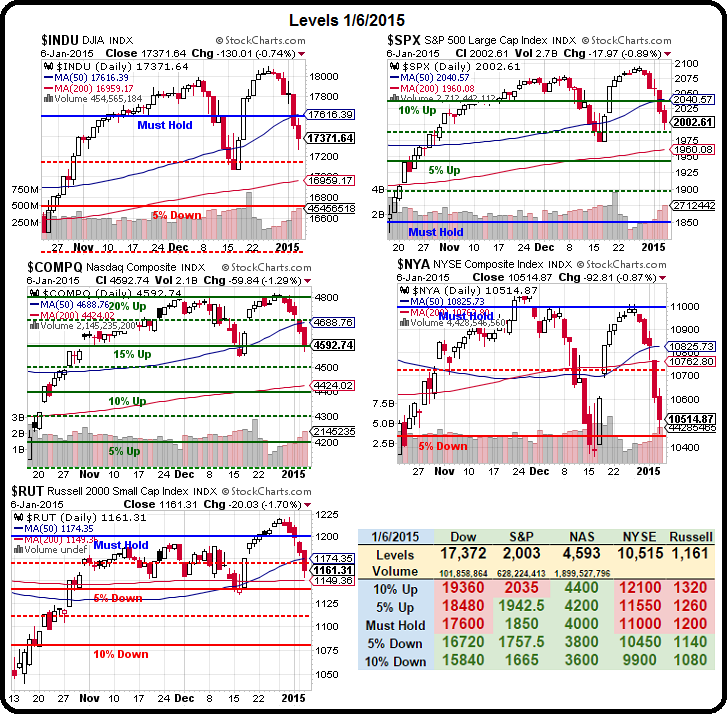

- The Dow fell from 18,000 to 17,250 but 17,100 is the 5% drop so we calculate a weak bounce of 180 points from that level (even though it hasn't hit yet) to 17,280 and another 180 would be the strong bounce line of 17,460 – that's what we'll be looking for today in order to stay bullish, though we really want to see 17,600 taken back (our Must Hold line).

- S&P topped out (ignoring spikes) at 2,090 and just missed a 5% pullback to 1,985 so we'll look for 21-point bounces off that 105-point drop to 2,006 (weak) and 2,027 (strong) and, as we said yesterday – 2,020 must hold on the S&P (along with Dow 17,600) for us to stay bullish.

- Nasdaq fell from 4,800 exactly to the 5% drop of 4,560 (that's why it's called the 5% Rule™!), so we're looking for 48-point bounces to 4,608 (weak) and 4,656 (strong).

- NYSE also fell 5% on the money from their Must Hold line at 11,000 to 10,450 (see how easy it was for us to call the turn yesterday?) and now we need to see 10,560 (weak) and 10,670 (strong) but it's been the persistent failure at 11,000 that has kept us Cashy and Cautious since September. Failing 10,500 again would be a very bearish sign for the markets.

- Russell is our favorite index as it's completely insane. That makes it fun for us to trade in and out of. Not surprisingly, the Russell also fell EXACTLY 5%, from 1,220 to 1,159 and we'll call that 60 points and call it 1,160 as a base (round numbers are nicer) so let's say 1,172.50 (weak) and 1,185 (strong) will be what we look for in a recovery.

Anything less than that and we'll be adding more downside hedges. Nothing has changed, as we noted on Monday, we're geared up for a rally today as we have the Fed Minutes at 2pm along with our predicted rally in oil this morning. That makes conditions right this morning for a nice bounce and our 5% Rule™ helps us benchmark the success of the move by removing the emotion from the "rally."

Anything less than that and we'll be adding more downside hedges. Nothing has changed, as we noted on Monday, we're geared up for a rally today as we have the Fed Minutes at 2pm along with our predicted rally in oil this morning. That makes conditions right this morning for a nice bounce and our 5% Rule™ helps us benchmark the success of the move by removing the emotion from the "rally."

We also have two doveish Fed speakers (Evans and Rosengren) between now and lunch tomorrow. If we can't manage a strong bounce off of that action, then we ARE in trouble!

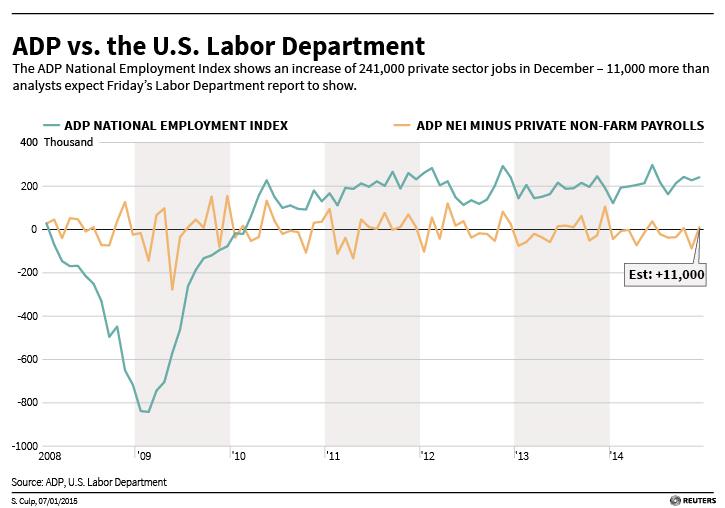

We even have a slightly bullish ADP report and we get Non-Farm Payrolls on Friday but good news may be bad news if the pundits believe strong employment will lead to Fed tightening – because the worst kind of inflation, according to the Fed, is wage inflation.

We even have a slightly bullish ADP report and we get Non-Farm Payrolls on Friday but good news may be bad news if the pundits believe strong employment will lead to Fed tightening – because the worst kind of inflation, according to the Fed, is wage inflation.

I don't think this economy will ever really get better until we do let wages rise back to livable levels. Unfortunately, that means taking back some of the 300% wealth gains that went to the top 1% over the past decade while the middle class stagnated (at best) and the poor in this country got much, much poorer.

With our new all-Republican Congress – don't hold your breath…