You're here to make money, right?

You're here to make money, right?

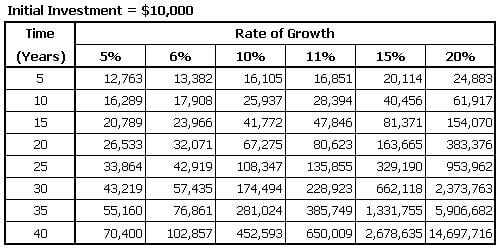

We do a lot of educational posts on various topics but, once in a while it's a good idea to put these concepts to some kind of practical use. Recently we discussed "How to Get Rich Slowly" and, in that post, we talked about the great value of making a consistent 20% annual return and, to start the year off, we've put up over 20 long-term trade ideas for our Members in our Live Chat Room, as well as some in our Top Trade Alerts (Members Only).

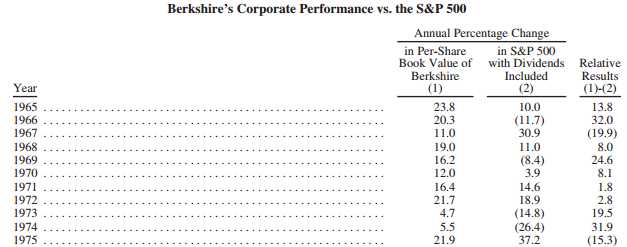

Our entire Long-Term Portfolio was up 20% last year, as was our Income Portfolio when we closed it and our smaller, Short-Term Portfolio managed to bring that net up over 25% for the year. As always, our goal is to make 20% a year and it's OK not to make 20% EVERY year, what you really want to avoid is losing money. Warren Buffett wasn't a famous investor in 1965 - or 1975 for that matter and, in fact, 1973 and 1974 were poor years for Berkshire - but they avoided losses - and that's the key!

Buffett is also a value investor who plays the slow and steady game in accumulating wealth. Not every year is going to be a big winner and not every year will beat the S&P because we HEDGE our bets and the same hedges that stop you from losing too much on the way down, stop you from winning too much on the way up. That's OK though, because it's the CONSISTENCY that makes you rich. While virtually unknown in 1975, by 1985 Warren Buffett was known as one of the greatest investors of all time.

Why is that? Did he do anything different? No, not at all.

Why is that? Did he do anything different? No, not at all.