Wow, I'm getting dizzy.

Wow, I'm getting dizzy.

I'd say the market is like a roller-coaster but there are no roller-coasters that make moves this crazy. Unfortunately, all this zig-zagging up and down is only serving to exhaust the erstwhile dip buyers, who haven't been getting quite the easy ride they've become used to over the past few years.

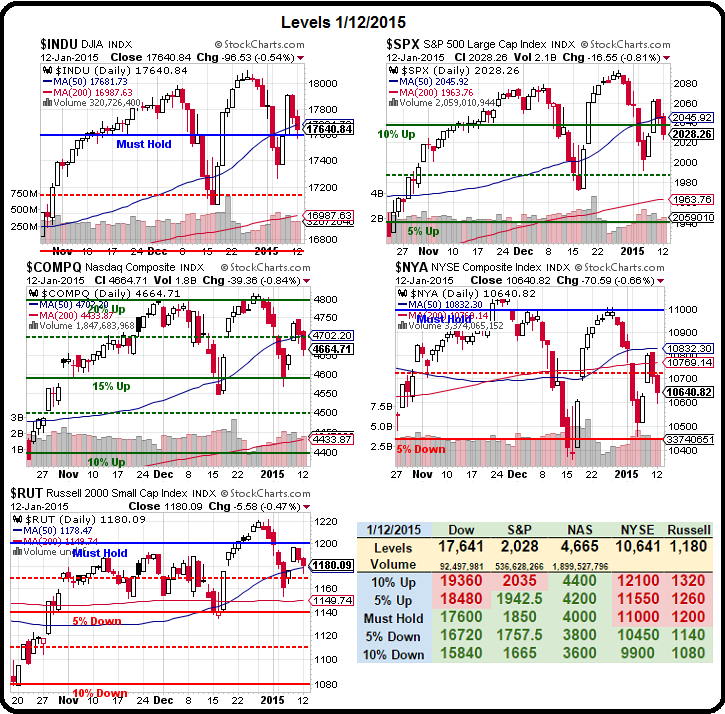

More importantly, we are NOT making our Strong Bounce Lines per our 5% Rule™, which has kept us from chasing these bounces as we just haven't quite gotten over the hump at:

- Dow 17,280 (weak) and 17,460 (strong)

- S&P 2,006 (weak) and 2,027 (strong)

- Nasdaq 4,608 (weak) and 4,656 (strong)

- NYSE 10,560 (weak) and 10,670 (strong)

- Russell 1,172.50 (weak) and 1,185 (strong)

As you can see, only the Dow has really cleared it's goal by any significant amount with the S&P right on the line and the NYSE and Russell pulling up the rear. All should be over at the open as we're getting a 1% pop in Europe, where inflation is so low that investors are CERTAIN that Draghi will come and save the day a week from Thursday (22nd) at the next scheduled meeting.

As you can see, only the Dow has really cleared it's goal by any significant amount with the S&P right on the line and the NYSE and Russell pulling up the rear. All should be over at the open as we're getting a 1% pop in Europe, where inflation is so low that investors are CERTAIN that Draghi will come and save the day a week from Thursday (22nd) at the next scheduled meeting.

The Euro is below $1.18 this morning, so weak that even the Pound shot up to $1.515 rather than be seen in the same neighborhood as its poorer cousin. Nous sommes Charlie, indeed! The Euro is so weak even the Yen can't get over 120 to the Dollar (now 118.50) because traders would rather buy Yen than Euros – and Draghi hasn't actually done anything yet!

What's really sick about the game the ECB is playing is that they seem grimly determined to find places to throw $600Bn into some form of QE – AS LONG AS IT ISN'T FOR GREECE! Greece they are letting twist in the wind, rather than give them $75Bn to totally fix their economy. How F'd up is that? The ECB is literally struggling to find ideas for where to jam the QE (as most places are already fully jammed) but they won't even let Greece skip an interest payment?

Well, Greece goes to the polls on Sunday, the 25th, just 3 days after the ECB decision and Greek voters will have a good opportunity to tell they EU where to shove their austerity program. Meanwhile, Germany's finance minister, Wolfgang Schäuble, who, as a proponent of austerity, insists that "all previously agreed Greek debt must be paid in full regardless of the composition of the next Greek government." As summed up so well by Nicos Devletoglou at Athens University:

Well, Greece goes to the polls on Sunday, the 25th, just 3 days after the ECB decision and Greek voters will have a good opportunity to tell they EU where to shove their austerity program. Meanwhile, Germany's finance minister, Wolfgang Schäuble, who, as a proponent of austerity, insists that "all previously agreed Greek debt must be paid in full regardless of the composition of the next Greek government." As summed up so well by Nicos Devletoglou at Athens University:

Such a proposition remains largely untenable, because first, as suggested, we would have to establish institutionally what the net remaining Greek debt is — after downward-adjusting it to compensate for, say, the shocking and still-rising rates of hunger and suicide and the lethal levels of unemployment that are already practically eviscerating the social and economic fabric of Greece, driven by the devastating momentum of continuing austerity, which is also responsible for the endemically collapsing aggregate demand in the eurozone's longest-suffering country, with steadily vanishing prospects of growth — generally prevalent elsewhere in Europe too — and nowadays threatening to bring Europe's Grande Démise yet closer as the euro continues depreciating and the eurozone slides deeper into deflation.

In other words "F you and the economic union you rode in on" and good for Nicos, this really is getting to be BS as Greece had an untenable settlement shoved down their throats in order to remain part of a Union that clearly doesn't want them – other than as a means to extract a huge portion of what little money they have left. This is now year 6 of austerity for Greece, which has a 25.9% unemployment rate and, to make it worse – they get paid in Euros! That's an additional 20% pay cut for the few people who still have jobs…

There are only 3.6M people in Greece who have jobs, and that's out of 11M people in the country. Those 3.6M people are expected to work off $350Bn in debts, that's $97,000 per person and the Greek bond rates are at 10%, so, if you work in Greece, $9,700 of your salary goes just towards paying interest on your country's debt. Meanwhile, to avoid going further into debt, social services have been cut to the bone. How exactly will more austerity make this better?

There are only 3.6M people in Greece who have jobs, and that's out of 11M people in the country. Those 3.6M people are expected to work off $350Bn in debts, that's $97,000 per person and the Greek bond rates are at 10%, so, if you work in Greece, $9,700 of your salary goes just towards paying interest on your country's debt. Meanwhile, to avoid going further into debt, social services have been cut to the bone. How exactly will more austerity make this better?

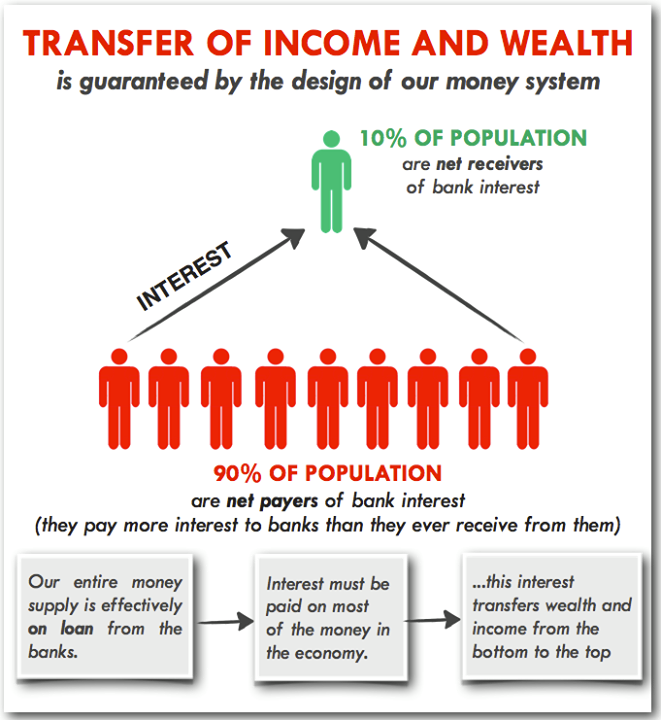

Don't laugh because Greece is an experiment being conducted by the Banksters to find out how far they can push a population until they break. Let he who is without debt cast the first stone, as the saying goes and our own National Debt Clock says the average US taxpayer owes $154,054 – that's 50% MORE than what the Greeks owe. The good news (so far) is that the US is only paying $237Bn on $18.1Tn worth of debt (1.3%) each year. Won't it be funny if we start having to pay 10% too?

Very funny for the Banksters, who will laugh all the way to their own banks while we are forced to tighten our belts until we cut off our circulation (like Greece) and that's why the Central Banksters are experimenting there first, before putting the squeeze on the rest of the World to further enrich themselves. That's why GS (and others, of course) have placed their operatives at the helm of many of Europe's Government Institutions.

Very funny for the Banksters, who will laugh all the way to their own banks while we are forced to tighten our belts until we cut off our circulation (like Greece) and that's why the Central Banksters are experimenting there first, before putting the squeeze on the rest of the World to further enrich themselves. That's why GS (and others, of course) have placed their operatives at the helm of many of Europe's Government Institutions.

You won't hear about this stuff in the US MSM because, according to a recent study by Princeton, the United States isn't even a democracy anymore. Using data drawn from over 1,800 different policy initiatives from 1981 to 2002, the study concludes that rich, well-connected individuals on the political scene now steer the direction of the United States, regardless of or even against the will of the majority of voters. America's political system has slowly transformed from a democracy into an oligarchy, where wealthy elites wield most power.

Multivariate analysis indicates that economic elites and organized groups representing business interests have substantial independent impacts on U.S. government policy, while average citizens and mass-based interest groups have little or no independent influence. The results provide substantial support for theories of Economic-Elite Domination and for theories of Biased Pluralism, but not for theories of Majoritarian Electoral Democracy or Majoritarian Pluralism.

It's not just the US, it's a global phenomenon. While we make fun of Russia's "oligarchy", they make fun of ours all the citizens think it's all so funny while our individual rights are stripped away and the wealth of our nations are transferred to the top 0.01% (even the 1% lose in this game, where 85 people have more wealth than 3.5Bn).

It's not just the US, it's a global phenomenon. While we make fun of Russia's "oligarchy", they make fun of ours all the citizens think it's all so funny while our individual rights are stripped away and the wealth of our nations are transferred to the top 0.01% (even the 1% lose in this game, where 85 people have more wealth than 3.5Bn).

Greece is nothing more than the Global situation in miniature. The entire planet lived far above its means for the last 40 years and accumulated $80Tn in debts and, logically, we should all default and start from scratch but that's not in the interest (get it?) of those at the top, who hold those notes – they want to get PAID and Greece is a test bed AND a precedent for what they want to do to the rest of us down the road.

Your vote doesn't matter, your voice doesn't matter – just shut up, go to work and pay your Government's debts – you are a wage slave, shackled by loans you didn't agree to borrow for wars you didn't want to fight in for a Government that taxes the people you work for and the Companies you buy from at 12.5% while making you pay 40% for the infrastructure they use to conduct their business.