Courtesy of Tim Knight of Slope of Hope

Remember, years ago, when the markets were a mechanism for honest price discovery and a gathering place for buyers and sellers to participate in open, unvarnished capitalism? Yes, I know it was years ago, but I'm sure you can think back to those days.

And do you sometimes ask yourself, "What would it be like if markets were normal again? What if the world's central bankers all decided to go f*ck themselves and leave the markets to act naturally on their own? And how much would I pay to see Janet Yellen commit suicide on pay-per-view?" OK, maybe not that last one, but I bet you've asked the first two.

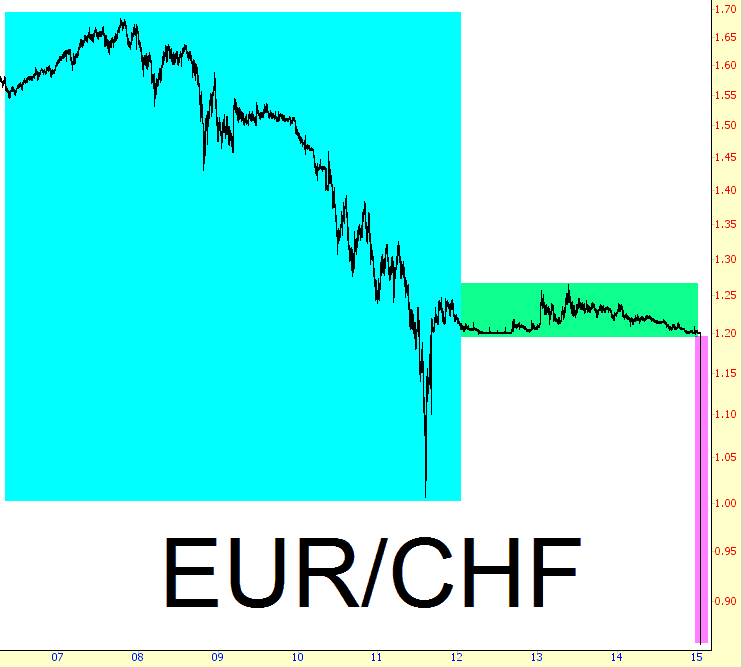

Well, my friends, the Swiss National Bank has, by their own actions, provided a sort of answer. Look no further than the Euro/Swiss Franc exchange rate graph:

There are, contained herein, three distinct section. The cyan (that's "blue" to the color illiterates out there) area is Markets As God Intended. The green section is the rigidly-controlled, ruled-by-doctrine, price-by-decree market, which went on for nearly three years. And the magenta area, which is just a single price bar, neatly represents what happens when the markets are allowed, pushing and shoving, back into reality.

And that single price bar, my friends, is really all you need to see in order to understand what's ahead. Because one day, probably when Janet is busy shaving her armpits one morning, the markets are going to pop back onto the scene, invited or not, and the graphs are going to "catch up" to where they should have been if our banker friends had never fucked with them in the first place.

So thank you, Switzerland! It's nice to get a little peek at how things are supposed to work.