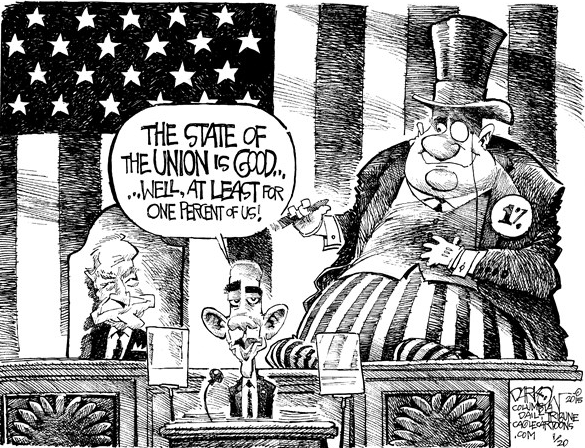

The state of the union is STRONG!

The state of the union is STRONG!

That was the word from our President last night as he set the agenda for his last two years in office. The GOP response was a very predictable no way and Uncle Rupert's Journal didn't waste a second publishing a front-page editorial blasting the President for his ridiculous idea of having the rich pay their fair share of taxes in order to improve the lot of the middle class.

In the 1944 film “Gaslight,” a con artist manipulates his new wife psychologically to make her doubt her own sanity in a scheme to steal her inheritance. That’s increasingly the way to understand President Obama ’s behavior toward Congress and especially the tax increase he floated in Tuesday’s State of the Union. The only plausible rationale is that he thinks he can gain politically by driving Republicans nuts.

It goes downhill from there… The true State of the Union is going to be two years of gridlock and bickering with nothing much being done – not too different from the last 6 years or the rest of the century, which has seen average household income drop 10% while the top 1% tripled their wealth.

It goes downhill from there… The true State of the Union is going to be two years of gridlock and bickering with nothing much being done – not too different from the last 6 years or the rest of the century, which has seen average household income drop 10% while the top 1% tripled their wealth.

Can we really afford 2 more years of the same? Romney and Bush III want to make it 10 if they can. Joni Ernst (I know, who?) delivered the GOP response, which centered on a promise to repeal the Affordable Care Act, "which has hurt so many American Families," though she couldn't actually name one, when asked later. Instead, in her speech she said:

Growing up, I had only one good pair of shoes. So on rainy school days, my mom would slip plastic bread bags over them to keep them dry. But I was never embarrassed. Because the school bus would be filled with rows and rows of young Iowans with bread bags slipped over their feet. Our parents may not have had much, but they worked hard for what they did have.

In other words "suck it up poor people – you have it good and we're not giving you a penny!" That is the Republican vision for America in 2020 – rows and rows of docile children with plastic bags for shoes being told they are patriots for not burdening the rich with their problems. This is the Scroogian narrative the GOP has come up with to combat Obama's radical plan to have the people who have 80% of the money pay more than 30% of the taxes. It's even more ridiculous for our Corporate Citizens, who pay just $300Bn out of $2.7Tn (11%) of the taxes collected by our Government

It's funny how we tend to pull our money out of foreign countries when they have dysfunctional governments yet our own government is as dysfunctional as they come – yet we keep so much of our money in US assets. Perhaps our economy works better when nothing is accomplished – score one for the Libertarians!

It's funny how we tend to pull our money out of foreign countries when they have dysfunctional governments yet our own government is as dysfunctional as they come – yet we keep so much of our money in US assets. Perhaps our economy works better when nothing is accomplished – score one for the Libertarians!

We still haven't gotten bullish signals from our bounce lines so we're still bearish heading into tomorrow's ECB announcement. As of the close, we were at:

- Dow 17,280 (weak) and 17,460 (strong)

- S&P 2,006 (weak) and 2,027 (strong)

- Nasdaq 4,608 (weak) and 4,656 (strong)

- NYSE 10,560 (weak) and 10,670 (strong)

- Russell 1,172.50 (weak) and 1,185 (strong)

So the only change from yesterday was the Nasdaq and NYSE creeping closer to their strong bounce lines but, so far this morning, it's looking like rejection pre-market as people are worried that Mario does not have what it takes to save the Global Economy.

So the only change from yesterday was the Nasdaq and NYSE creeping closer to their strong bounce lines but, so far this morning, it's looking like rejection pre-market as people are worried that Mario does not have what it takes to save the Global Economy.

We're happy to be Cashy and Cautious heading into the ECB (and earnings have not been thrilling either) and we'll see how tomorrow goes before deciding whether or not to change our generally bearish stance.

We had a nice re-entry on oil (/CL Futures) this morning at $46.50 and we'll see how that goes and also look for /NG at $2.90 for another bullish entry, though we'd prefer $2.825 (our usual) so tight stops below $2.90 on that one!