The Anti-Austerity Party won in Greece yesterday.

The Anti-Austerity Party won in Greece yesterday.

What it means for the markets is hard to say on day one of the new Government but it's not looking good for the people who Greece still owe over 300Bn Euros to. As you can see from this chart, that's 170% of their GDP and, frankly, its unpayable and it's ridiculous to pretend otherwise. Yet, for the past 6 years, instead of helping Greece out by forgiving or refinancing the debt at low rates, the EU has lent them more money in exchange for ramming harsh austerity measures down their throats.

What a shocker that 6 years of bottowing another $130Bn without using any of it to boost the economy (cutting back all stimulus spending, in fact) did not, in fact, lead to an economic recovery in which the debt was paid off. In fact, the debt is 70% worse and that doesn't go away and the now the lender (the ECB and their Bankster Buddies) want MORE austerity to make sure they get paid first.

Well BS to that says any rational person and BS said Greece this weekend as they voted in Alexis Tsipras and his Syriza Party, who are now just 2 seats shy of a full majority in Parliament. Already though, Tsipras has calmed the markets by calling for gradual negotiations with the EU, not an outright revolt:

Well BS to that says any rational person and BS said Greece this weekend as they voted in Alexis Tsipras and his Syriza Party, who are now just 2 seats shy of a full majority in Parliament. Already though, Tsipras has calmed the markets by calling for gradual negotiations with the EU, not an outright revolt:

“There will neither be a catastrophic clash nor will continued kowtowing be accepted,” Tsipras, 40, told crowds of cheering supporters in central Athens late Sunday. “We are fully aware that the Greek people haven’t given us carte blanche but a mandate for national revival.”

Of course, he hasn't actually been sworn in yet. The Syriza party is a Socialist, almost Marxist party – they believe in taxing the rich and raising minimum wages – and not in the wimpy way the US Democrats believe in it – it's going to be a very interesting couple of weeks. Make that months, actually as the real tipping point comes in August, when Greece needs Billions in new financing to repay/rollover bonds held by the ECB. IMF loans are due in March and Greece ain't gots no money so the next few weeks will be critical. It's always difficult to discuss debt financing, isn't it?

As noted by the WSJ: Even rising doubts about whether a compromise can be found could lead to heavy deposit withdrawals from Greek banksand capital flight from the country. At that point, the ECB would have to decide whether to keep liquidity open for Greek banks or to cut them off, because of the lack of a prospective agreement and Europe’s rising financial exposure in case Greece leaves the euro. Greece and the eurozone would very likely have to impose capital controls, like in Cyprus, to stop the capital flight. But that would probably be an interim step. Either Syriza would have to give in and sign a bailout program, or Greece would have to print drachmas to keep the economy, government and financial system from collapse.

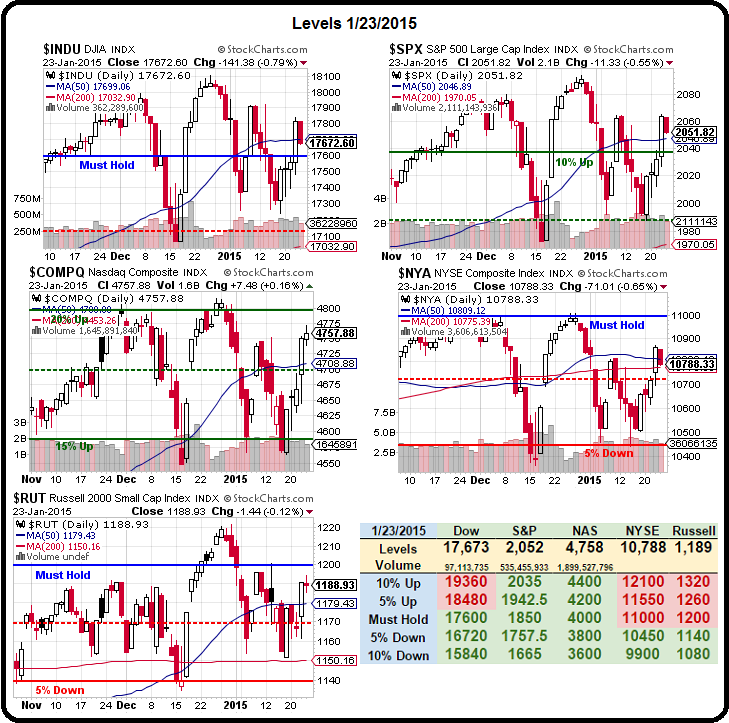

Meanwhile, we have the Fed on Wednesday this week and tons of earnings reports to sift though. We finished the week holding all our strong bounce lines but we won't be able to call it until Tuesday, when we're willing to flip more bullish if we're still over on all 5 (see Thurday's post for levels).

Meanwhile, we're already having fun this morning playing Oil and Natural Gas Futures in our Live Member Chat Room and oil has come back down to $45.40, so hopefully we'll have a chance to reload our longs (/CL) around there. /NG just topped $2.90 and we're long until that fails as well ($3 would be a $1,000 per contract profit).

On Friday, right in the main post, we gave you a long trade idea on oil at $46, buying 500,000 contracts long with a goal of $46.50. That trade went according to plan and made $250,000,000 in one day – you're welcome!