Boy this is fun!

Boy this is fun!

It sure is fun for those of us getting in and out of our Futures trades as the lines have been fairly reliable in the channels as we make lower lows and lower highs on the way down, with plenty of up and down action in between.

While generally, we find choppy markets annoying, when we have choppy action for this long we begin to play for it and then it becomes a great source of profits for us. Just this morning, in our Live Member Chat Room, we were taking full advantage of the gyrations in Oil (/CL), Natural Gas (/NG) and the indexes (/YM, /ES, /NQ and /TF) to make some pre-breakfast profits.

At the moment (7:45), we're short /CL at $51 and short /TF at 1,180 and /NQ at 4,200 and /YM at 17,350 and /ES at 2,025 but long /NG at $2.69 – how's that for confusing? If you want the logic, go to our live chat room and read the discussion but these are our trades and we're sticking with them.

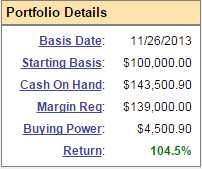

As you can see from our Short-Term Portfolio's balance box, sticking with them has been very, very good to us. That figure is just for our stock an options trades over the past year and doesn't include our Futures trades, which are more like side bets we make for fun. Our much larger Long-Term Portfolio finished the day up 20.3% on that BS surge (the one we are now shorting to lock in our profits) at $601,260, giving us a total of $806K – our best yet on our paired, primary portfolios and up more than 33% in a year.

As you can see from our Short-Term Portfolio's balance box, sticking with them has been very, very good to us. That figure is just for our stock an options trades over the past year and doesn't include our Futures trades, which are more like side bets we make for fun. Our much larger Long-Term Portfolio finished the day up 20.3% on that BS surge (the one we are now shorting to lock in our profits) at $601,260, giving us a total of $806K – our best yet on our paired, primary portfolios and up more than 33% in a year.

Like our STP, our LTP is mainly in cash with $565,000 (94%) and, without our "risky" short-term hedges, we used very little margin, just $331,000 of the $1M allocated. This is what we mean when we say we are "Cashy and Cautious" but being in cash doesn't mean we can't participate – it just means we're very careful about how we allocate our resources – staying flexible in uncertain markets.

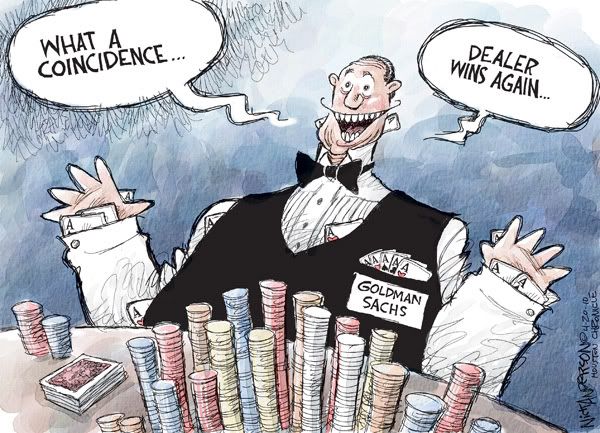

Because we are "Being the House – Not the Gambler" in our trading, the choppy market action does nothing more than give us endless opportunities to sell risk premium to the suckers who think the channels are going to break. When they don't, we rake in the profits on their expiring options and we still maintain our long positions so we just wait for an opportunity to sell more short positions and rake in more profits. It's really not a complicated strategy – we have been teaching it to thousands of people for almost 10 years now.

Because we are "Being the House – Not the Gambler" in our trading, the choppy market action does nothing more than give us endless opportunities to sell risk premium to the suckers who think the channels are going to break. When they don't, we rake in the profits on their expiring options and we still maintain our long positions so we just wait for an opportunity to sell more short positions and rake in more profits. It's really not a complicated strategy – we have been teaching it to thousands of people for almost 10 years now.

This year, we are emphasizing our "Get Rich Slowly" strategy, which builds on the "Be the House" strategy that helped create our paired LTP/STP. We're also demonstrating it with our $25,000 Portfolio, which is now our $30,656 Portfolio (up 22.6%) after 13 months because, using the logic of the linked article, $25,000 compounded for 10 years at 20% should give us $154,793.41. It's our intention to prove this out using the same strategies we teach every day (and see our recent Top Trade Review for specific examples).

You don't have to bet a lot to win a lot, what's important is consistency. It's better to consistently make 10% than to occasionally make 20% and occasionally lose 10%. Why? Let's say you make 20% half the time and lose 10% the other half. Then you'd have (alternating): 100, 120, 108, 129, 116, 139, 125, 150, 135, 162, 146. However, making 10% the same 10 years consistently gives you 100, 110, 121, 133, 146, 160, 176, 193, 212, 233, 256. That's 75% more money CONSISTENTLY making 10% than AVERAGING 15% over 10 years.

You don't have to bet a lot to win a lot, what's important is consistency. It's better to consistently make 10% than to occasionally make 20% and occasionally lose 10%. Why? Let's say you make 20% half the time and lose 10% the other half. Then you'd have (alternating): 100, 120, 108, 129, 116, 139, 125, 150, 135, 162, 146. However, making 10% the same 10 years consistently gives you 100, 110, 121, 133, 146, 160, 176, 193, 212, 233, 256. That's 75% more money CONSISTENTLY making 10% than AVERAGING 15% over 10 years.

That's why we considered cashing our out LTP/STP combo yesterday, up 33% in just over a year is way ahead of schedule and certainly not something we want to risk. However, our balance is excellent and we love our positions (longs and shorts, of course) so we're going to just make sure we don't fall below 30% between now and June, which keeps us on track for our 20% annual goal. By having CONSERVATIVE targets and making sure we achieve them, any luck we have along the way becomes a bonus we can lock in.

In our Live Trading Webinar last Thursday, for example we features two trade ideas I have been banging the table on. One was RIG, which was $15.75 at the time and the other was CLF, which was at $6.30. Our very simple premise was that both material stocks had been oversold and, with earnings around the corner, we felt it would be difficult for them to disappoint.

In our Live Trading Webinar last Thursday, for example we features two trade ideas I have been banging the table on. One was RIG, which was $15.75 at the time and the other was CLF, which was at $6.30. Our very simple premise was that both material stocks had been oversold and, with earnings around the corner, we felt it would be difficult for them to disappoint.

Already we've had some good action on both stocks and you can watch the replay of our Live Webinar here to get the specifics of the trade but it's a bit late to get on the bandwagon now that we've had our earnings reports for those trades, though both stocks still have plenty of room to run. Not to worry though, we have dozens of trade ideas every week just like them!

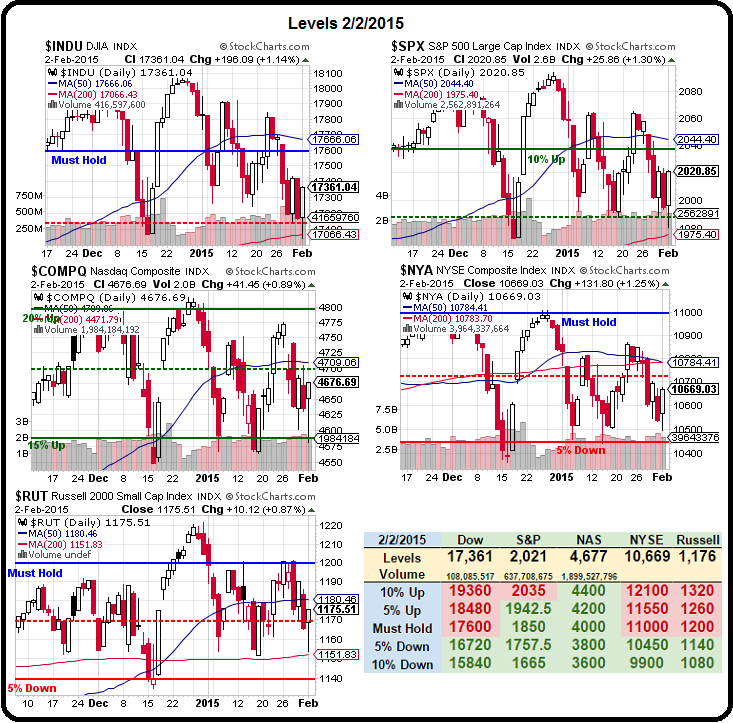

As noted above, we're still watching for our strong bounce lines (see yesterday's post for details) at Dow 17,460, S&P 2,027, Nasdaq 4,656, NYSE 10,670 and Russell 1,185. Failing those would be BAD today and will probably have us making some more bearish bets in our Short-Term Portfolio, perhaps even on some specific stocks that have run up too far (AMZN, TSLA, NFLX).

A lot of the bullish move in the markets is relief that oil stopped falling, which may be temporary and relief that Greece may not destroy Europe (also temporary) while everyone continues to ignore the escalating war footing on both sides of the Ukraine as well as the escalating catastrophe that is the Chinese Financial System. We'll stay "Cashy and Cautious," thank you!