Good morning!

I still like PM for this trade.

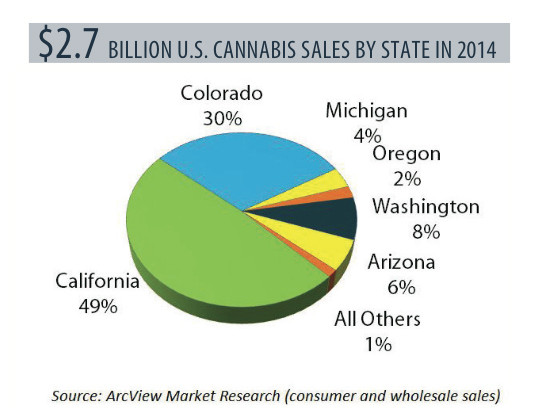

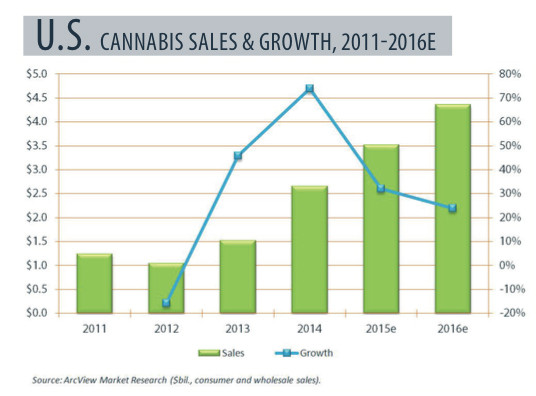

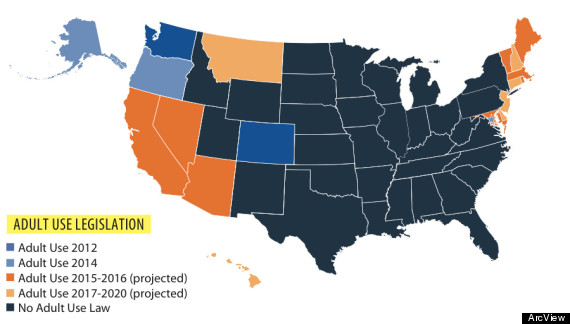

They have $80Bn in sales now and pot is $4Bn now but probably $40Bn by the time they add those states over the next two years. That's not even looking at all the states that will allow medical marijuana. Hemp has historically been a great cash crop and it can be used to make fabrics as well so could be more profitable than tobacco so I can't imagine PM (and others) aren't looking into it, but cautiously as they don't want to piss people off by moving too soon.

Anyway, even as they are now, they drop 10% to the bottom line ($8Bn) with a $127Bn market cap so about 15 on p/e and they pay a $4 dividend (5%), so what's not to like?

Earnings are tomorrow but, in the Long-Term Portfolio, let's buy 300 shares at $80 ($24,000) to initiate a position and sell the 2017 $75 calls for $9 and the 80 puts for $10 for net $61/70.50 so our worst case is owning 600 at net $70.50 less $8 in dividends would be $62.50, which is 25% below the current price and a max expected commitment of $37,500 if assigned to us below $80 - still a number we could easily double down on.

Another way to play them as a more speculative bet would be selling the 2017 $65 puts for $3.60 and buying the $80/90 bull call spread for $3.65. That's net 0.05 on the $10 spread (19,900% upside potential on the cash) and your worst case is owning 1x of PM at net $65.05 and your best case is $9.95 profit.