MORE FREE MONEY!!!

MORE FREE MONEY!!!

Mario Draghi (a Goldman employee) will discuss his $75Bn/month QE program for the ECB this morning and the BOE (another Goldman employee) has already announced they will continue their $35Bn/month QE program while Japan continues their $80Bn/month QE program and our own Fed is still at $80Bn/month with China probably around the same.

That's $350Bn PER MONTH or $4.2Tn per year being pumped into the Global Economy by Central Banksters. AND IT'S NOT REALLY HELPING!!!

Well, it is helping the Top 1% as they get richer and richer and richer. It's easy to get richer when we can borrow money at 0.25% and then lend it to poor people (and we're justified because their credit simply isn't as good as ours) for 5%. That's a 20x return on our borrowing cost – don't you just love the Central Banksters?!?

Well, it is helping the Top 1% as they get richer and richer and richer. It's easy to get richer when we can borrow money at 0.25% and then lend it to poor people (and we're justified because their credit simply isn't as good as ours) for 5%. That's a 20x return on our borrowing cost – don't you just love the Central Banksters?!?

Now, I know that there are those of you in America who are confused by these numbers because you think your economy is improving – and it is – but that's because you're not thinking the math through. 300M Americans, with an average income of $55,000 per family, are already in the top 10% of the Worlds 7Bn people. So the whole top 10% of America is already in the Global Top 1%, which is what is giving our economy such a boost – but it's at the expense of Billions of others.

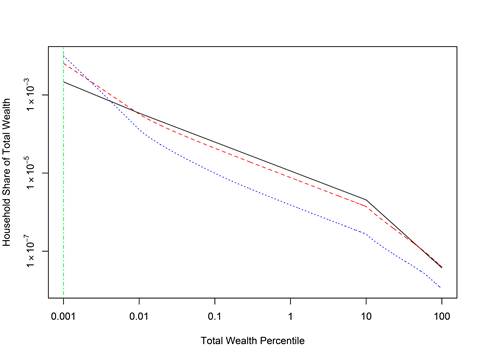

A study by Fernholz in Econobrowser shows the very direct correlation between the gains of wealth held by the top 0.01% and 0.01-0.1% of households are increasing by 3% and 1% per year, respectively, while the share of wealth held by the bottom 90% of households is decreasing by 1.5% per year. 1.5% PER YEAR. When you graph it, it looks like this over time:

A study by Fernholz in Econobrowser shows the very direct correlation between the gains of wealth held by the top 0.01% and 0.01-0.1% of households are increasing by 3% and 1% per year, respectively, while the share of wealth held by the bottom 90% of households is decreasing by 1.5% per year. 1.5% PER YEAR. When you graph it, it looks like this over time:

Not only is wealth being taken from the poor and given to the rich but the process is accelerating through QE policies. One of the ways the top 0.1% is reaping these rewards is through share buybacks – $2Tn worth of them since 2009, which is 6 times more money than the amount contributed by actual investors (apx $300Bn of inflows) during the same period. That too is accelerating as $550Bn worth of buybacks have been announced for 2015 and that doesn't include M&A deals, which take 100% of some companies' stock off the market.

Per Bloomberg, that compares to just $85Bn worth of deposits by customers of mutual and exchange-traded funds. In other words, if you are selling a share of stock in the US markets, chances are 86% that the buyer is the company that issued the share in the first place. Taking all those shares off the market enriches the insiders, who have stock options and existing shares and it, of course, enriches the already invested class – those who have no need to sell and simply watch their stocks go up and up in PRICE.

I'm emphasizing PRICE because PRICE is not VALUE. Yes, less shares mean more earnings per share but the companies themselves aren't growing and their actual business is not improving and, one day (probably not today), that will become a problem they can no longer hide by manipulating their share count to cover up the lack of actual growth.

I'm emphasizing PRICE because PRICE is not VALUE. Yes, less shares mean more earnings per share but the companies themselves aren't growing and their actual business is not improving and, one day (probably not today), that will become a problem they can no longer hide by manipulating their share count to cover up the lack of actual growth.

All that is happening is the Top 1%, who own and run the corporations, are using the 0.25% money provided by the Central Banking Cartel (who work for the Top 1% Banksters who own the majority of those same corporations) to finance Debt Restructuring, M&A, Dividend Payouts and, of course Stock Buybacks in order to enrich themselves NOW – based on the COMPLETELY UNSUSTAINABLE FANTASY that they will be able to roll that debt over at 0.25% and that all this debt will never come back to destroy the companies as rates go up.

Indeed, when that does happen, you will hear them say the same thing over and over again: "Who could have known rates would go up?" They will blame the banks, they will blame the wars (that's why they are starting them), they will blame the Government (too big or not doing enough – doesn't matter which) and they will blame the leaders and they will parachute out of their falling companies with even more Trillions of Dollars while the economy and the markets once again collapse.

This isn't speculative conjecture – it happened before – 7 years ago!!! I mean, really, WTF is wrong with you people? They just did this to us 7 years ago and now they are doing it again and NO ONE SAYS A WORD!

It's the same game plan being run by the same people the bottom 99% had to bail out last time. See this chart? Companies were buying record amounts of their own shares in 2005, 6 and 7 too – that pushed the market to record highs then too. They paid record amounts of dividends and borrowed record amounts of money and did record amounts of M&A and the rich got much, much richer and then the economy imploded (because it's not real and it's not sustainable) and then we, the American People and the People of the Earth had to have all of our Governments go massively into debt to bail them out.

It's the same game plan being run by the same people the bottom 99% had to bail out last time. See this chart? Companies were buying record amounts of their own shares in 2005, 6 and 7 too – that pushed the market to record highs then too. They paid record amounts of dividends and borrowed record amounts of money and did record amounts of M&A and the rich got much, much richer and then the economy imploded (because it's not real and it's not sustainable) and then we, the American People and the People of the Earth had to have all of our Governments go massively into debt to bail them out.

And here we are again — IDIOTS!

That $350Bn per month of QE that's being pumped into the markets (and we're only counting the Big 5) comes in the form of Government Debt that the bottom 99% eventually have to repay and, as noted by Fernholz – not only are the bottom 90% not benefiting from this scheme but they are, in fact, LOSING THEIR WEALTH. It is simply being transferred to the top 1% and, because the top 1% has TWICE AS MUCH wealth than the bottom 90%, the bottom 90% have to give up 1.5% of their wealth just to make the top 1% 3% richer. Get it?

Do you suppose, at some point, the top 1% will stop wanting to get richer? Do you think they'll say "Hey, fellahs, stop, we have all we need – please take a little something for yourselves!"? No, that's not going to happen. What is happening, and why that chart is accelerating, is that as the top 1% get richer, the gap between them and the bottom 90% gets bigger and it takes even more of the bottom 90%'s money to make the top 1% just a little bit richer.

Eventually the bottom 90% will have nothing left to give and then the top 1% will turn on the top 10-1% because, still, it will not be enough. After that, the top 0.01% will turn on the top 1-0.01%. That's the end game – strap yourselves in!