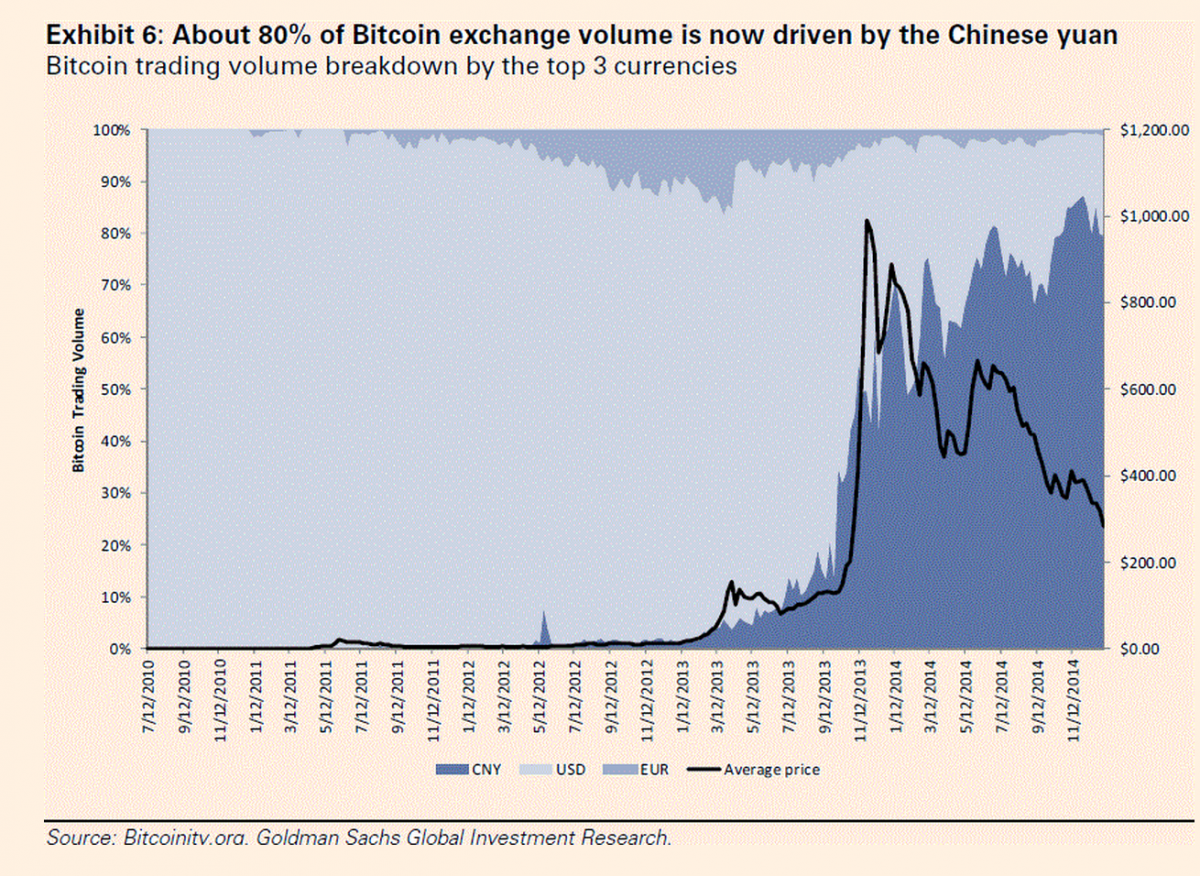

Currently, 80% of Bitcoin exchange volume is being driven by the renminbi. But is the use in China more due to despiration than confidence?

According to the Financial Times, "[Bitcoin’s] widespread usage is particularly interesting because China clamps down on traditional currency exchange via capital control measures. Despite China's efforts to ban banks from handling Bitcoin transactions, Bitcoin gained currency in China last year as the renminbi suffered its first annual fall against the US dollar in two decades. This suggests more and more Chinese are evading capital controls and using the virtual currency to exchange cash, as the economy slows and the outlook worsens."

Mish argues that Bitcoin will not survive the move towards digital currencies. Currencies require trust, and Bitcoin will never have enought of that. IBM, with central bank backing, might…

Bitcoin End Coming?

Digital currencies will soon be mandatory.

I believe the only reason bitcoin has survived is the Fed wants to study digital currencies. When the Fed decides to go 100% digital (I have no timeframe in mind) bitcoin may very well go back to its initial roots: worthless.

The primary user of bitcoin right now is Chinese money laundering.

Disagree? Then please explain why 80% of Bitcoin Transaction Volume is Chinese.

How long can that really last?

Digital currencies are coming. Is bitcoin the answer?

[Excerpt from Mish's Cash Dinosaur: France Limits Cash Transactions to €1,000, Puts Restrictions on Gold; Bitcoin End Coming?]

.jpg)

Picture via Pixabay.