Will bad news be good news?

Will bad news be good news?

We're waiting on the revised Q4 GDP Report and the data we've been seeing does not bode well for the revision we'll get at 8:30 this morning and, currently, the expectations are for 2.4% growth – less than that will signal a weaker economy but that then may give investors the impression the Fed will maintain an easy monetary stance later into the year.

Meanwhile, as you can see from Dave Fry's SPY chart, we've already completed the first part of the "Golden Arches" pattern that we predicted back on the 19th (while everyone else was in bull mode) and it would be a good bullish sign still (now that everyone is bearish) if SPY manages to hold the 200 dma at 204.50 – so there's going to be a lot riding on the GDP report AND people's reaction to it this morning.

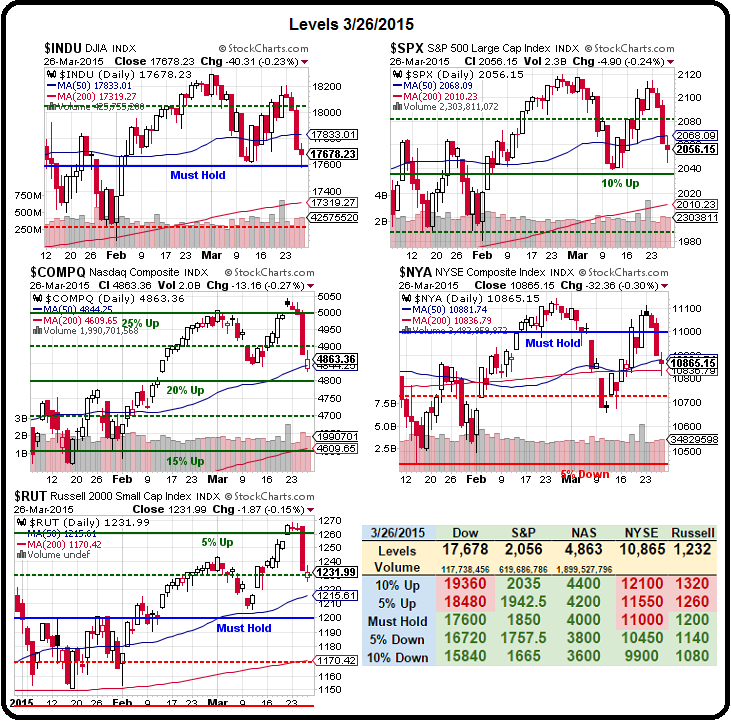

Yesterday we charted out the 5% Rule™ for our Members (and we reviewed the charts in yesterday's Live Trading Webinar) and our bounce lines were at:

Yesterday we charted out the 5% Rule™ for our Members (and we reviewed the charts in yesterday's Live Trading Webinar) and our bounce lines were at:

- Dow 17,720 (weak) and 17,850 (strong)

- S&P 2,055 (weak) and 2,060 (strong)

- Nasdaq 4,865 (weak) and 4,905 (strong)

- NYSE 10,880 (weak) and 10,910 (strong)

- Russell 1,235 (weak) and 1,245 (strong)

We made that call at 10:19, when the Dow was at 17,612, S&P 2,048, Nasdaq 4,828, NYSE 10,854 and Russell 1,226 and, in the end, we were off by a grand total of 63 points on 5 indexes that total 36,694 points so we missed it by 0.17% – not bad! Even better if you were a Member (sign up here) who got our Morning Report delivered to your In Box pre-markets, as we said right at the bottom of the post:

We have already hit our primary goal at 2,035 (the 10% line on our Big Chart) on the S&P Futures (/ES) and we flipped long there in our Live Member Chat as well as long on /TF (Russell Futures) at 1,220 and short on oil at $52 (/CL) to lock in our bonus gains for the morning and take advantage of the bounce (probably weak).

We may have missed our weak bounce lines by 0.17% but that was good enough to give us a $1,000 per contract gain on the Russell Futures when they crossed 1,030 as well as a $2,000 per contract gain on oil when it fell back to $50 – not bad money for a Thursday, right? As I said yesterday morning: "Remember – I can only tell you what is going to happen and how to profit from it – the rest is up to you…"

Unfortunately for the Cheap Readers, it isn't April yet so I'm not supposed to be giving away trade ideas in the morning posts (which are syndicated later in the day sometimes) so I can't tell you how our Members are going to make money off the GDP Report today – that's going to be an exclusive in our Live Member Chat Room. I will be able to tell you what we think of the report, but we all have to wait a few minutes for it to be released.

Unfortunately for the Cheap Readers, it isn't April yet so I'm not supposed to be giving away trade ideas in the morning posts (which are syndicated later in the day sometimes) so I can't tell you how our Members are going to make money off the GDP Report today – that's going to be an exclusive in our Live Member Chat Room. I will be able to tell you what we think of the report, but we all have to wait a few minutes for it to be released.

8:30 Update: Unchanged! Oh how friggin' dull… Still, unchanged is 2.2%, which is weaker than the improvement to 2.4% economorons were looking for but not weak enough to bring the Fed back to the QE table so this is NOT a good thing for the indexes and we'll be expecting some follow-through to the downside once the Dollar stops slipping (due to lower demand outlook), now 97.66.

What is of much more concerns in the Real World (not sure where it is but I've heard of it) should be Corporate Profits, which have been revised down to 2.9% from 5.06% in the last estimate. That's a pretty big cut! Profits from Domestic Financial Corporations (we're short FAS) decreased by $12.5Bn in Q4 and overall Global Corporate Revenues fell by $36.1Bn – this is exactly what I was talking about on BNN this week, when I gave my economic overview.

What is of much more concerns in the Real World (not sure where it is but I've heard of it) should be Corporate Profits, which have been revised down to 2.9% from 5.06% in the last estimate. That's a pretty big cut! Profits from Domestic Financial Corporations (we're short FAS) decreased by $12.5Bn in Q4 and overall Global Corporate Revenues fell by $36.1Bn – this is exactly what I was talking about on BNN this week, when I gave my economic overview.

This all ties back to the chart we discussed on Money Talk on Wednesday (we actually taped it Monday night), which was similar to the one I shared with you last week, when we were discussing whether or not the market was in a bubble and I was pointing out that, Globally, GDP expectations were already trending down while the market was going in the other direction.

Which is more likely, that traders moving into the market knew something the Data wasn't showing us or that the traders were irrationally exuberant and miscalculating the value of ongoing stimulus programs that haven't been working for the past few years – so why should they suddenly start now?

Which is more likely, that traders moving into the market knew something the Data wasn't showing us or that the traders were irrationally exuberant and miscalculating the value of ongoing stimulus programs that haven't been working for the past few years – so why should they suddenly start now?

The markets have been moving up and up and up and up on expectations that bad news was good news and we've had PLENTY of bad news for the past 2 years but, at some point, the piper must be paid and even investors who have nowhere else to put their money begin to recognize that THERE IS RISK in owning a stock with a p/e of 25, which effectively pays a 4% rate of return, that is not worth taking compared to a bond that GUARANTEES to give you 95% of your money back after 10 years.

Hard to wrap your head around, I know – that's why I saved it for weekend contemplation.

Have a good one,

– Phil