"I've been up and down and over and out and I know one thing

Each time I find myself flat on my face

I pick myself up and get back in the raceThat's life (that's life), I tell you I can't deny it

I thought of quitting, baby, but my heart just ain't gonna buy it" – Sinatra

What a crazy way to start the month!

What a crazy way to start the month!

As you can see from the S&P chart above, we went nowhere, despite Monday's massive 2% pop, which was quickly followed by Tuesday and Wednesday's 2% drop. So here we are again, testing the same strong bounce lines we were watching last week which, to summarize, were (as of yesterday's close):

- Dow 17,720 (weak) and 17,850 (strong)

- S&P 2,055 (weak) and 2,060 (strong)

- Nasdaq 4,865 (weak) and 4,905 (strong)

- NYSE 10,880 (weak) and 10,910 (strong)

- Russell 1,235 (weak) and 1,245 (strong)

As usual, the Russell is leading us up and the Dow is dragging behind – even with the addition of AAPL this week. When in doubt, we stick to the 5% Rule™ and just wait to see if 3 of 5 of our strong bounce lines turn green, THEN we can go long on the laggards. Otherwise, we're not going to be impressed – especially by low-volume, BS rallies like we had on Monday which, fortuntately, we stayed short on.

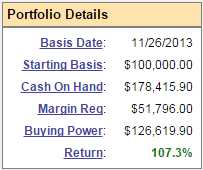

I've mentioned that our Short-Term Portfolio had been left very short, since we cashed in most of our Long-Term Portfolio last Tuesday (see also, "Why Worry Wednesday – We're in CASH Suckers!"). When we cashed out the LTP on Tuesday, the markets were peaking and the STP was down to $183,820.90 (up 83.8%) when we reviewed it Wednesday Morning (7:17 am in our Live Member Chat Room). Now, just a week later, with no changes, those same positions are up 107.3% at $207,325.90 – that's a gain of $23,505 (12.7%) in a week!

I've mentioned that our Short-Term Portfolio had been left very short, since we cashed in most of our Long-Term Portfolio last Tuesday (see also, "Why Worry Wednesday – We're in CASH Suckers!"). When we cashed out the LTP on Tuesday, the markets were peaking and the STP was down to $183,820.90 (up 83.8%) when we reviewed it Wednesday Morning (7:17 am in our Live Member Chat Room). Now, just a week later, with no changes, those same positions are up 107.3% at $207,325.90 – that's a gain of $23,505 (12.7%) in a week!

Whatever you do – DO NOT SUBSCRIBE TO OUR SERVICE – you might save a few dollars next week too!

See what I did there? That was some subtle reverse-psychology… Seriously, though, it amazes me that we get something like 1M people a month visiting our site and 99.99% of them don't want to pay to be Members. That's why we give out FREE Trade Ideas each quarter – to show you we're not like those other sites that make vague predictions and change like the weather.

At Philstockworld, we tell you what is going to happen and we tell you how to profit from it – what can be simpler than that? And we actually TEACH people how to trade – we don't just make a bunch of picks. One of our Members, IHS, commented yesterday:

At Philstockworld, we tell you what is going to happen and we tell you how to profit from it – what can be simpler than that? And we actually TEACH people how to trade – we don't just make a bunch of picks. One of our Members, IHS, commented yesterday:

Phil and All: Well the 1st quarter performance figures are in and, while I gave back some of my realized and unrealized profits, the results as of the close on 3/31/15 are: Profitable closed trades = $75,138; Account gain = +12.20%; profitable trades vs unprifitable trades= 76% profitable vs 24% unprofitable. Starting position value=$500K closing position value=$561K.

That's pretty good, right? That makes me very proud and yes, we want more subscribers so we can continue to provide you with top-notch service WITHOUT the influence of outside sponsors (a rarity these days) but also I get Emails all the time from people who blew up their accounts and want to know if our service can help them. Sadly, we can't – we're not a "get rich quick" operation – we teach people How to Get Rich Slowly, using options to HEDGE our positons and using leverage to REDUCE our downside exposure, not to increase it.

I WANT to help more people learn how to trade better but, sadly, 999,900 of you won't sign up this month and you'll continue to flip from site to site getting all the free advice you can, rather than settling down somewhere and learning a system that might actually help you make money.

I WANT to help more people learn how to trade better but, sadly, 999,900 of you won't sign up this month and you'll continue to flip from site to site getting all the free advice you can, rather than settling down somewhere and learning a system that might actually help you make money.

This morning, for example, the Dollar has fallen to 97.94 and that is down half a point from yesterday and it's falsely supporting the Futures and the Russell is at 1,249 and we can short /TF (Russell Futures) here with a stop at 1,251, which would be a $200, loss per contract (our risk) but hopefully we'll get a ride down to at least 1,245 for $400 – so we like the risk/reward ratio on that trade.

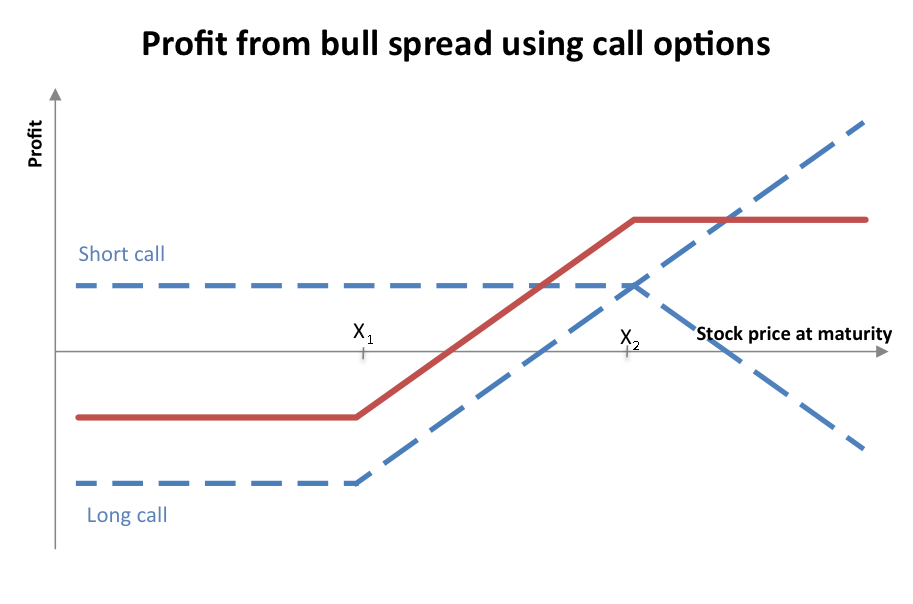

TZA is the ultra-short ETF on the Russell and it's down to $10.11 and you can play that straight if you are afraid of options or futures or you can sell the April $10 put for 0.30, which obligates you to own TZA at net $9.70 but anything over $10 (Russell below 1,270) two weeks from tomorrow (17th) will let you keep $30 per contract. If you are willing to own $9,750 worth of TZA, you can sell 10 contracts for $300 and that will be your profit in 15 days (3% of capital at risk). That sure beats what the bank pays you, right?

Another way to go long TZA from here (and we have a lot of TZA longs in the STP) is to buy the April $9 calls for $1.20 and sell the $10 calls for 0.50 for net 0.70 on the $1 spread that's 100% in the money to start. Here, you just risk the 0.70 ($70 per contract) you put into the trade and, if TZA is over $10, you get the same 0.30 ($30 per contract profit) so now you risk $700 to make the same $300 and that's a 42.8% return on capital at risk in 15 days – MUCH better than the bank.

Another way to go long TZA from here (and we have a lot of TZA longs in the STP) is to buy the April $9 calls for $1.20 and sell the $10 calls for 0.50 for net 0.70 on the $1 spread that's 100% in the money to start. Here, you just risk the 0.70 ($70 per contract) you put into the trade and, if TZA is over $10, you get the same 0.30 ($30 per contract profit) so now you risk $700 to make the same $300 and that's a 42.8% return on capital at risk in 15 days – MUCH better than the bank.

Of course, if you combine the two, and sell 10 TZA April $10 puts and buy 10 of the April $9/10 bull call spreads, your net on the whole spread would be just 0.40 and now you make 0.60 (150%) on your cash in 15 days.

See – Options are Fun!

Markets are closed tomorrow, have a very happy holiday weekend,

– Phil